| Management: | Investor Relations: | ||||

| Stephen E. Budorick, President & CEO | Stephanie Krewson-Kelly, VP of IR | ||||

| Todd Hartman, EVP & COO | 443-285-5453, stephanie.kelly@copt.com | ||||

| Anthony Mifsud, EVP & CFO | Michelle Layne, Manager of IR | ||||

443-285-5452, michelle.layne@copt.com | |||||

| Firm | Senior Analyst | Phone | ||||||||||||||||||

| Bank of America Securities | Jamie Feldman | 646-855-5808 | james.feldman@bofa.com | |||||||||||||||||

| BTIG | Tom Catherwood | 212-738-6410 | tcatherwood@btig.com | |||||||||||||||||

| Capital One Securities | Chris Lucas | 571-633-8151 | christopher.lucas@capitalone.com | |||||||||||||||||

| Citigroup Global Markets | Manny Korchman | 212-816-1382 | emmanuel.korchman@citi.com | |||||||||||||||||

| Evercore ISI | Steve Sakwa | 212-446-9462 | steve.sakwa@evercoreisi.com | |||||||||||||||||

| Green Street | Daniel Ismail | 949-640-8780 | dismail@greenstreet.com | |||||||||||||||||

| Jefferies & Co. | Peter Abramowitz | 212-336-7241 | pabramowitz@jefferies.com | |||||||||||||||||

| JP Morgan | Tony Paolone | 212-622-6682 | anthony.paolone@jpmorgan.com | |||||||||||||||||

| KeyBanc Capital Markets | Craig Mailman | 917-368-2316 | cmailman@key.com | |||||||||||||||||

| Mizuho Securities USA Inc. | Tayo Okusanya | 646-949-9672 | omotayo.okusanya@mizuhogroup.com | |||||||||||||||||

| Raymond James | Bill Crow | 727-567-2594 | bill.crow@raymondjames.com | |||||||||||||||||

| Robert W. Baird & Co., Inc. | Dave Rodgers | 216-737-7341 | drodgers@rwbaird.com | |||||||||||||||||

| SMBC Nikko Securities America, Inc. | Rich Anderson | 646-521-2351 | randerson@smbcnikko-si.com | |||||||||||||||||

| Truist Securities | Michael Lewis | 212-319-5659 | michael.r.lewis@truist.com | |||||||||||||||||

| Wells Fargo Securities | Blaine Heck | 443-263-6529 | blaine.heck@wellsfargo.com | |||||||||||||||||

| Page | Three Months Ended | |||||||||||||||||||||||||||||||||||||

| SUMMARY OF RESULTS | Refer. | 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | ||||||||||||||||||||||||||||||||

| Net (loss) income | 6 | $ | (6,079) | $ | 83,549 | $ | (31,342) | $ | 25,121 | $ | 25,550 | |||||||||||||||||||||||||||

| NOI from real estate operations | 13 | $ | 89,107 | $ | 89,304 | $ | 84,643 | $ | 84,059 | $ | 83,830 | |||||||||||||||||||||||||||

| Same Properties NOI | 16 | $ | 75,833 | $ | 77,142 | $ | 75,595 | $ | 76,456 | $ | 76,755 | |||||||||||||||||||||||||||

| Same Properties cash NOI | 17 | $ | 74,000 | $ | 77,886 | $ | 75,077 | $ | 76,991 | $ | 76,041 | |||||||||||||||||||||||||||

| Adjusted EBITDA | 10 | $ | 83,338 | $ | 82,298 | $ | 80,062 | $ | 78,582 | $ | 77,989 | |||||||||||||||||||||||||||

Diluted AFFO avail. to common share and unit holders | 9 | $ | 52,387 | $ | 56,792 | $ | 50,340 | $ | 46,690 | $ | 41,495 | |||||||||||||||||||||||||||

| Dividend per common share | N/A | $ | 0.275 | $ | 0.275 | $ | 0.275 | $ | 0.275 | $ | 0.275 | |||||||||||||||||||||||||||

| Per share - diluted: | ||||||||||||||||||||||||||||||||||||||

| EPS | 8 | $ | (0.06) | $ | 0.73 | $ | (0.29) | $ | 0.21 | $ | 0.21 | |||||||||||||||||||||||||||

| FFO - Nareit | 8 | $ | 0.27 | $ | 0.53 | $ | 0.04 | $ | 0.51 | $ | 0.41 | |||||||||||||||||||||||||||

| FFO - as adjusted for comparability | 8 | $ | 0.56 | $ | 0.56 | $ | 0.54 | $ | 0.51 | $ | 0.51 | |||||||||||||||||||||||||||

| Numerators for diluted per share amounts: | ||||||||||||||||||||||||||||||||||||||

| Diluted EPS | 6 | $ | (6,839) | $ | 81,501 | $ | (31,990) | $ | 23,388 | $ | 23,957 | |||||||||||||||||||||||||||

Diluted FFO available to common share and unit holders | 7 | $ | 30,997 | $ | 60,137 | $ | 5,069 | $ | 57,809 | $ | 46,706 | |||||||||||||||||||||||||||

Diluted FFO available to common share and unit holders, as adjusted for comparability | 7 | $ | 64,454 | $ | 64,188 | $ | 61,485 | $ | 57,817 | $ | 57,866 | |||||||||||||||||||||||||||

| Payout ratios: | ||||||||||||||||||||||||||||||||||||||

| Diluted FFO | N/A | 100.5% | 51.8% | 613.6% | 53.9% | 66.6% | ||||||||||||||||||||||||||||||||

| Diluted FFO - as adjusted for comparability | N/A | 48.3% | 48.6% | 50.7% | 53.9% | 53.9% | ||||||||||||||||||||||||||||||||

Diluted AFFO | N/A | 59.5% | 54.9% | 61.9% | 66.8% | 75.1% | ||||||||||||||||||||||||||||||||

| CAPITALIZATION | ||||||||||||||||||||||||||||||||||||||

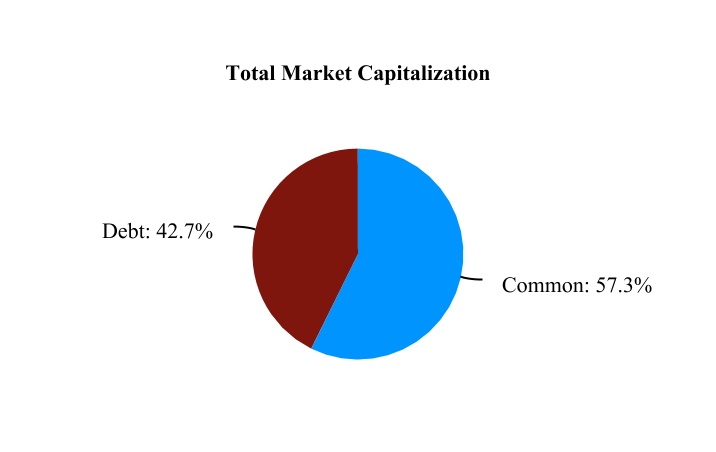

| Total Market Capitalization | 26 | $ | 5,226,694 | $ | 5,062,432 | $ | 4,898,459 | $ | 4,908,346 | $ | 4,609,280 | |||||||||||||||||||||||||||

| Total Equity Market Capitalization | 26 | $ | 2,995,090 | $ | 2,960,967 | $ | 2,701,186 | $ | 2,885,245 | $ | 2,520,400 | |||||||||||||||||||||||||||

| Gross debt | 27 | $ | 2,257,854 | $ | 2,127,715 | $ | 2,247,523 | $ | 2,073,351 | $ | 2,139,130 | |||||||||||||||||||||||||||

| Net debt to adjusted book | 29 | 40.8% | 39.1% | 41.0% | 38.6% | 38.2% | ||||||||||||||||||||||||||||||||

| Net debt plus preferred equity to adjusted book | 29 | 40.8% | 39.1% | 41.1% | 38.8% | 38.3% | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA fixed charge coverage ratio | 29 | 4.3x | 4.1x | 3.9x | 3.8x | 3.8x | ||||||||||||||||||||||||||||||||

| Net debt plus pref. equity to in-place adj. EBITDA ratio | 29 | 6.6x | 6.2x | 6.8x | 6.4x | 6.3x | ||||||||||||||||||||||||||||||||

| Net debt adjusted for fully-leased development plus pref. equity to in-place adj. EBITDA ratio | 29 | 6.3x | 5.9x | 6.4x | 5.9x | 5.8x | ||||||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Operating Office and Data Center Shell Properties | |||||||||||||||||||||||||||||

| # of Properties | |||||||||||||||||||||||||||||

| Total Portfolio | 182 | 181 | 176 | 174 | 171 | ||||||||||||||||||||||||

| Consolidated Portfolio | 165 | 164 | 161 | 159 | 156 | ||||||||||||||||||||||||

| Core Portfolio | 180 | 179 | 174 | 172 | 169 | ||||||||||||||||||||||||

| Same Properties | 161 | 161 | 161 | 161 | 161 | ||||||||||||||||||||||||

| % Occupied | |||||||||||||||||||||||||||||

| Total Portfolio | 93.8 | % | 94.1 | % | 93.8 | % | 93.4 | % | 93.7 | % | |||||||||||||||||||

| Consolidated Portfolio | 92.9 | % | 93.2 | % | 93.0 | % | 92.5 | % | 92.8 | % | |||||||||||||||||||

| Core Portfolio | 94.0 | % | 94.3 | % | 94.0 | % | 93.6 | % | 94.0 | % | |||||||||||||||||||

| Same Properties | 92.8 | % | 93.1 | % | 93.0 | % | 92.8 | % | 93.2 | % | |||||||||||||||||||

| % Leased | |||||||||||||||||||||||||||||

| Total Portfolio | 94.7 | % | 94.8 | % | 94.4 | % | 94.5 | % | 94.9 | % | |||||||||||||||||||

| Consolidated Portfolio | 93.9 | % | 94.0 | % | 93.6 | % | 93.7 | % | 94.2 | % | |||||||||||||||||||

| Core Portfolio | 94.9 | % | 95.0 | % | 94.6 | % | 94.7 | % | 95.2 | % | |||||||||||||||||||

| Same Properties | 93.8 | % | 94.0 | % | 93.6 | % | 94.0 | % | 94.5 | % | |||||||||||||||||||

| Square Feet (in thousands) | |||||||||||||||||||||||||||||

| Total Portfolio | 21,006 | 20,959 | 20,389 | 19,781 | 19,378 | ||||||||||||||||||||||||

| Consolidated Portfolio | 18,257 | 18,209 | 17,940 | 17,346 | 16,943 | ||||||||||||||||||||||||

| Core Portfolio | 20,849 | 20,802 | 20,232 | 19,624 | 19,221 | ||||||||||||||||||||||||

| Same Properties | 17,802 | 17,802 | 17,802 | 17,802 | 17,802 | ||||||||||||||||||||||||

| Wholesale Data Center | |||||||||||||||||||||||||||||

| Megawatts Operational | 19.25 | 19.25 | 19.25 | 19.25 | 19.25 | ||||||||||||||||||||||||

| % Leased | 86.7 | % | 86.7 | % | 86.7 | % | 90.6 | % | 76.9 | % | |||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Properties, net: | |||||||||||||||||||||||||||||

| Operating properties, net | $ | 3,106,698 | $ | 3,115,280 | $ | 2,999,892 | $ | 2,888,817 | $ | 2,813,949 | |||||||||||||||||||

| Development and redevelopment in progress, including land (1) | 187,290 | 172,614 | 302,158 | 315,243 | 300,836 | ||||||||||||||||||||||||

| Land held (1) | 285,266 | 274,655 | 284,888 | 309,039 | 304,843 | ||||||||||||||||||||||||

| Total properties, net | 3,579,254 | 3,562,549 | 3,586,938 | 3,513,099 | 3,419,628 | ||||||||||||||||||||||||

| Property - operating right-of-use assets | 39,810 | 40,570 | 36,442 | 31,009 | 27,793 | ||||||||||||||||||||||||

| Property - finance right-of-use assets | 40,091 | 40,425 | 40,432 | 40,441 | 40,450 | ||||||||||||||||||||||||

| Cash and cash equivalents | 36,139 | 18,369 | 11,458 | 21,596 | 159,061 | ||||||||||||||||||||||||

| Investment in unconsolidated real estate joint ventures | 28,934 | 29,303 | 49,662 | 50,457 | 51,220 | ||||||||||||||||||||||||

| Accounts receivable, net | 44,916 | 41,637 | 36,151 | 30,404 | 30,317 | ||||||||||||||||||||||||

| Deferred rent receivable | 98,048 | 92,876 | 92,853 | 90,493 | 89,690 | ||||||||||||||||||||||||

| Intangible assets on real estate acquisitions, net | 18,137 | 19,344 | 22,433 | 24,768 | 26,078 | ||||||||||||||||||||||||

| Deferred leasing costs, net | 56,508 | 58,613 | 59,392 | 58,666 | 58,608 | ||||||||||||||||||||||||

| Investing receivables, net | 71,831 | 68,754 | 74,136 | 72,333 | 71,197 | ||||||||||||||||||||||||

