DEF 14A0000860546false00008605462023-01-012023-12-31iso4217:USDiso4217:USDxbrli:shares00008605462022-01-012022-12-3100008605462021-01-012021-12-3100008605462020-01-012020-12-31000086054612023-01-012023-12-310000860546cdp:EquityAwardsValueInCompensationTableForTheApplicableYearMemberecd:PeoMember2023-01-012023-12-310000860546cdp:EquityAwardsValueInCompensationTableForTheApplicableYearMemberecd:PeoMember2022-01-012022-12-310000860546cdp:EquityAwardsValueInCompensationTableForTheApplicableYearMemberecd:PeoMember2021-01-012021-12-310000860546cdp:EquityAwardsValueInCompensationTableForTheApplicableYearMemberecd:PeoMember2020-01-012020-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsValueInCompensationTableForTheApplicableYearMember2023-01-012023-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsValueInCompensationTableForTheApplicableYearMember2022-01-012022-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsValueInCompensationTableForTheApplicableYearMember2021-01-012021-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsValueInCompensationTableForTheApplicableYearMember2020-01-012020-12-310000860546cdp:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberecd:PeoMember2023-01-012023-12-310000860546cdp:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberecd:PeoMember2022-01-012022-12-310000860546cdp:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberecd:PeoMember2021-01-012021-12-310000860546cdp:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMemberecd:PeoMember2020-01-012020-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMember2023-01-012023-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMember2022-01-012022-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMember2021-01-012021-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsYearEndFairValueOfAwardsGrantedInCurrentYearMember2020-01-012020-12-310000860546cdp:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMemberecd:PeoMember2023-01-012023-12-310000860546cdp:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMemberecd:PeoMember2022-01-012022-12-310000860546cdp:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMemberecd:PeoMember2021-01-012021-12-310000860546cdp:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMemberecd:PeoMember2020-01-012020-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMember2023-01-012023-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMember2022-01-012022-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMember2021-01-012021-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfYearEndOfOutstandingAndUnvestedAwardsGrantedInPriorYearsMember2020-01-012020-12-310000860546ecd:PeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMember2023-01-012023-12-310000860546ecd:PeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMember2022-01-012022-12-310000860546ecd:PeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMember2021-01-012021-12-310000860546ecd:PeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMember2020-01-012020-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMember2023-01-012023-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMember2022-01-012022-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMember2021-01-012021-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsChangeInFairValueAsOfVestingDateOfPriorYearAwardsVestedDuringCurrentYearMember2020-01-012020-12-310000860546cdp:PriorYearEndValueOfGrantsForfeitedInYearMemberecd:PeoMember2023-01-012023-12-310000860546cdp:PriorYearEndValueOfGrantsForfeitedInYearMemberecd:PeoMember2022-01-012022-12-310000860546cdp:PriorYearEndValueOfGrantsForfeitedInYearMemberecd:PeoMember2021-01-012021-12-310000860546cdp:PriorYearEndValueOfGrantsForfeitedInYearMemberecd:PeoMember2020-01-012020-12-310000860546ecd:NonPeoNeoMembercdp:PriorYearEndValueOfGrantsForfeitedInYearMember2023-01-012023-12-310000860546ecd:NonPeoNeoMembercdp:PriorYearEndValueOfGrantsForfeitedInYearMember2022-01-012022-12-310000860546ecd:NonPeoNeoMembercdp:PriorYearEndValueOfGrantsForfeitedInYearMember2021-01-012021-12-310000860546ecd:NonPeoNeoMembercdp:PriorYearEndValueOfGrantsForfeitedInYearMember2020-01-012020-12-310000860546cdp:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMemberecd:PeoMember2023-01-012023-12-310000860546cdp:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMemberecd:PeoMember2022-01-012022-12-310000860546cdp:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMemberecd:PeoMember2021-01-012021-12-310000860546cdp:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMemberecd:PeoMember2020-01-012020-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMember2023-01-012023-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMember2022-01-012022-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMember2021-01-012021-12-310000860546ecd:NonPeoNeoMembercdp:EquityAwardsAdjustmentsDividendsOrOtherEarningsPaidOnEquityAwardsNotOtherwiseReflectedInFairValueMember2020-01-012020-12-31000086054622023-01-012023-12-31000086054632023-01-012023-12-31000086054642023-01-012023-12-31000086054652023-01-012023-12-31000086054662023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

COPT DEFENSE PROPERTIES

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Message from our President +

Chief Executive Officer

Dear Fellow Shareholders,

You are cordially invited to attend our 2024 Annual Meeting of Shareholders to be held on May 9, 2024, at 9:30 a.m. Eastern Time. To ensure each of our shareholders have an opportunity to participate in the Annual Meeting regardless of where they live or the number of shares they own, we will hold this year’s Annual Meeting virtually through an online webcast.

You will be able to attend the Annual Meeting, vote and submit questions by visiting www.virtualshareholdermeeting.com/CDP2024. The notice of Annual Meeting and proxy statement accompanying this letter contain further information about the meeting, including the different methods you can use to vote your proxy and how to participate in the meeting.