| Prepaid expenses and other assets, net | 99,280 | 104,583 | 110,292 | 78,059 | 80,415 | ||||||||||||||||||||||||

| Total assets | $ | 4,112,948 | $ | 4,077,023 | $ | 4,120,189 | $ | 4,011,325 | $ | 4,054,457 | |||||||||||||||||||

| Liabilities and equity | |||||||||||||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||||||||

| Debt | $ | 2,207,903 | $ | 2,086,918 | $ | 2,181,551 | $ | 2,012,019 | $ | 2,076,839 | |||||||||||||||||||

| Accounts payable and accrued expenses | 96,465 | 142,717 | 140,921 | 149,836 | 128,441 | ||||||||||||||||||||||||

| Rents received in advance and security deposits | 30,922 | 33,425 | 30,276 | 30,459 | 33,323 | ||||||||||||||||||||||||

| Dividends and distributions payable | 31,305 | 31,231 | 31,307 | 31,302 | 31,301 | ||||||||||||||||||||||||

| Deferred revenue associated with operating leases | 10,221 | 10,832 | 8,579 | 8,821 | 6,972 | ||||||||||||||||||||||||

| Property - operating lease liabilities | 30,176 | 30,746 | 26,382 | 20,796 | 17,365 | ||||||||||||||||||||||||

| Interest rate derivatives | 7,640 | 9,522 | 10,977 | 65,612 | 63,232 | ||||||||||||||||||||||||

| Other liabilities | 15,599 | 12,490 | 17,038 | 12,408 | 8,886 | ||||||||||||||||||||||||

| Total liabilities | 2,430,231 | 2,357,881 | 2,447,031 | 2,331,253 | 2,366,359 | ||||||||||||||||||||||||

| Redeemable noncontrolling interests | 25,925 | 25,430 | 23,522 | 23,148 | 22,912 | ||||||||||||||||||||||||

| Equity: | |||||||||||||||||||||||||||||

| COPT’s shareholders’ equity: | |||||||||||||||||||||||||||||

| Common shares | 1,123 | 1,122 | 1,122 | 1,122 | 1,122 | ||||||||||||||||||||||||

| Additional paid-in capital | 2,476,807 | 2,478,906 | 2,479,321 | 2,477,977 | 2,476,677 | ||||||||||||||||||||||||

| Cumulative distributions in excess of net income | (847,407) | (809,836) | (860,647) | (797,959) | (790,600) | ||||||||||||||||||||||||

| Accumulated other comprehensive loss | (7,391) | (9,157) | (10,548) | (64,513) | (62,201) | ||||||||||||||||||||||||

| Total COPT’s shareholders’ equity | 1,623,132 | 1,661,035 | 1,609,248 | 1,616,627 | 1,624,998 | ||||||||||||||||||||||||

| Noncontrolling interests in subsidiaries: | |||||||||||||||||||||||||||||

| Common units in the Operating Partnership | 21,345 | 20,465 | 19,522 | 19,611 | 19,600 | ||||||||||||||||||||||||

| Preferred units in the Operating Partnership | — | — | 8,800 | 8,800 | 8,800 | ||||||||||||||||||||||||

| Other consolidated entities | 12,315 | 12,212 | 12,066 | 11,886 | 11,788 | ||||||||||||||||||||||||

| Total noncontrolling interests in subsidiaries | 33,660 | 32,677 | 40,388 | 40,297 | 40,188 | ||||||||||||||||||||||||

| Total equity | 1,656,792 | 1,693,712 | 1,649,636 | 1,656,924 | 1,665,186 | ||||||||||||||||||||||||

| Total liabilities, redeemable noncontrolling interests and equity | $ | 4,112,948 | $ | 4,077,023 | $ | 4,120,189 | $ | 4,011,325 | $ | 4,054,457 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Lease revenue | $ | 144,624 | $ | 139,093 | $ | 133,875 | $ | 132,147 | $ | 131,012 | |||||||||||||||||||

| Other property revenue | 540 | 535 | 568 | 391 | 1,104 | ||||||||||||||||||||||||

| Construction contract and other service revenues | 16,558 | 24,400 | 20,323 | 12,236 | 13,681 | ||||||||||||||||||||||||

| Total revenues | 161,722 | 164,028 | 154,766 | 144,774 | 145,797 | ||||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||||||||

| Property operating expenses | 56,974 | 52,085 | 51,552 | 50,204 | 49,999 | ||||||||||||||||||||||||

| Depreciation and amortization associated with real estate operations | 37,321 | 36,653 | 35,332 | 33,612 | 32,596 | ||||||||||||||||||||||||

| Construction contract and other service expenses | 15,793 | 23,563 | 19,220 | 11,711 | 13,121 | ||||||||||||||||||||||||

| Impairment losses | — | — | 1,530 | — | — | ||||||||||||||||||||||||

| General and administrative expenses | 6,062 | 7,897 | 5,558 | 6,511 | 5,303 | ||||||||||||||||||||||||

| Leasing expenses | 2,344 | 1,993 | 1,909 | 1,647 | 2,183 | ||||||||||||||||||||||||

| Business development expenses and land carry costs | 1,094 | 999 | 1,094 | 1,262 | 1,118 | ||||||||||||||||||||||||

| Total operating expenses | 119,588 | 123,190 | 116,195 | 104,947 | 104,320 | ||||||||||||||||||||||||

| Interest expense | (17,519) | (17,148) | (17,152) | (16,797) | (16,840) | ||||||||||||||||||||||||

| Interest and other income | 1,865 | 3,341 | 1,746 | 2,282 | 1,205 | ||||||||||||||||||||||||

| Credit loss recoveries (expense) (1) | 907 | 772 | 1,465 | (615) | (689) | ||||||||||||||||||||||||

| Gain on sales of real estate | (490) | 30,204 | — | — | 5 | ||||||||||||||||||||||||

| Gain on sale of investment in unconsolidated real estate joint venture | — | 29,416 | — | — | — | ||||||||||||||||||||||||

| Loss on early extinguishment of debt | (33,166) | (4,069) | (3,237) | — | — | ||||||||||||||||||||||||

| Loss on interest rate derivatives | — | — | (53,196) | — | — | ||||||||||||||||||||||||

| (Loss) income before equity in income of unconsolidated entities and income taxes | (6,269) | 83,354 | (31,803) | 24,697 | 25,158 | ||||||||||||||||||||||||

| Equity in income of unconsolidated entities | 222 | 453 | 477 | 454 | 441 | ||||||||||||||||||||||||

| Income tax expense | (32) | (258) | (16) | (30) | (49) | ||||||||||||||||||||||||

| Net (loss) income | (6,079) | 83,549 | (31,342) | 25,121 | 25,550 | ||||||||||||||||||||||||

| Net loss (income) attributable to noncontrolling interests: | |||||||||||||||||||||||||||||

| Common units in the Operating Partnership | 85 | (995) | 386 | (284) | (287) | ||||||||||||||||||||||||

| Preferred units in the Operating Partnership | — | (69) | (77) | (77) | (77) | ||||||||||||||||||||||||

| Other consolidated entities | (675) | (817) | (812) | (1,263) | (1,132) | ||||||||||||||||||||||||

| Net (loss) income attributable to COPT common shareholders | $ | (6,669) | $ | 81,668 | $ | (31,845) | $ | 23,497 | $ | 24,054 | |||||||||||||||||||

| Amount allocable to share-based compensation awards | (170) | (280) | (145) | (109) | (97) | ||||||||||||||||||||||||

| Redeemable noncontrolling interests | — | 44 | — | — | — | ||||||||||||||||||||||||

| Distributions on dilutive convertible preferred units | — | 69 | — | — | — | ||||||||||||||||||||||||

| Numerator for diluted EPS | $ | (6,839) | $ | 81,501 | $ | (31,990) | $ | 23,388 | $ | 23,957 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Net (loss) income | $ | (6,079) | $ | 83,549 | $ | (31,342) | $ | 25,121 | $ | 25,550 | |||||||||||||||||||

| Real estate-related depreciation and amortization | 37,321 | 36,653 | 35,332 | 33,612 | 32,596 | ||||||||||||||||||||||||

Impairment losses on real estate | — | — | 1,530 | — | — | ||||||||||||||||||||||||

| Gain on sales of real estate | 490 | (30,204) | — | — | (5) | ||||||||||||||||||||||||

| Gain on sale of investment in unconsolidated real estate JV | — | (29,416) | — | — | — | ||||||||||||||||||||||||

| Depreciation and amortization on unconsolidated real estate JVs (1) | 454 | 874 | 819 | 818 | 818 | ||||||||||||||||||||||||

| FFO - per Nareit (2)(3) | 32,186 | 61,456 | 6,339 | 59,551 | 58,959 | ||||||||||||||||||||||||

| Noncontrolling interests - preferred units in the Operating Partnership | — | (69) | (77) | (77) | (77) | ||||||||||||||||||||||||

| FFO allocable to other noncontrolling interests (4) | (1,027) | (1,091) | (1,074) | (1,525) | (12,015) | ||||||||||||||||||||||||

| Basic FFO allocable to share-based compensation awards | (162) | (272) | (119) | (254) | (193) | ||||||||||||||||||||||||

| Basic FFO available to common share and common unit holders (3) | 30,997 | 60,024 | 5,069 | 57,695 | 46,674 | ||||||||||||||||||||||||

| Dilutive preferred units in the Operating Partnership | — | 69 | — | 77 | — | ||||||||||||||||||||||||

| Redeemable noncontrolling interests | — | 44 | — | 37 | 32 | ||||||||||||||||||||||||

Diluted FFO available to common share and common unit holders - per Nareit (3) | 30,997 | 60,137 | 5,069 | 57,809 | 46,706 | ||||||||||||||||||||||||

| Loss on early extinguishment of debt | 33,166 | 4,069 | 3,237 | — | — | ||||||||||||||||||||||||

| Loss on interest rate derivatives | — | — | 53,196 | — | — | ||||||||||||||||||||||||

| Demolition costs on redevelopment and nonrecurring improvements | — | — | 11 | 9 | 43 | ||||||||||||||||||||||||

| Dilutive preferred units in the Operating Partnership | — | — | 77 | — | 77 | ||||||||||||||||||||||||

| FFO allocation to other noncontrolling interests resulting from capital event (4) | — | — | — | — | 11,090 | ||||||||||||||||||||||||

| Diluted FFO comparability adjustments for redeemable noncontrolling interests | 458 | — | 34 | — | — | ||||||||||||||||||||||||

Diluted FFO comparability adjustments allocable to share-based compensation awards | (167) | (18) | (139) | (1) | (50) | ||||||||||||||||||||||||

Diluted FFO available to common share and common unit holders, as adjusted for comparability (3) | $ | 64,454 | $ | 64,188 | $ | 61,485 | $ | 57,817 | $ | 57,866 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| EPS Denominator: | |||||||||||||||||||||||||||||

| Weighted average common shares - basic | 111,888 | 111,817 | 111,811 | 111,800 | 111,724 | ||||||||||||||||||||||||

Dilutive effect of share-based compensation awards | — | 320 | — | 321 | 239 | ||||||||||||||||||||||||

Dilutive effect of redeemable noncontrolling interests | — | 117 | — | — | — | ||||||||||||||||||||||||

| Dilutive convertible preferred units | — | 155 | — | — | — | ||||||||||||||||||||||||

| Weighted average common shares - diluted | 111,888 | 112,409 | 111,811 | 112,121 | 111,963 | ||||||||||||||||||||||||

| Diluted EPS | $ | (0.06) | $ | 0.73 | $ | (0.29) | $ | 0.21 | $ | 0.21 | |||||||||||||||||||

| Weighted Average Shares for period ended: | |||||||||||||||||||||||||||||

| Common shares | 111,888 | 111,817 | 111,811 | 111,800 | 111,724 | ||||||||||||||||||||||||

Dilutive effect of share-based compensation awards | 261 | 320 | 274 | 321 | 239 | ||||||||||||||||||||||||

Common units | 1,246 | 1,239 | 1,240 | 1,237 | 1,226 | ||||||||||||||||||||||||

| Redeemable noncontrolling interests | — | 117 | — | 157 | 110 | ||||||||||||||||||||||||

| Dilutive convertible preferred units | — | 155 | — | 176 | — | ||||||||||||||||||||||||

Denominator for diluted FFO per share | 113,395 | 113,648 | 113,325 | 113,691 | 113,299 | ||||||||||||||||||||||||

| Redeemable noncontrolling interests | 940 | — | 109 | — | — | ||||||||||||||||||||||||

| Dilutive convertible preferred units | — | — | 176 | — | 176 | ||||||||||||||||||||||||

| Denominator for diluted FFO per share, as adjusted for comparability | 114,335 | 113,648 | 113,610 | 113,691 | 113,475 | ||||||||||||||||||||||||

| Weighted average common units | (1,246) | (1,239) | (1,240) | (1,237) | (1,226) | ||||||||||||||||||||||||

| Redeemable noncontrolling interests | (940) | — | (109) | (157) | (110) | ||||||||||||||||||||||||

| Anti-dilutive EPS effect of share-based compensation awards | (261) | — | (274) | — | — | ||||||||||||||||||||||||

| Dilutive convertible preferred units | — | — | (176) | (176) | (176) | ||||||||||||||||||||||||

| Denominator for diluted EPS | 111,888 | 112,409 | 111,811 | 112,121 | 111,963 | ||||||||||||||||||||||||

| Diluted FFO per share - Nareit | $ | 0.27 | $ | 0.53 | $ | 0.04 | $ | 0.51 | $ | 0.41 | |||||||||||||||||||

| Diluted FFO per share - as adjusted for comparability | $ | 0.56 | $ | 0.56 | $ | 0.54 | $ | 0.51 | $ | 0.51 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

Diluted FFO available to common share and common unit holders, as adjusted for comparability | $ | 64,454 | $ | 64,188 | $ | 61,485 | $ | 57,817 | $ | 57,866 | |||||||||||||||||||

| Straight line rent adjustments and lease incentive amortization | (3,357) | 3,438 | (1,009) | 2,523 | (852) | ||||||||||||||||||||||||

| Amortization of intangibles and other assets included in NOI | 40 | 24 | (39) | (73) | (74) | ||||||||||||||||||||||||

| Share-based compensation, net of amounts capitalized | 1,904 | 1,751 | 1,727 | 1,638 | 1,389 | ||||||||||||||||||||||||

| Amortization of deferred financing costs | 793 | 664 | 658 | 642 | 575 | ||||||||||||||||||||||||

| Amortization of net debt discounts, net of amounts capitalized | 542 | 504 | 453 | 390 | 386 | ||||||||||||||||||||||||

| Replacement capital expenditures (1) | (12,230) | (13,973) | (13,085) | (16,132) | (17,754) | ||||||||||||||||||||||||

Other diluted AFFO adjustments associated with real estate JVs (2) | 241 | 196 | 150 | (115) | (41) | ||||||||||||||||||||||||

Diluted AFFO available to common share and common unit holders (“diluted AFFO”) | $ | 52,387 | $ | 56,792 | $ | 50,340 | $ | 46,690 | $ | 41,495 | |||||||||||||||||||

| Replacement capital expenditures (1) | |||||||||||||||||||||||||||||

| Tenant improvements and incentives | $ | 7,139 | $ | 9,165 | $ | 6,950 | $ | 8,870 | $ | 11,357 | |||||||||||||||||||

| Building improvements | 3,628 | 7,523 | 10,400 | 13,662 | 2,475 | ||||||||||||||||||||||||

| Leasing costs | 1,129 | 1,514 | 1,934 | 2,222 | 2,762 | ||||||||||||||||||||||||

| Net additions to (exclusions from) tenant improvements and incentives | 2,900 | (370) | (943) | 329 | 2,026 | ||||||||||||||||||||||||

| Excluded building improvements and leasing costs | (2,566) | (3,859) | (5,256) | (8,951) | (866) | ||||||||||||||||||||||||

| Replacement capital expenditures | $ | 12,230 | $ | 13,973 | $ | 13,085 | $ | 16,132 | $ | 17,754 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Net (loss) income | $ | (6,079) | $ | 83,549 | $ | (31,342) | $ | 25,121 | $ | 25,550 | |||||||||||||||||||

| Interest expense | 17,519 | 17,148 | 17,152 | 16,797 | 16,840 | ||||||||||||||||||||||||

| Income tax expense | 32 | 258 | 16 | 30 | 49 | ||||||||||||||||||||||||

| Real estate-related depreciation and amortization | 37,321 | 36,653 | 35,332 | 33,612 | 32,596 | ||||||||||||||||||||||||

| Other depreciation and amortization | 555 | 513 | 457 | 448 | 419 | ||||||||||||||||||||||||

| Impairment losses on real estate | — | — | 1,530 | — | — | ||||||||||||||||||||||||

| Gain on sales of real estate | 490 | (30,204) | — | — | (5) | ||||||||||||||||||||||||

| Gain on sale of investment in unconsolidated real estate JV | — | (29,416) | — | — | — | ||||||||||||||||||||||||

| Adjustments from unconsolidated real estate JVs | 693 | 1,306 | 1,274 | 1,270 | 1,270 | ||||||||||||||||||||||||

| EBITDAre | 50,531 | 79,807 | 24,419 | 77,278 | 76,719 | ||||||||||||||||||||||||

| Loss on early extinguishment of debt | 33,166 | 4,069 | 3,237 | — | — | ||||||||||||||||||||||||

| Loss on interest rate derivatives | — | — | 53,196 | — | — | ||||||||||||||||||||||||

| Net (gain) loss on other investments | — | (1,218) | 250 | 2 | — | ||||||||||||||||||||||||

| Credit loss (recoveries) expense | (907) | (772) | (1,465) | 615 | 689 | ||||||||||||||||||||||||

| Business development expenses | 548 | 412 | 414 | 678 | 538 | ||||||||||||||||||||||||

| Demolition costs on redevelopment and nonrecurring improvements | — | — | 11 | 9 | 43 | ||||||||||||||||||||||||

| Adjusted EBITDA | 83,338 | 82,298 | 80,062 | 78,582 | 77,989 | ||||||||||||||||||||||||

| Proforma NOI adjustment for property changes within period | 166 | 1,459 | 1,631 | 959 | 734 | ||||||||||||||||||||||||

| Change in collectability of deferred rental revenue | 124 | 678 | 224 | 1,007 | — | ||||||||||||||||||||||||

| In-place adjusted EBITDA | $ | 83,628 | $ | 84,435 | $ | 81,917 | $ | 80,548 | $ | 78,723 | |||||||||||||||||||

| # of Properties | Operational Square Feet | % Occupied | % Leased | |||||||||||||||||||||||

| Core Portfolio: (2) | ||||||||||||||||||||||||||

Defense/IT Locations: | ||||||||||||||||||||||||||

Fort Meade/Baltimore Washington (“BW”) Corridor: | ||||||||||||||||||||||||||

National Business Park | 31 | 3,821 | 90.5% | 92.7% | ||||||||||||||||||||||

Howard County | 35 | 2,858 | 89.3% | 92.6% | ||||||||||||||||||||||

Other | 23 | 1,678 | 91.8% | 92.2% | ||||||||||||||||||||||

Total Fort Meade/BW Corridor | 89 | 8,357 | 90.4% | 92.5% | ||||||||||||||||||||||

Northern Virginia (“NoVA”) Defense/IT | 13 | 1,992 | 87.6% | 87.8% | ||||||||||||||||||||||

Lackland AFB (San Antonio, Texas) | 7 | 953 | 100.0% | 100.0% | ||||||||||||||||||||||

Navy Support | 21 | 1,242 | 96.9% | 96.9% | ||||||||||||||||||||||

Redstone Arsenal (Huntsville, Alabama) | 16 | 1,500 | 99.6% | 99.6% | ||||||||||||||||||||||

Data Center Shells: | ||||||||||||||||||||||||||

Consolidated Properties | 9 | 1,990 | 100.0% | 100.0% | ||||||||||||||||||||||

Unconsolidated JV Properties (3) | 17 | 2,749 | 100.0% | 100.0% | ||||||||||||||||||||||

Total Defense/IT Locations | 172 | 18,783 | 94.2% | 95.1% | ||||||||||||||||||||||

Regional Office | 8 | 2,066 | 92.9% | 92.9% | ||||||||||||||||||||||

| Core Portfolio | 180 | 20,849 | 94.0% | 94.9% | ||||||||||||||||||||||

| Other Properties | 2 | 157 | 68.4% | 68.4% | ||||||||||||||||||||||

| Total Portfolio | 182 | 21,006 | 93.8% | 94.7% | ||||||||||||||||||||||

| Consolidated Portfolio | 165 | 18,257 | 92.9% | 93.9% | ||||||||||||||||||||||

| As of Period End | ||||||||||||||||||||||||||||||||||||||||||||

| # of Office and Data Center Shell Properties | Operational Square Feet | % Occupied (1) | % Leased (1) | Annualized Rental Revenue (2) | % of Total Annualized Rental Revenue (2) | NOI from Real Estate Operations | ||||||||||||||||||||||||||||||||||||||

| Property Grouping | Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||

| Core Portfolio: | ||||||||||||||||||||||||||||||||||||||||||||

Same Properties: (3) | ||||||||||||||||||||||||||||||||||||||||||||

Consolidated properties | 150 | 16,174 | 92.4% | 93.5% | $ | 499,156 | 91.1 | % | $ | 75,006 | ||||||||||||||||||||||||||||||||||

| Unconsolidated real estate JV | 9 | 1,471 | 100.0% | 100.0% | 2,147 | 0.4 | % | 499 | ||||||||||||||||||||||||||||||||||||

| Total Same Properties in Core Portfolio | 159 | 17,645 | 93.0% | 94.0% | 501,303 | 91.5 | % | 75,505 | ||||||||||||||||||||||||||||||||||||

| Properties Placed in Service (4) | 13 | 1,926 | 99.5% | 99.6% | 42,274 | 7.7 | % | 9,229 | ||||||||||||||||||||||||||||||||||||

| Other unconsolidated JV properties (5) | 8 | 1,278 | 100.0% | 100.0% | 1,723 | 0.3 | % | 418 | ||||||||||||||||||||||||||||||||||||

Wholesale Data Center and Other | N/A | N/A | N/A | N/A | N/A | N/A | 3,627 | |||||||||||||||||||||||||||||||||||||

| Total Core Portfolio | 180 | 20,849 | 94.0% | 94.9% | 545,300 | 99.5 | % | 88,779 | ||||||||||||||||||||||||||||||||||||

| Other Properties (Same Properties) (3) | 2 | 157 | 68.4% | 68.4% | 2,626 | 0.5 | % | 328 | ||||||||||||||||||||||||||||||||||||

| Total Portfolio | 182 | 21,006 | 93.8% | 94.7% | $ | 547,926 | 100.0 | % | $ | 89,107 | ||||||||||||||||||||||||||||||||||

| Consolidated Portfolio | 165 | 18,257 | 92.9% | 93.9% | $ | 544,055 | 99.3 | % | $ | 88,190 | ||||||||||||||||||||||||||||||||||

| As of Period End | ||||||||||||||||||||||||||||||||||||||||||||

| # of Office and Data Center Shell Properties | Operational Square Feet | % Occupied (1) | % Leased (1) | Annualized Rental Revenue (2) | % of Core Annualized Rental Revenue (2) | NOI from Real Estate Operations | ||||||||||||||||||||||||||||||||||||||

| Property Grouping | Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||

| Core Portfolio: | ||||||||||||||||||||||||||||||||||||||||||||

| Defense/IT Locations: | ||||||||||||||||||||||||||||||||||||||||||||

Consolidated properties | 155 | 16,034 | 93.2% | 94.3% | $ | 473,625 | 86.9 | % | $ | 75,160 | ||||||||||||||||||||||||||||||||||

| Unconsolidated real estate JVs | 17 | 2,749 | 100.0% | 100.0% | 3,870 | 0.7 | % | 917 | ||||||||||||||||||||||||||||||||||||

| Total Defense/IT Locations | 172 | 18,783 | 94.2% | 95.1% | 477,495 | 87.6 | % | 76,077 | ||||||||||||||||||||||||||||||||||||

| Regional Office | 8 | 2,066 | 92.9% | 92.9% | 67,805 | 12.4 | % | 9,013 | ||||||||||||||||||||||||||||||||||||

| Wholesale Data Center and Other | N/A | N/A | N/A | N/A | N/A | N/A | 3,689 | |||||||||||||||||||||||||||||||||||||

| Total Core Portfolio | 180 | 20,849 | 94.0% | 94.9% | $ | 545,300 | 100.0 | % | $ | 88,779 | ||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Consolidated real estate revenues | |||||||||||||||||||||||||||||

| Defense/IT Locations: | |||||||||||||||||||||||||||||

| Fort Meade/BW Corridor | $ | 66,446 | $ | 63,733 | $ | 63,328 | $ | 62,698 | $ | 64,438 | |||||||||||||||||||

| NoVA Defense/IT | 15,211 | 14,993 | 14,699 | 14,447 | 13,678 | ||||||||||||||||||||||||

| Lackland Air Force Base | 12,555 | 13,047 | 12,602 | 13,257 | 12,076 | ||||||||||||||||||||||||

| Navy Support | 8,398 | 8,403 | 8,006 | 8,119 | 8,341 | ||||||||||||||||||||||||

| Redstone Arsenal | 8,253 | 7,113 | 6,079 | 4,647 | 4,676 | ||||||||||||||||||||||||

| Data Center Shells-Consolidated | 8,787 | 8,491 | 7,995 | 7,076 | 5,577 | ||||||||||||||||||||||||

| Total Defense/IT Locations | 119,650 | 115,780 | 112,709 | 110,244 | 108,786 | ||||||||||||||||||||||||

| Regional Office | 16,677 | 15,092 | 14,913 | 15,162 | 15,460 | ||||||||||||||||||||||||

| Wholesale Data Center | 8,090 | 8,093 | 6,068 | 6,455 | 7,172 | ||||||||||||||||||||||||

| Other | 747 | 663 | 753 | 677 | 698 | ||||||||||||||||||||||||

| Consolidated real estate revenues | $ | 145,164 | $ | 139,628 | $ | 134,443 | $ | 132,538 | $ | 132,116 | |||||||||||||||||||

| NOI | |||||||||||||||||||||||||||||

| Defense/IT Locations: | |||||||||||||||||||||||||||||

| Fort Meade/BW Corridor | $ | 41,775 | $ | 42,319 | $ | 41,791 | $ | 41,839 | $ | 43,216 | |||||||||||||||||||

| NoVA Defense/IT | 9,335 | 9,437 | 9,454 | 9,112 | 8,493 | ||||||||||||||||||||||||

| Lackland Air Force Base | 5,681 | 5,688 | 5,486 | 5,472 | 5,281 | ||||||||||||||||||||||||

| Navy Support | 4,965 | 5,248 | 4,962 | 4,948 | 5,056 | ||||||||||||||||||||||||

| Redstone Arsenal | 5,699 | 4,482 | 4,050 | 3,035 | 2,829 | ||||||||||||||||||||||||

| Data Center Shells: | |||||||||||||||||||||||||||||

Consolidated properties | 7,705 | 7,603 | 7,134 | 6,287 | 4,920 | ||||||||||||||||||||||||

| COPT’s share of unconsolidated real estate JVs | 917 | 1,761 | 1,752 | 1,725 | 1,713 | ||||||||||||||||||||||||

| Total Defense/IT Locations | 76,077 | 76,538 | 74,629 | 72,418 | 71,508 | ||||||||||||||||||||||||

| Regional Office | 9,013 | 8,155 | 7,131 | 8,274 | 7,923 | ||||||||||||||||||||||||

| Wholesale Data Center | 3,669 | 4,260 | 2,426 | 2,992 | 3,939 | ||||||||||||||||||||||||

| Other | 348 | 351 | 457 | 375 | 460 | ||||||||||||||||||||||||

| NOI from real estate operations | $ | 89,107 | $ | 89,304 | $ | 84,643 | $ | 84,059 | $ | 83,830 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Cash NOI | |||||||||||||||||||||||||||||

| Defense/IT Locations: | |||||||||||||||||||||||||||||

| Fort Meade/BW Corridor | $ | 39,666 | $ | 42,430 | $ | 41,365 | $ | 41,968 | $ | 42,170 | |||||||||||||||||||

| NoVA Defense/IT | 9,222 | 9,519 | 9,410 | 9,610 | 9,118 | ||||||||||||||||||||||||

| Lackland Air Force Base | 5,999 | 6,006 | 5,929 | 5,903 | 5,701 | ||||||||||||||||||||||||

| Navy Support | 4,965 | 5,376 | 5,130 | 5,248 | 5,146 | ||||||||||||||||||||||||

| Redstone Arsenal | 4,706 | 4,383 | 2,848 | 2,580 | 2,494 | ||||||||||||||||||||||||

| Data Center Shells: | |||||||||||||||||||||||||||||

Consolidated properties | 6,505 | 6,588 | 6,234 | 5,505 | 4,316 | ||||||||||||||||||||||||

| COPT’s share of unconsolidated real estate JVs | 816 | 1,668 | 1,655 | 1,641 | 1,633 | ||||||||||||||||||||||||

| Total Defense/IT Locations | 71,879 | 75,970 | 72,571 | 72,455 | 70,578 | ||||||||||||||||||||||||

| Regional Office | 7,448 | 8,156 | 7,045 | 8,078 | 7,479 | ||||||||||||||||||||||||

| Wholesale Data Center | 3,760 | 4,320 | 2,480 | 3,005 | 3,848 | ||||||||||||||||||||||||

| Other | 363 | 356 | 438 | 358 | 457 | ||||||||||||||||||||||||

| Cash NOI from real estate operations | 83,450 | 88,802 | 82,534 | 83,896 | 82,362 | ||||||||||||||||||||||||

Straight line rent adjustments and lease incentive amortization | 4,006 | (3,104) | 1,016 | (2,360) | 909 | ||||||||||||||||||||||||

| Amortization of acquired above- and below-market rents | 99 | 99 | 98 | 97 | 96 | ||||||||||||||||||||||||

| Amortization of intangibles and other assets to property operating expenses | (139) | (122) | (60) | (22) | (23) | ||||||||||||||||||||||||

| Lease termination fees, net | 1,362 | 141 | 455 | 199 | 37 | ||||||||||||||||||||||||

| Tenant funded landlord assets and lease incentives | 228 | 3,395 | 504 | 2,164 | 369 | ||||||||||||||||||||||||

| Cash NOI adjustments in unconsolidated real estate JVs | 101 | 93 | 96 | 85 | 80 | ||||||||||||||||||||||||

| NOI from real estate operations | $ | 89,107 | $ | 89,304 | $ | 84,643 | $ | 84,059 | $ | 83,830 | |||||||||||||||||||

| # of Properties | Operational Square Feet | Three Months Ended | |||||||||||||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||||||||||||||

| Core Portfolio: | |||||||||||||||||||||||||||||||||||||||||

Defense/IT Locations: | |||||||||||||||||||||||||||||||||||||||||

| Fort Meade/BW Corridor | 87 | 8,195 | 90.3 | % | 91.2 | % | 90.8 | % | 91.2 | % | 92.3 | % | |||||||||||||||||||||||||||||

| NoVA Defense/IT | 13 | 1,992 | 87.8 | % | 88.4 | % | 88.4 | % | 87.0 | % | 83.9 | % | |||||||||||||||||||||||||||||

| Lackland Air Force Base | 7 | 953 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||||||||||

| Navy Support | 21 | 1,242 | 96.8 | % | 96.9 | % | 94.6 | % | 94.0 | % | 93.6 | % | |||||||||||||||||||||||||||||

| Redstone Arsenal | 10 | 806 | 99.2 | % | 99.1 | % | 99.7 | % | 99.7 | % | 99.5 | % | |||||||||||||||||||||||||||||

| Data Center Shells: | |||||||||||||||||||||||||||||||||||||||||

| Consolidated properties | 5 | 1,027 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||||||||||

| Unconsolidated JV properties | 9 | 1,471 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||||||||||

Total Defense/IT Locations | 152 | 15,686 | 93.1 | % | 93.6 | % | 93.3 | % | 93.3 | % | 93.4 | % | |||||||||||||||||||||||||||||

Regional Office | 7 | 1,959 | 92.0 | % | 92.1 | % | 92.1 | % | 92.0 | % | 90.6 | % | |||||||||||||||||||||||||||||

| Core Portfolio Same Properties | 159 | 17,645 | 92.9 | % | 93.4 | % | 93.2 | % | 93.1 | % | 93.1 | % | |||||||||||||||||||||||||||||

| Other Same Properties | 2 | 157 | 68.4 | % | 68.4 | % | 68.4 | % | 65.8 | % | 67.4 | % | |||||||||||||||||||||||||||||

| Total Same Properties | 161 | 17,802 | 92.7 | % | 93.2 | % | 92.9 | % | 92.9 | % | 92.8 | % | |||||||||||||||||||||||||||||

Same Properties (1) Period End Occupancy Rates by Segment (square feet in thousands) | |||||||||||||||||||||||||||||||||||||||||

| # of Properties | Operational Square Feet | ||||||||||||||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||||||||||||||

| Core Portfolio: | |||||||||||||||||||||||||||||||||||||||||

Defense/IT Locations: | |||||||||||||||||||||||||||||||||||||||||

Fort Meade/BW Corridor | 87 | 8,195 | 90.3 | % | 91.0 | % | 90.9 | % | 91.0 | % | 92.4 | % | |||||||||||||||||||||||||||||

NoVA Defense/IT | 13 | 1,992 | 87.6 | % | 88.1 | % | 88.5 | % | 87.0 | % | 85.5 | % | |||||||||||||||||||||||||||||

Lackland Air Force Base | 7 | 953 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||||||||||

Navy Support | 21 | 1,242 | 96.9 | % | 97.2 | % | 95.6 | % | 93.9 | % | 94.0 | % | |||||||||||||||||||||||||||||

Redstone Arsenal | 10 | 806 | 99.2 | % | 98.9 | % | 99.2 | % | 99.7 | % | 99.7 | % | |||||||||||||||||||||||||||||

Data Center Shells: | |||||||||||||||||||||||||||||||||||||||||

| Consolidated properties | 5 | 1,027 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||||||||||

| Unconsolidated JV properties | 9 | 1,471 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | |||||||||||||||||||||||||||||

Total Defense/IT Locations | 152 | 15,686 | 93.1 | % | 93.5 | % | 93.4 | % | 93.2 | % | 93.7 | % | |||||||||||||||||||||||||||||

Regional Office | 7 | 1,959 | 92.5 | % | 92.1 | % | 92.3 | % | 92.0 | % | 91.4 | % | |||||||||||||||||||||||||||||

| Core Portfolio Same Properties | 159 | 17,645 | 93.0 | % | 93.3 | % | 93.3 | % | 93.0 | % | 93.4 | % | |||||||||||||||||||||||||||||

| Other Same Properties | 2 | 157 | 68.4 | % | 68.4 | % | 68.4 | % | 68.4 | % | 64.6 | % | |||||||||||||||||||||||||||||

| Total Same Properties | 161 | 17,802 | 92.8 | % | 93.1 | % | 93.0 | % | 92.8 | % | 93.2 | % | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Same Properties real estate revenues | |||||||||||||||||||||||||||||

| Defense/IT Locations: | |||||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 65,278 | $ | 62,912 | $ | 62,694 | $ | 62,075 | $ | 63,798 | |||||||||||||||||||

NoVA Defense/IT | 15,127 | 14,993 | 14,698 | 14,447 | 13,678 | ||||||||||||||||||||||||

Lackland Air Force Base | 12,555 | 13,047 | 12,603 | 13,257 | 12,076 | ||||||||||||||||||||||||

Navy Support | 8,398 | 8,403 | 8,007 | 8,119 | 8,340 | ||||||||||||||||||||||||

Redstone Arsenal | 4,555 | 4,487 | 4,449 | 4,405 | 4,676 | ||||||||||||||||||||||||

Data Center Shells-Consolidated | 4,182 | 4,273 | 4,021 | 4,143 | 3,919 | ||||||||||||||||||||||||

| Total Defense/IT Locations | 110,095 | 108,115 | 106,472 | 106,446 | 106,487 | ||||||||||||||||||||||||

| Regional Office | 14,995 | 14,829 | 14,913 | 15,162 | 15,460 | ||||||||||||||||||||||||

| Other Properties | 665 | 663 | 753 | 676 | 698 | ||||||||||||||||||||||||

| Same Properties real estate revenues | $ | 125,755 | $ | 123,607 | $ | 122,138 | $ | 122,284 | $ | 122,645 | |||||||||||||||||||

| Same Properties NOI | |||||||||||||||||||||||||||||

| Defense/IT Locations: | |||||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 40,975 | $ | 41,756 | $ | 41,369 | $ | 41,412 | $ | 42,791 | |||||||||||||||||||

NoVA Defense/IT | 9,251 | 9,436 | 9,454 | 9,112 | 8,494 | ||||||||||||||||||||||||

Lackland Air Force Base | 5,682 | 5,688 | 5,486 | 5,472 | 5,281 | ||||||||||||||||||||||||

Navy Support | 4,965 | 5,248 | 4,961 | 4,949 | 5,056 | ||||||||||||||||||||||||

Redstone Arsenal | 2,912 | 2,684 | 2,743 | 2,835 | 2,829 | ||||||||||||||||||||||||

Data Center Shells: | |||||||||||||||||||||||||||||

| Consolidated properties | 3,530 | 3,581 | 3,491 | 3,521 | 3,415 | ||||||||||||||||||||||||

| COPT’s share of unconsolidated real estate JV | 499 | 506 | 504 | 506 | 505 | ||||||||||||||||||||||||

| Total Defense/IT Locations | 67,814 | 68,899 | 68,008 | 67,807 | 68,371 | ||||||||||||||||||||||||

| Regional Office | 7,715 | 7,892 | 7,131 | 8,274 | 7,923 | ||||||||||||||||||||||||

| Other Properties | 304 | 351 | 456 | 375 | 461 | ||||||||||||||||||||||||

| Same Properties NOI | $ | 75,833 | $ | 77,142 | $ | 75,595 | $ | 76,456 | $ | 76,755 | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Same Properties cash NOI | |||||||||||||||||||||||||||||

| Defense/IT Locations: | |||||||||||||||||||||||||||||

Fort Meade/BW Corridor | $ | 39,192 | $ | 42,068 | $ | 40,991 | $ | 41,668 | $ | 42,241 | |||||||||||||||||||

NoVA Defense/IT | 9,138 | 9,519 | 9,410 | 9,610 | 9,118 | ||||||||||||||||||||||||

Lackland Air Force Base | 5,999 | 6,005 | 5,929 | 5,904 | 5,701 | ||||||||||||||||||||||||

Navy Support | 4,965 | 5,376 | 5,130 | 5,248 | 5,146 | ||||||||||||||||||||||||

Redstone Arsenal | 2,957 | 2,790 | 2,628 | 2,609 | 2,494 | ||||||||||||||||||||||||

| Data Center Shells: | |||||||||||||||||||||||||||||

| Consolidated properties | 3,142 | 3,155 | 3,050 | 3,060 | 2,952 | ||||||||||||||||||||||||

| COPT’s share of unconsolidated real estate JV | 456 | 460 | 456 | 456 | 453 | ||||||||||||||||||||||||

| Total Defense/IT Locations | 65,849 | 69,373 | 67,594 | 68,555 | 68,105 | ||||||||||||||||||||||||

| Regional Office | 7,832 | 8,157 | 7,045 | 8,078 | 7,479 | ||||||||||||||||||||||||

| Other Properties | 319 | 356 | 438 | 358 | 457 | ||||||||||||||||||||||||

| Same Properties cash NOI | 74,000 | 77,886 | 75,077 | 76,991 | 76,041 | ||||||||||||||||||||||||

Straight line rent adjustments and lease incentive amortization | 151 | (1,278) | (401) | (838) | 182 | ||||||||||||||||||||||||

| Amortization of acquired above- and below-market rents | 99 | 99 | 98 | 97 | 96 | ||||||||||||||||||||||||

| Amortization of intangibles and other assets to property operating expenses | — | — | (23) | (23) | (23) | ||||||||||||||||||||||||

| Lease termination fees, net | 1,362 | 141 | 454 | 200 | 38 | ||||||||||||||||||||||||

| Tenant funded landlord assets and lease incentives | 179 | 249 | 342 | (20) | 368 | ||||||||||||||||||||||||

| Cash NOI adjustments in unconsolidated real estate JV | 42 | 45 | 48 | 49 | 53 | ||||||||||||||||||||||||

| Same Properties NOI | $ | 75,833 | $ | 77,142 | $ | 75,595 | $ | 76,456 | $ | 76,755 | |||||||||||||||||||

| Percentage change in total Same Properties cash NOI (1) | (2.7 | %) | |||||||||||||||||||||||||||

| Percentage change in Defense/IT Locations Same Properties cash NOI (1) | (3.3 | %) | |||||||||||||||||||||||||||

| Defense/IT Locations | |||||||||||||||||||||||||||||||||||||||||

| Ft Meade/BW Corridor | NoVA Defense/IT | Navy Support | Redstone Arsenal | Total Defense/IT Locations | Regional Office | Total | |||||||||||||||||||||||||||||||||||

| Renewed Space | |||||||||||||||||||||||||||||||||||||||||

| Leased Square Feet | 63 | — | 81 | 10 | 154 | — | 154 | ||||||||||||||||||||||||||||||||||

| Expiring Square Feet | 149 | — | 92 | 10 | 251 | 46 | 297 | ||||||||||||||||||||||||||||||||||

| Vacating Square Feet | 87 | — | 10 | — | 97 | 46 | 143 | ||||||||||||||||||||||||||||||||||

| Retention Rate (% based upon square feet) | 42.0 | % | — | % | 88.6 | % | 100.0 | % | 61.3 | % | — | % | 51.8 | % | |||||||||||||||||||||||||||

| Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||||||||

| Per Annum Average Committed Cost per Square Foot (2) | $ | 3.39 | $ | — | $ | 0.92 | $ | 1.06 | $ | 1.93 | $ | — | $ | 1.93 | |||||||||||||||||||||||||||

| Weighted Average Lease Term in Years | 4.1 | — | 2.6 | 1.0 | 3.1 | — | 3.1 | ||||||||||||||||||||||||||||||||||

| Average Rent Per Square Foot | |||||||||||||||||||||||||||||||||||||||||

Renewal Average Rent | $ | 32.96 | $ | — | $ | 20.67 | $ | 27.32 | $ | 26.11 | $ | — | $ | 26.11 | |||||||||||||||||||||||||||

Expiring Average Rent | $ | 31.32 | $ | — | $ | 20.15 | $ | 22.96 | $ | 24.88 | $ | — | $ | 24.88 | |||||||||||||||||||||||||||

Change in Average Rent | 5.2 | % | — | % | 2.6 | % | 19.0 | % | 4.9 | % | — | % | 4.9 | % | |||||||||||||||||||||||||||

| Cash Rent Per Square Foot | |||||||||||||||||||||||||||||||||||||||||

Renewal Cash Rent | $ | 31.81 | $ | — | $ | 20.50 | $ | 27.32 | $ | 25.56 | $ | — | $ | 25.56 | |||||||||||||||||||||||||||

Expiring Cash Rent | $ | 32.95 | $ | — | $ | 20.81 | $ | 26.55 | $ | 26.13 | $ | — | $ | 26.13 | |||||||||||||||||||||||||||

Change in Cash Rent | (3.5) | % | — | % | (1.5) | % | 2.9 | % | (2.2) | % | — | % | (2.2) | % | |||||||||||||||||||||||||||

Average Escalations Per Year | 2.5 | % | — | % | 2.8 | % | — | % | 2.6 | % | — | % | 2.6 | % | |||||||||||||||||||||||||||

| New Leases | |||||||||||||||||||||||||||||||||||||||||

| Development and Redevelopment Space | |||||||||||||||||||||||||||||||||||||||||

| Leased Square Feet | — | — | — | 11 | 11 | — | 11 | ||||||||||||||||||||||||||||||||||

| Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||||||||

| Per Annum Average Committed Cost per Square Foot (2) | $ | — | $ | — | $ | — | $ | 13.33 | $ | 13.33 | $ | — | $ | 13.33 | |||||||||||||||||||||||||||

| Weighted Average Lease Term in Years | — | — | — | 5.5 | 5.5 | — | 5.5 | ||||||||||||||||||||||||||||||||||

| Average Rent Per Square Foot | $ | — | $ | — | $ | — | $ | 26.37 | $ | 26.37 | $ | — | $ | 26.37 | |||||||||||||||||||||||||||

| Cash Rent Per Square Foot | $ | — | $ | — | $ | — | $ | 27.25 | $ | 27.25 | $ | — | $ | 27.25 | |||||||||||||||||||||||||||

| Vacant Space (3) | |||||||||||||||||||||||||||||||||||||||||

| Leased Square Feet | 82 | 8 | 3 | — | 93 | — | 93 | ||||||||||||||||||||||||||||||||||

| Statistics for Completed Leasing: | |||||||||||||||||||||||||||||||||||||||||

| Per Annum Average Committed Cost per Square Foot (2) | $ | 6.92 | $ | 5.96 | $ | 2.50 | $ | — | $ | 6.69 | $ | — | $ | 6.69 | |||||||||||||||||||||||||||

| Weighted Average Lease Term in Years | 8.8 | 6.0 | 6.6 | — | 8.5 | — | 8.5 | ||||||||||||||||||||||||||||||||||

| Average Rent Per Square Foot | $ | 25.69 | $ | 36.37 | $ | 33.40 | $ | — | $ | 26.90 | $ | — | $ | 26.90 | |||||||||||||||||||||||||||

| Cash Rent Per Square Foot | $ | 27.55 | $ | 34.69 | $ | 44.00 | $ | — | $ | 28.72 | $ | — | $ | 28.72 | |||||||||||||||||||||||||||

| Total Square Feet Leased | 145 | 8 | 84 | 21 | 258 | — | 258 | ||||||||||||||||||||||||||||||||||

| Average Escalations Per Year | 2.4 | % | 2.9 | % | 2.8 | % | 2.5 | % | 2.5 | % | — | % | 2.5 | % | |||||||||||||||||||||||||||

| Average Escalations Excl. Data Center Shells | 2.5 | % | |||||||||||||||||||||||||||||||||||||||

| Segment of Lease and Year of Expiration (2) | Square Footage of Leases Expiring | Annualized Rental Revenue of Expiring Leases (3) | % of Core/Total Annualized Rental Revenue Expiring (3)(4) | Annualized Rental Revenue of Expiring Leases per Occupied Sq. Foot (3) | ||||||||||||||||||||||

Core Portfolio | ||||||||||||||||||||||||||

| Ft Meade/BW Corridor | 592 | $ | 19,431 | 3.6 | % | $ | 31.29 | |||||||||||||||||||

| NoVA Defense/IT | 69 | 2,168 | 0.4 | % | 31.48 | |||||||||||||||||||||

| Lackland Air Force Base | 250 | 11,836 | 2.2 | % | 47.34 | |||||||||||||||||||||

| Navy Support | 145 | 5,000 | 0.9 | % | 34.37 | |||||||||||||||||||||

| Redstone Arsenal | 4 | 105 | — | % | 24.97 | |||||||||||||||||||||

| Regional Office | 76 | 2,577 | 0.5 | % | 33.97 | |||||||||||||||||||||

| 2021 | 1,136 | 41,117 | 7.5 | % | 35.28 | |||||||||||||||||||||

| Ft Meade/BW Corridor | 1,116 | 39,417 | 7.2 | % | 35.31 | |||||||||||||||||||||

| NoVA Defense/IT | 135 | 4,731 | 0.9 | % | 34.95 | |||||||||||||||||||||

| Navy Support | 272 | 6,854 | 1.3 | % | 25.16 | |||||||||||||||||||||

| Redstone Arsenal | 403 | 9,111 | 1.7 | % | 22.62 | |||||||||||||||||||||

| Regional Office | 531 | 17,632 | 3.2 | % | 33.10 | |||||||||||||||||||||

| 2022 | 2,457 | 77,744 | 14.3 | % | 31.61 | |||||||||||||||||||||

| Ft Meade/BW Corridor | 1,296 | 47,463 | 8.7 | % | 36.60 | |||||||||||||||||||||

| NoVA Defense/IT | 177 | 5,913 | 1.1 | % | 33.29 | |||||||||||||||||||||

| Navy Support | 215 | 6,205 | 1.1 | % | 28.91 | |||||||||||||||||||||

| Redstone Arsenal | 14 | 336 | 0.1 | % | 24.15 | |||||||||||||||||||||

| Regional Office | 143 | 4,328 | 0.8 | % | 30.21 | |||||||||||||||||||||

| 2023 | 1,845 | 64,245 | 11.8 | % | 34.80 | |||||||||||||||||||||

| Ft Meade/BW Corridor | 1,192 | 43,822 | 8.0 | % | 36.58 | |||||||||||||||||||||

| NoVA Defense/IT | 406 | 14,212 | 2.6 | % | 35.01 | |||||||||||||||||||||

| Navy Support | 273 | 5,922 | 1.1 | % | 21.70 | |||||||||||||||||||||

| Redstone Arsenal | 75 | 1,840 | 0.3 | % | 24.40 | |||||||||||||||||||||

| Data Center Shells-Unconsolidated JV Properties | 546 | 661 | 0.1 | % | 12.11 | |||||||||||||||||||||

| Regional Office | 77 | 2,370 | 0.4 | % | 30.27 | |||||||||||||||||||||

| 2024 | 2,569 | 68,827 | 12.6 | % | 33.01 | |||||||||||||||||||||

| Ft Meade/BW Corridor | 1,441 | 49,484 | 9.1 | % | 34.27 | |||||||||||||||||||||

| NoVA Defense/IT | 250 | 10,151 | 1.9 | % | 40.65 | |||||||||||||||||||||

| Lackland Air Force Base | 703 | 39,198 | 7.2 | % | 55.78 | |||||||||||||||||||||

| Navy Support | 51 | 1,199 | 0.2 | % | 23.39 | |||||||||||||||||||||

| Redstone Arsenal | 253 | 5,265 | 1.0 | % | 20.68 | |||||||||||||||||||||

| Data Center Shells-Unconsolidated JV Properties | 121 | 156 | — | % | 12.93 | |||||||||||||||||||||

| Regional Office | 110 | 4,052 | 0.7 | % | 36.76 | |||||||||||||||||||||

| 2025 | 2,929 | 109,505 | 20.1 | % | 38.78 | |||||||||||||||||||||

| Thereafter | ||||||||||||||||||||||||||

| Consolidated Properties | 6,586 | 180,809 | 33.3 | % | 26.93 | |||||||||||||||||||||

| Unconsolidated JV Properties | 2,083 | 3,053 | 0.6 | % | 14.66 | |||||||||||||||||||||

| Core Portfolio | 19,605 | $ | 545,300 | 100.0 | % | $ | 31.54 | |||||||||||||||||||

| Segment of Lease and Year of Expiration (2) | Square Footage of Leases Expiring | Annualized Rental Revenue of Expiring Leases (3) | % of Core/Total Annualized Rental Revenue Expiring (3)(4) | Annualized Rental Revenue of Expiring Leases per Occupied Sq. Foot (3) | ||||||||||||||||||||||

| Core Portfolio | 19,605 | $ | 545,300 | 99.5 | % | $ | 31.54 | |||||||||||||||||||

Other Properties | 108 | 2,626 | 0.5 | % | 24.39 | |||||||||||||||||||||

| Total Portfolio | 19,713 | $ | 547,926 | 100.0 | % | $ | 31.50 | |||||||||||||||||||

| Consolidated Portfolio | 16,964 | $ | 544,055 | |||||||||||||||||||||||

| Unconsolidated JV Properties | 2,749 | $ | 3,870 | |||||||||||||||||||||||

| Year of Expiration | Critical Load (MW) | Annualized Rental Revenue of Expiring Leases (3) | ||||||||||||

2021 (5) | 11.40 | $ | 14,939 | |||||||||||

| 2022 | 1.27 | 2,560 | ||||||||||||

| 2023 | 0.92 | 1,742 | ||||||||||||

| 2024 | — | 10 | ||||||||||||

| 2025 | 3.10 | 5,297 | ||||||||||||

| Thereafter | — | 289 | ||||||||||||

| 16.69 | $ | 24,837 | ||||||||||||

| Segment of Lease and Quarter of Expiration (2) | Square Footage of Leases Expiring | Annualized Rental Revenue of Expiring Leases (3) | % of Core Annualized Rental Revenue Expiring (3)(4) | Annualized Rental Revenue of Expiring Leases per Occupied Sq. Foot | ||||||||||||||||||||||

Core Portfolio | ||||||||||||||||||||||||||

| Ft Meade/BW Corridor | 242 | $ | 7,727 | 1.4 | % | $ | 31.92 | |||||||||||||||||||

| NoVA Defense/IT | 16 | 575 | 0.1 | % | 35.67 | |||||||||||||||||||||

| Lackland Air Force Base | 250 | 11,836 | 2.2 | % | 47.34 | |||||||||||||||||||||

| Navy Support | 12 | 354 | 0.1 | % | 29.56 | |||||||||||||||||||||

| Regional Office | 26 | 820 | 0.2 | % | 31.06 | |||||||||||||||||||||

| Q2 2021 | 546 | 21,312 | 4.0 | % | 37.08 | |||||||||||||||||||||

| Ft Meade/BW Corridor | 149 | 4,986 | 0.9 | % | 33.22 | |||||||||||||||||||||

| NoVA Defense/IT | 14 | 356 | 0.1 | % | 25.70 | |||||||||||||||||||||

| Navy Support | 20 | 503 | 0.1 | % | 25.54 | |||||||||||||||||||||

| Redstone Arsenal | 4 | 105 | — | % | 24.97 | |||||||||||||||||||||

| Regional Office | 15 | 503 | 0.1 | % | 33.83 | |||||||||||||||||||||

| Q3 2021 | 202 | 6,453 | 1.2 | % | 31.83 | |||||||||||||||||||||

| Ft Meade/BW Corridor | 201 | 6,718 | 1.2 | % | 33.48 | |||||||||||||||||||||

| NoVA Defense/IT | 39 | 1,237 | 0.2 | % | 31.81 | |||||||||||||||||||||

| Navy Support | 114 | 4,143 | 0.8 | % | 36.40 | |||||||||||||||||||||

| Regional Office | 34 | 1,254 | 0.2 | % | 36.26 | |||||||||||||||||||||

| Q4 2021 | 388 | 13,352 | 2.4 | % | 34.41 | |||||||||||||||||||||

| 1,136 | $ | 41,117 | 7.5 | % | $ | 35.28 | ||||||||||||||||||||

| Tenant | Total Annualized Rental Revenue (2) | % of Total Annualized Rental Revenue (2) | Occupied Square Feet in Office and Data Center Shells | Weighted Average Remaining Lease Term in Office and Data Center Shells (3) | |||||||||||||||||||||||||

| United States Government | (4) | $ | 193,849 | 33.8 | % | 4,691 | 4.1 | ||||||||||||||||||||||

| Fortune 100 Company | 51,669 | 9.0 | % | 4,769 | 9.2 | ||||||||||||||||||||||||

| General Dynamics Corporation | 32,909 | 5.7 | % | 752 | 2.7 | ||||||||||||||||||||||||

| The Boeing Company | 17,327 | 3.0 | % | 610 | 1.3 | ||||||||||||||||||||||||

| CACI International Inc | 13,525 | 2.4 | % | 354 | 4.0 | ||||||||||||||||||||||||

| CareFirst Inc. | 11,409 | 2.0 | % | 312 | 1.9 | ||||||||||||||||||||||||

| Booz Allen Hamilton, Inc. | 11,013 | 1.9 | % | 297 | 3.1 | ||||||||||||||||||||||||

| Peraton Corp. | 9,070 | 1.6 | % | 268 | 5.5 | ||||||||||||||||||||||||

| Northrop Grumman Corporation | 8,027 | 1.4 | % | 284 | 2.7 | ||||||||||||||||||||||||

| Well Fargo & Company | 7,055 | 1.2 | % | 172 | 6.9 | ||||||||||||||||||||||||

| AT&T Corporation | 6,263 | 1.1 | % | 321 | 8.5 | ||||||||||||||||||||||||

| Miles and Stockbridge, PC | 6,064 | 1.1 | % | 160 | 6.5 | ||||||||||||||||||||||||

| Yulista Holding, LLC | 5,948 | 1.0 | % | 366 | 8.7 | ||||||||||||||||||||||||

| Morrison & Foerster, LLP | 5,925 | 1.0 | % | 102 | 16.0 | ||||||||||||||||||||||||

| Raytheon Technologies Corporation | 5,731 | 1.0 | % | 157 | 2.3 | ||||||||||||||||||||||||

| University of Maryland | 5,486 | 1.0 | % | 169 | 7.1 | ||||||||||||||||||||||||

| Transamerica Life Insurance Company | 5,296 | 0.9 | % | 140 | 0.8 | ||||||||||||||||||||||||

| Jacobs Engineering Group Inc. | 5,229 | 0.9 | % | 165 | 4.8 | ||||||||||||||||||||||||

| Science Applications International Corp. | 5,202 | 0.9 | % | 134 | 1.3 | ||||||||||||||||||||||||

| Mantech International Corp. | 4,838 | 0.8 | % | 165 | 3.5 | ||||||||||||||||||||||||

| Subtotal Top 20 Tenants | 411,835 | 71.7 | % | 14,388 | 5.8 | ||||||||||||||||||||||||

| All remaining tenants | 160,928 | 28.3 | % | 5,325 | 4.0 | ||||||||||||||||||||||||

| Total/Weighted Average | $ | 572,763 | 100.0 | % | 19,713 | 5.3 | |||||||||||||||||||||||

| Total Rentable Square Feet | % Leased as of 3/31/21 | as of 3/31/21 (2) | Actual or Anticipated Shell Completion Date | Anticipated Operational Date (3) | |||||||||||||||||||||||||

| Anticipated Total Cost | Cost to Date | Cost to Date Placed in Service | |||||||||||||||||||||||||||

| Property and Segment | Location | ||||||||||||||||||||||||||||

| Fort Meade/BW Corridor: | |||||||||||||||||||||||||||||

| 4600 River Road (4) | College Park, Maryland | 102 | 54% | $ | 30,927 | $ | 24,420 | $ | 16,536 | 4Q 20 | 4Q 21 | ||||||||||||||||||

| 610 Guardian Way | Annapolis Junction, Maryland | 107 | 100% | 64,000 | 24,303 | — | 4Q 21 | 4Q 21 | |||||||||||||||||||||

| Subtotal / Average | 209 | 78% | 94,927 | 48,723 | 16,536 | ||||||||||||||||||||||||

| NoVA Defense/IT: | |||||||||||||||||||||||||||||

NoVA Office C | Chantilly, Virginia | 348 | 100% | 106,219 | 67,217 | 2,794 | 4Q 21 | 4Q 21 | |||||||||||||||||||||

| Lackland Air Force Base: | |||||||||||||||||||||||||||||

| Project EL | San Antonio, Texas | 107 | 100% | 51,500 | 28,144 | — | 3Q 21 | 3Q 21 | |||||||||||||||||||||

| Navy Support: | |||||||||||||||||||||||||||||

| Expedition VII | St. Mary’s County, Maryland | 30 | 60% | 8,189 | 1,764 | — | 4Q 21 | 4Q 22 | |||||||||||||||||||||

| Redstone Arsenal: | |||||||||||||||||||||||||||||

| 6000 Redstone Gateway (5) | Huntsville, Alabama | 42 | 100% | 9,796 | 8,790 | 7,759 | 4Q 20 | 3Q 21 | |||||||||||||||||||||

8000 Rideout Road | Huntsville, Alabama | 100 | 20% | 26,991 | 17,005 | — | 2Q 21 | 2Q 22 | |||||||||||||||||||||

| Subtotal / Average | 142 | 44% | 36,787 | 25,795 | 7,759 | ||||||||||||||||||||||||

| Data Center Shells: | |||||||||||||||||||||||||||||

| PS A | Northern Virginia | 227 | 100% | 65,600 | 5,598 | — | 2Q 23 | 2Q 23 | |||||||||||||||||||||

| PS B | Northern Virginia | 193 | 100% | 55,000 | 4,533 | — | 1Q 24 | 1Q 24 | |||||||||||||||||||||

| Subtotal / Average | 420 | 100% | 120,600 | 10,131 | — | ||||||||||||||||||||||||

| Regional Office: | |||||||||||||||||||||||||||||

| 2100 L Street (6) | Washington, D.C. | 190 | 56% | 177,000 | 158,420 | 121,279 | 2Q 20 | 2Q 21 | |||||||||||||||||||||

| Total Under Development | 1,446 | 85% | $ | 595,222 | $ | 340,194 | $ | 148,368 | |||||||||||||||||||||

| Total Property | Square Feet Placed in Service | Space Placed in Service % Leased as of 3/31/21 | ||||||||||||||||||

| Property Segment | % Leased as of 3/31/21 | Rentable Square Feet | 2021 | |||||||||||||||||

| Property and Location | 1st Quarter | |||||||||||||||||||

7100 Redstone Gateway Huntsville, Alabama | Redstone Arsenal | 100% | 46 | 46 | 100% | |||||||||||||||

| Location | Acres | Estimated Developable Square Feet | Carrying Amount | ||||||||||||||

| Land owned/controlled for future development | |||||||||||||||||

Defense/IT Locations: | |||||||||||||||||

Fort Meade/BW Corridor: | |||||||||||||||||

National Business Park | 175 | 1,999 | |||||||||||||||

Howard County | 19 | 290 | |||||||||||||||

Other | 126 | 1,338 | |||||||||||||||

Total Fort Meade/BW Corridor | 320 | 3,627 | |||||||||||||||

NoVA Defense/IT | 29 | 1,133 | |||||||||||||||

Lackland AFB | 19 | 410 | |||||||||||||||

Navy Support | 38 | 64 | |||||||||||||||

Redstone Arsenal (2) | 355 | 3,125 | |||||||||||||||

Data Center Shells | 53 | 1,180 | |||||||||||||||

Total Defense/IT Locations | 814 | 9,539 | |||||||||||||||

Regional Office | 10 | 900 | |||||||||||||||

| Total land owned/controlled for future development | 824 | 10,439 | $ | 281,835 | |||||||||||||

| Other land owned/controlled | 43 | 638 | 3,431 | ||||||||||||||

| Land held, net | 867 | 11,077 | $ | 285,266 | |||||||||||||

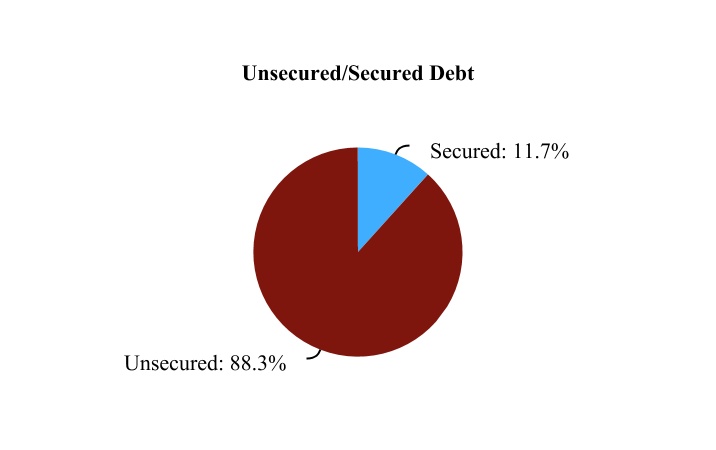

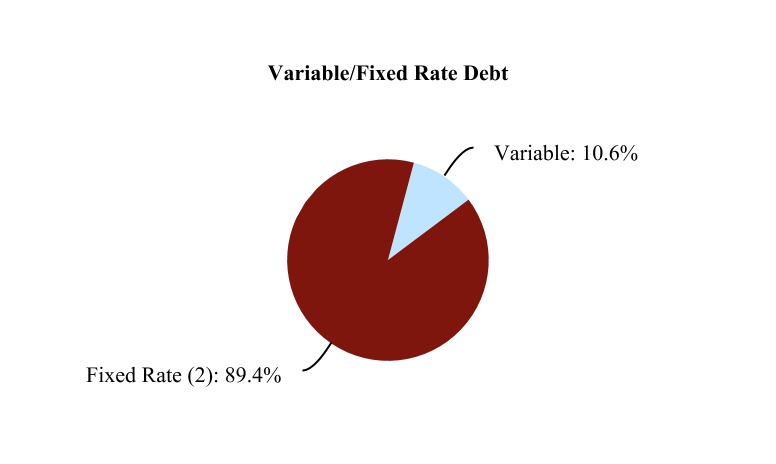

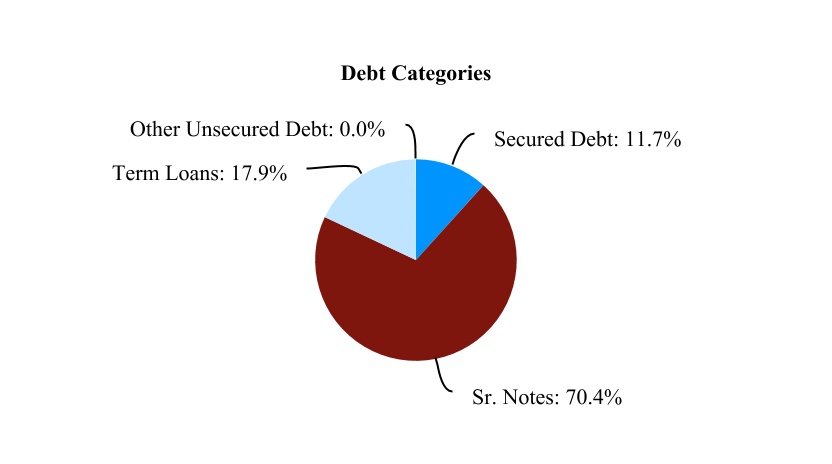

| Wtd. Avg. Maturity (Years) (1)(2) | Stated Rate | Effective Rate (3)(4) | Gross Debt Balance at 3/31/21 | |||||||||||||||||||||||

| Debt | ||||||||||||||||||||||||||

| Secured debt | 2.8 | 3.27 | % | 3.35 | % | $ | 260,632 | |||||||||||||||||||

| Unsecured debt | 5.1 | 2.86 | % | 3.24 | % | 1,970,972 | ||||||||||||||||||||

| Total Consolidated Debt | 4.8 | 2.91 | % | 3.25 | % | $ | 2,231,604 | |||||||||||||||||||

| Fixed rate debt (4) | 5.7 | 3.38 | % | 3.45 | % | $ | 1,994,582 | |||||||||||||||||||

| Variable rate debt | 1.8 | 1.38 | % | 1.61 | % | 237,022 | ||||||||||||||||||||

| Total Consolidated Debt | $ | 2,231,604 | ||||||||||||||||||||||||

| Common Equity | ||||||||||||||||||||||||||

| Common Shares | 112,327 | |||||||||||||||||||||||||

| Common Units (5) | 1,425 | |||||||||||||||||||||||||

| Total Common Shares and Units | 113,752 | |||||||||||||||||||||||||

Closing Common Share Price on 3/31/21 | $ | 26.33 | ||||||||||||||||||||||||

| Equity Market Capitalization | $ | 2,995,090 | ||||||||||||||||||||||||

| Total Market Capitalization | $ | 5,226,694 | ||||||||||||||||||||||||

| Investment Grade Ratings & Outlook | Latest Affirmation | |||||||||||||||||||

| Fitch | BBB- | Stable | 3/3/21 | |||||||||||||||||

Moody’s | Baa3 | Stable | 3/3/21 | |||||||||||||||||

Standard & Poor’s | BBB- | Stable | 3/3/21 | |||||||||||||||||

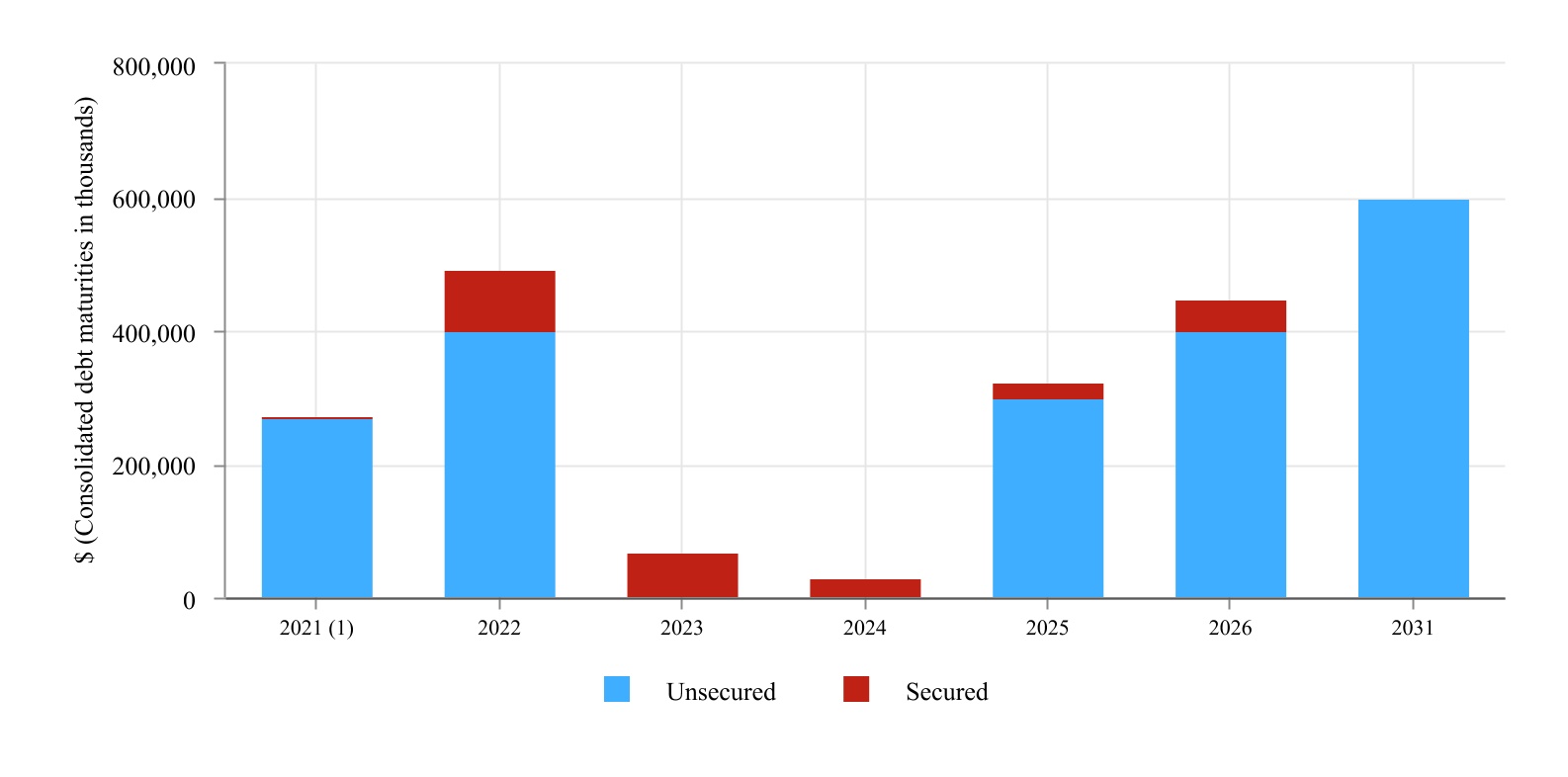

| Unsecured Debt | Stated Rate | Amount Outstanding | Maturity Date | Secured Debt | Stated Rate | Amount Outstanding | Balloon Payment Due Upon Maturity | Maturity Date | |||||||||||||||||||||||||||||||||

| Revolving Credit Facility | L + 1.10% | $ | — | Mar-23 | (1)(2) | 7740 Milestone Parkway | 3.96% | $ | 16,784 | $ | 15,902 | Feb-23 | |||||||||||||||||||||||||||||

| Senior Unsecured Notes | 100 & 30 Light Street | 4.32% | 50,183 | 47,676 | Jun-23 | ||||||||||||||||||||||||||||||||||||

| 3.60% due 2023 | 3.60% | 165,576 | Apr-21 | (3) | LW Redstone: | ||||||||||||||||||||||||||||||||||||

| 5.25% due 2024 | 5.25% | 104,385 | Apr-21 | (3) | 1000, 1200 & 1100 Redstone | ||||||||||||||||||||||||||||||||||||

| 5.00% due 2025 | 5.00% | 300,000 | Jul-25 | Gateway (4) | 4.47% | (5) | 31,499 | 27,649 | Jun-24 | ||||||||||||||||||||||||||||||||

| 2.25% due 2026 | 2.25% | 400,000 | Mar-26 | 4000 & 4100 Market Street and | |||||||||||||||||||||||||||||||||||||

| 2.75% due 2031 | 2.75% | 600,000 | Apr-31 | 8800 Redstone Gateway (2)(4) | L + 1.55% | 23,000 | 22,100 | Mar-25 | (6) | ||||||||||||||||||||||||||||||||

| Subtotal - Senior Unsecured Notes | 3.31% | $ | 1,569,961 | M Square: | |||||||||||||||||||||||||||||||||||||

| 5825 & 5850 University Research | |||||||||||||||||||||||||||||||||||||||||

| Unsecured Bank Term Loans | Court (4) | 3.82% | 40,944 | 35,603 | Jun-26 | ||||||||||||||||||||||||||||||||||||

| 2022 Maturity | L + 1.00% | $ | 400,000 | Dec-22 | (2) | 5801 University Research Court (2)(5) | L + 1.45% | 11,200 | 10,020 | Aug-26 | |||||||||||||||||||||||||||||||

| Other Unsecured Debt | 0.00% | 1,011 | May-26 | 2100 L Street (2)(4) | L + 2.35% | 87,022 | 87,022 | Sept-22 | (7) | ||||||||||||||||||||||||||||||||

| Total Unsecured Debt | 2.86% | $ | 1,970,972 | Total Secured Debt | 3.27% | $ | 260,632 | ||||||||||||||||||||||||||||||||||

| Debt Summary | |||||||||||||||||||||||||||||||||||||||||

| Total Unsecured Debt | 2.86% | $ | 1,970,972 | ||||||||||||||||||||||||||||||||||||||

| Total Secured Debt | 3.27% | 260,632 | |||||||||||||||||||||||||||||||||||||||

| Consolidated Debt | 2.91% | $ | 2,231,604 | ||||||||||||||||||||||||||||||||||||||

Net discounts and deferred financing costs | (23,701) | ||||||||||||||||||||||||||||||||||||||||

| Debt, per balance sheet | $ | 2,207,903 | |||||||||||||||||||||||||||||||||||||||

| Consolidated Debt | $ | 2,231,604 | |||||||||||||||||||||||||||||||||||||||

| COPT’s share of unconsolidated JV gross debt | 26,250 | ||||||||||||||||||||||||||||||||||||||||

| Gross debt | $ | 2,257,854 | |||||||||||||||||||||||||||||||||||||||

As of and for Three Months Ended 3/31/21 | As of and for Three Months Ended 3/31/21 | ||||||||||||||||||||||||||||||||||

| Senior Note Covenants (1) | Required | 2.25% and 2.75% Notes | Other Notes | Line of Credit & Term Loan Covenants (1) | Required | ||||||||||||||||||||||||||||||

| Total Debt / Total Assets | < 60% | 41.4% | 42.0% | Total Debt / Total Assets | < 60% | 39.4% | |||||||||||||||||||||||||||||

| Secured Debt / Total Assets | < 40% | 4.8% | 5.4% | Secured Debt / Total Assets | < 40% | 4.6% | |||||||||||||||||||||||||||||

| Debt Service Coverage | > 1.5x | 4.4x | 4.5x | Adjusted EBITDA / Fixed Charges | > 1.5x | 4.2x | |||||||||||||||||||||||||||||

| Unencumbered Assets / Unsecured Debt | > 150% | 244.1% | 244.1% | Unsecured Debt / Unencumbered Assets | < 60% | 38.9% | |||||||||||||||||||||||||||||

Unencumbered Adjusted NOI / Unsecured Interest Expense | > 1.75x | 4.7x | |||||||||||||||||||||||||||||||||

| Debt Ratios | Page Refer. | Unencumbered Portfolio Analysis | |||||||||||||||||||||||||||||||||

| Gross debt | 27 | $ | 2,257,854 | # of unencumbered properties | 155 | ||||||||||||||||||||||||||||||

| Adjusted book | 34 | $ | 5,450,919 | % of total portfolio | 85 | % | |||||||||||||||||||||||||||||

| Net debt / adjusted book ratio | 40.8 | % | Unencumbered square feet in-service | 16,923 | |||||||||||||||||||||||||||||||

| Net debt plus pref. equity / adj. book ratio | 40.8 | % | % of total portfolio | 81 | % | ||||||||||||||||||||||||||||||

| Net debt | 34 | $ | 2,221,513 | NOI from unencumbered real estate operations | $ | 80,629 | |||||||||||||||||||||||||||||

| Net debt plus preferred equity | 34 | $ | 2,221,513 | % of total NOI from real estate operations | 90 | % | |||||||||||||||||||||||||||||

| Net debt adj. for fully-leased dev. plus pref. equity | 34 | $ | 2,093,481 | Adjusted EBITDA from unencumbered real estate operations | $ | 75,270 | |||||||||||||||||||||||||||||

| In-place adjusted EBITDA | 10 | $ | 83,628 | % of total adjusted EBITDA from real estate operations | 90 | % | |||||||||||||||||||||||||||||

Net debt / in-place adjusted EBITDA ratio | 6.6 | x | Unencumbered adjusted book | $ | 4,850,711 | ||||||||||||||||||||||||||||||

Net debt plus pref. equity / in-place adj. EBITDA ratio | 6.6 | x | % of total adjusted book | 89 | % | ||||||||||||||||||||||||||||||

| Net debt adj. for fully-leased development plus pref. equity / in-place adj. EBITDA ratio | 6.3 | x | |||||||||||||||||||||||||||||||||

| Denominator for debt service coverage | 33 | $ | 17,380 | ||||||||||||||||||||||||||||||||

| Denominator for fixed charge coverage | 33 | $ | 19,185 | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA | 10 | $ | 83,338 | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA debt service coverage ratio | 4.8 | x | |||||||||||||||||||||||||||||||||

| Adjusted EBITDA fixed charge coverage ratio | 4.3 | x | |||||||||||||||||||||||||||||||||

| Operating Properties | Operational Square Feet | % Occupied | % Leased | NOI for the Three Months Ended 3/31/21 (1) | Total Assets (2) | Venture Level Debt | COPT Nominal Ownership % | |||||||||||||||||||

| Suburban Maryland: | ||||||||||||||||||||||||||

M Square Associates, LLC (4 properties) | 368 | 98.0% | 98.0% | $ | 1,753 | $ | 87,949 | $ | 52,144 | 50% | ||||||||||||||||

| Huntsville, Alabama: | ||||||||||||||||||||||||||

LW Redstone Company, LLC (15 properties) | 1,363 | 100.0% | 100.0% | 5,260 | 294,165 | 54,499 | 85% | (3) | ||||||||||||||||||

| Washington, D.C.: | ||||||||||||||||||||||||||

Stevens Place (1 property) | 107 | 100.0% | 100.0% | 1,298 | 109,355 | 54,450 | 95% | |||||||||||||||||||

| Total/Average | 1,838 | 99.6% | 99.6% | $ | 8,311 | $ | 491,469 | $ | 161,093 | |||||||||||||||||

| Non-operating Properties | Estimated Developable Square Feet | Total Assets (2) | Venture Level Debt | COPT Nominal Ownership % | ||||||||||||||||

| Suburban Maryland: | ||||||||||||||||||||

| M Square Research Park | 395 | $ | 13,562 | $ | — | 50% | ||||||||||||||

| Huntsville, Alabama: | ||||||||||||||||||||

| Redstone Gateway (4) | 3,235 | 124,412 | — | 85% | (3) | |||||||||||||||

| Washington, D.C.: | ||||||||||||||||||||

| Stevens Place | 83 | 52,230 | 32,572 | 95% | ||||||||||||||||

| Total | 3,713 | $ | 190,204 | $ | 32,572 | |||||||||||||||

| Joint venture information (1) | BREIT-COPT | B RE COPT | ||||||||||||||||||||||||

| COPT ownership % | 10% | 10% | ||||||||||||||||||||||||

| COPT’s investment | $ | 13,094 | $ | 15,840 | ||||||||||||||||||||||

| # of Properties | 9 | 8 | ||||||||||||||||||||||||

| Square Feet | 1,471 | 1,278 | ||||||||||||||||||||||||

| % Occupied | 100 | % | 100 | % | ||||||||||||||||||||||

| COPT’s share of ARR | $ | 2,147 | $ | 1,723 | ||||||||||||||||||||||

| Balance sheet information (1) | BREIT-COPT | B RE COPT | Total | COPT’s Share (2) | ||||||||||||||||||||||

| Operating properties, net | $ | 307,720 | $ | 271,952 | $ | 579,672 | $ | 57,967 | ||||||||||||||||||

| Total assets | $ | 338,285 | $ | 300,660 | $ | 638,945 | $ | 63,895 | ||||||||||||||||||

| Debt | $ | 200,959 | $ | 60,707 | $ | 261,666 | $ | 26,167 | ||||||||||||||||||

| Total liabilities | $ | 207,346 | $ | 68,681 | $ | 276,027 | $ | 27,603 | ||||||||||||||||||

| Three Months Ended 3/31/21 | ||||||||||||||||||||||||||

| Operating information (1) | BREIT-COPT | B RE COPT | Total | COPT’s Share (2) | ||||||||||||||||||||||

| Revenue | $ | 6,017 | $ | 5,058 | $ | 11,075 | $ | 1,107 | ||||||||||||||||||

| Operating expenses | (1,030) | (876) | (1,906) | (190) | ||||||||||||||||||||||

| NOI and EBITDA | 4,987 | 4,182 | 9,169 | 917 | ||||||||||||||||||||||

| Interest expense | (1,842) | (549) | (2,391) | (239) | ||||||||||||||||||||||

| Depreciation and amortization | (2,520) | (2,481) | (5,001) | (454) | ||||||||||||||||||||||

| Net income | $ | 625 | $ | 1,152 | $ | 1,777 | $ | 224 | ||||||||||||||||||

| NOI (per above) | $ | 4,987 | $ | 4,182 | $ | 9,169 | $ | 917 | ||||||||||||||||||

| Straight line rent adjustments | (284) | (249) | (533) | (53) | ||||||||||||||||||||||

| Amortization of acquired above- and below-market rents | (142) | (334) | (476) | (48) | ||||||||||||||||||||||

| Cash NOI | $ | 4,561 | $ | 3,599 | $ | 8,160 | $ | 816 | ||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| NOI from real estate operations (1) | |||||||||||||||||||||||||||||

| Real estate revenues | $ | 145,164 | $ | 139,628 | $ | 134,443 | $ | 132,538 | $ | 132,116 | |||||||||||||||||||

| Property operating expenses | (56,974) | (52,085) | (51,552) | (50,204) | (49,999) | ||||||||||||||||||||||||

| COPT’s share of NOI in unconsolidated real estate JVs (2) | 917 | 1,761 | 1,752 | 1,725 | 1,713 | ||||||||||||||||||||||||

| NOI from real estate operations | 89,107 | 89,304 | 84,643 | 84,059 | 83,830 | ||||||||||||||||||||||||

| General and administrative expenses | (6,062) | (7,897) | (5,558) | (6,511) | (5,303) | ||||||||||||||||||||||||

| Leasing expenses | (2,344) | (1,993) | (1,909) | (1,647) | (2,183) | ||||||||||||||||||||||||

| Business development expenses and land carry costs | (1,094) | (999) | (1,094) | (1,262) | (1,118) | ||||||||||||||||||||||||

| NOI from construction contracts and other service operations | 765 | 837 | 1,103 | 525 | 560 | ||||||||||||||||||||||||

| Equity in loss of unconsolidated non-real estate entities | (2) | (2) | (1) | (1) | (2) | ||||||||||||||||||||||||

| Interest and other income | 1,865 | 3,341 | 1,746 | 2,282 | 1,205 | ||||||||||||||||||||||||

| Credit loss recoveries (expense) (3) | 907 | 772 | 1,465 | (615) | (689) | ||||||||||||||||||||||||

| Loss on early extinguishment of debt | (33,166) | (4,069) | (3,237) | — | — | ||||||||||||||||||||||||

| Loss on interest rate derivatives | — | — | (53,196) | — | — | ||||||||||||||||||||||||

| Interest expense | (17,519) | (17,148) | (17,152) | (16,797) | (16,840) | ||||||||||||||||||||||||

| COPT’s share of interest expense of unconsolidated real estate JVs (2) | (239) | (432) | (455) | (452) | (452) | ||||||||||||||||||||||||

| Income tax expense | (32) | (258) | (16) | (30) | (49) | ||||||||||||||||||||||||

| FFO - per Nareit (1) | $ | 32,186 | $ | 61,456 | $ | 6,339 | $ | 59,551 | $ | 58,959 | |||||||||||||||||||

| Real estate revenues | |||||||||||||||||||||||||||||

| Lease revenue | |||||||||||||||||||||||||||||

Fixed contractual payments | $ | 112,425 | $ | 110,748 | $ | 106,743 | $ | 103,993 | $ | 104,109 | |||||||||||||||||||

| Variable lease payments (4) | 32,199 | 28,345 | 27,132 | 28,154 | 26,903 | ||||||||||||||||||||||||

| Lease revenue | 144,624 | 139,093 | 133,875 | 132,147 | 131,012 | ||||||||||||||||||||||||

| Other property revenue | 540 | 535 | 568 | 391 | 1,104 | ||||||||||||||||||||||||

| Real estate revenues | $ | 145,164 | $ | 139,628 | $ | 134,443 | $ | 132,538 | $ | 132,116 | |||||||||||||||||||

| Provision for credit losses (recoveries) on billed lease revenue | $ | — | $ | 41 | $ | 212 | $ | 358 | $ | (355) | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Total interest expense | $ | 17,519 | $ | 17,148 | $ | 17,152 | $ | 16,797 | $ | 16,840 | |||||||||||||||||||

| Less: Amortization of deferred financing costs | (793) | (664) | (658) | (642) | (575) | ||||||||||||||||||||||||

Less: Amortization of net debt discounts, net of amounts capitalized | (542) | (504) | (453) | (390) | (386) | ||||||||||||||||||||||||

COPT’s share of interest expense of unconsolidated real estate JVs, excluding deferred financing costs | 234 | 422 | 444 | 442 | 441 | ||||||||||||||||||||||||

| Denominator for interest coverage | 16,418 | 16,402 | 16,485 | 16,207 | 16,320 | ||||||||||||||||||||||||

| Scheduled principal amortization | 962 | 1,048 | 1,033 | 1,023 | 1,021 | ||||||||||||||||||||||||

| Denominator for debt service coverage | 17,380 | 17,450 | 17,518 | 17,230 | 17,341 | ||||||||||||||||||||||||

| Capitalized interest | 1,805 | 2,620 | 2,908 | 3,174 | 3,358 | ||||||||||||||||||||||||

| Preferred unit distributions | — | 69 | 77 | 77 | 77 | ||||||||||||||||||||||||

| Denominator for fixed charge coverage | $ | 19,185 | $ | 20,139 | $ | 20,503 | $ | 20,481 | $ | 20,776 | |||||||||||||||||||

| Common share dividends - unrestricted shares and deferred shares | $ | 30,805 | $ | 30,764 | $ | 30,763 | $ | 30,761 | $ | 30,754 | |||||||||||||||||||

| Common share dividends - restricted shares and deferred shares | 97 | 94 | 80 | 94 | 84 | ||||||||||||||||||||||||

| Common unit distributions - unrestricted units | 347 | 341 | 341 | 341 | 339 | ||||||||||||||||||||||||

| Common unit distributions - restricted units | 51 | 31 | 25 | 25 | 25 | ||||||||||||||||||||||||

| Preferred unit distributions | — | 69 | 77 | 77 | 77 | ||||||||||||||||||||||||

| Total dividends/distributions | $ | 31,300 | $ | 31,299 | $ | 31,286 | $ | 31,298 | $ | 31,279 | |||||||||||||||||||

| Common share dividends - unrestricted shares and deferred shares | $ | 30,805 | $ | 30,764 | $ | 30,763 | $ | 30,761 | $ | 30,754 | |||||||||||||||||||

| Common unit distributions - unrestricted units | 347 | 341 | 341 | 341 | 339 | ||||||||||||||||||||||||

| Distributions on dilutive preferred units | — | 69 | — | 77 | — | ||||||||||||||||||||||||

| Dividends and distributions for diluted FFO payout ratio | 31,152 | 31,174 | 31,104 | 31,179 | 31,093 | ||||||||||||||||||||||||

| Distributions on dilutive preferred units | — | — | 77 | — | 77 | ||||||||||||||||||||||||

| Dividends and distributions for other payout ratios | $ | 31,152 | $ | 31,174 | $ | 31,181 | $ | 31,179 | $ | 31,170 | |||||||||||||||||||

| 3/31/21 | 12/31/20 | 9/30/20 | 6/30/20 | 3/31/20 | |||||||||||||||||||||||||

| Total assets | $ | 4,112,948 | $ | 4,077,023 | $ | 4,120,189 | $ | 4,011,325 | $ | 4,054,457 | |||||||||||||||||||

| Accumulated depreciation | 1,157,059 | 1,124,253 | 1,095,441 | 1,065,094 | 1,035,703 | ||||||||||||||||||||||||

| Accumulated amort. of real estate intangibles and deferred leasing costs | 217,811 | 217,124 | 215,651 | 216,267 | 214,693 | ||||||||||||||||||||||||

COPT’s share of liabilities of unconsolidated real estate JVs | 27,603 | 26,710 | 50,957 | 50,984 | 50,966 | ||||||||||||||||||||||||