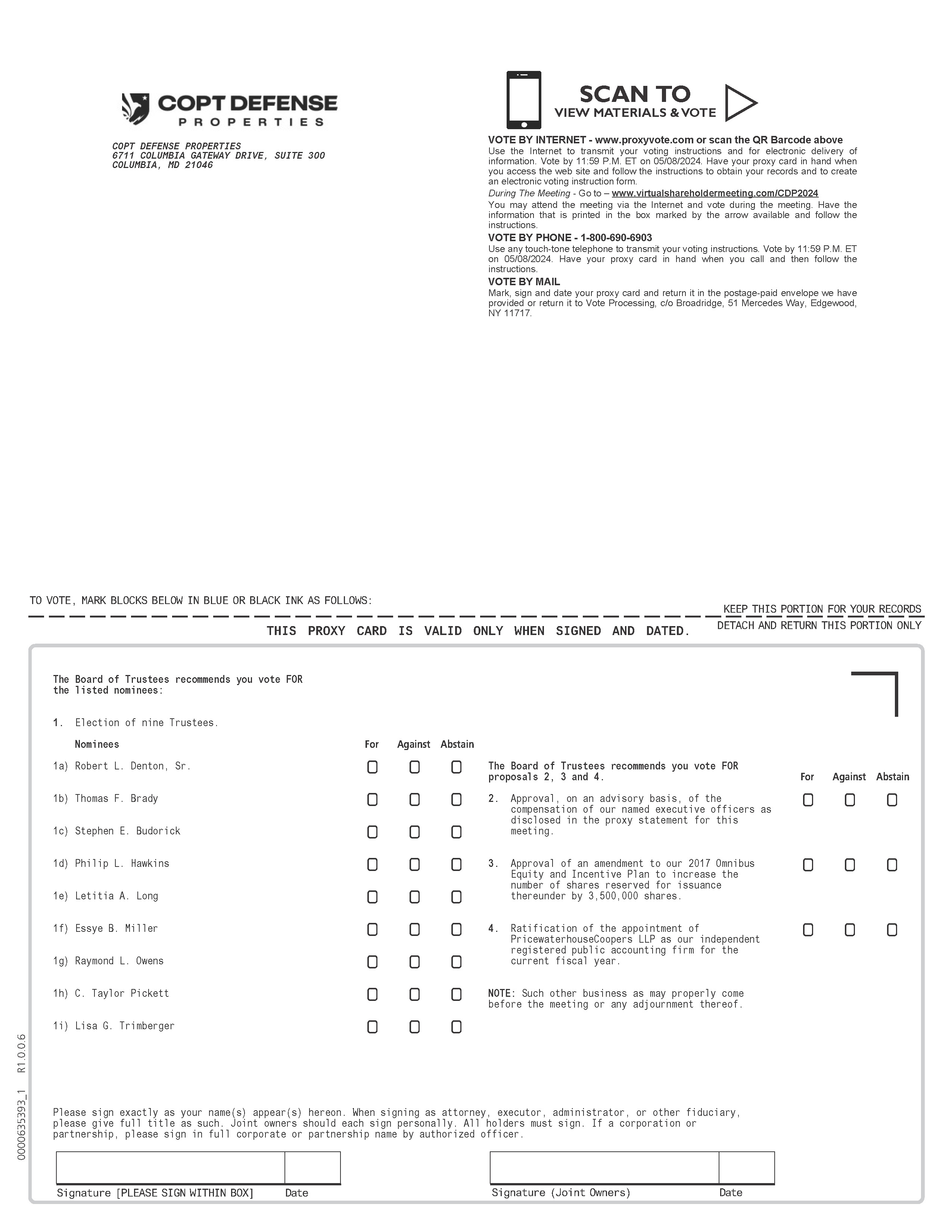

At this year’s meeting, you will be asked to vote on the following:

>election of nine people to our Board of Trustees;

>approval, on an advisory basis, of the compensation of our named executive officers as disclosed in the proxy statement for this meeting;

>approval of an amendment to our 2017 Omnibus Equity and Incentive Plan to increase the number of shares reserved for issuance thereunder by 3,500,000 shares; and

>the ratification of PricewaterhouseCoopers LLP’s appointment as our independent registered public accounting firm for the current fiscal year.

We are using Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their shareholders via the Internet. We believe that these rules allow us to provide our shareholders with the information they need, while lowering the costs of printing and delivery and reducing the environmental impact of our Annual Meeting. Thank you for your continued support of COPT Defense Properties, and I encourage you to participate in our Annual Meeting.

| | |

Stephen E. Budorick

President + Chief Executive Officer |

Notice of Annual Meeting

of Stockholders

| | | | | | | | | | | | | | |

| | | | |

TIME + DATE | | PLACE | | RECORD DATE |

9:30 a.m. Eastern Time

on Thursday, May 9, 2024 | | Virtual Meeting

www.virtualshareholdermeeting.com/CDP2024 | | March 8, 2024 |

| | | | | | | | | | | | | | | | | |

| Items of Business | Board Recommendation | | How to Vote |

| 1 | Elect nine Trustees. | | | | Internet

www.proxyvote.com |

| | | | | |

| 2 | Approve, on an advisory basis, the compensation of our named executive officers as disclosed in the proxy statement for this meeting. | | | | Tablet or Smartphone

Scan the QR code on your proxy card, notice of internet availability of proxy materials or voting instruction form to vote with your mobile device. |

| 3 | Approve an amendment to our 2017 Omnibus Equity and Incentive Plan to increase the number of shares reserved for issuance thereunder by 3,500,000 shares. | | | | Telephone

1-800-690-6903

Call toll-free 24/7 |

| 4 | Ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm for the current fiscal year. | | | | Mail

Complete, sign and date your proxy card and return it in the postage-paid envelope provided. |

| 5 | Transact any other business properly brought before the Annual Meeting. | | | | |

You may vote on these proposals if you were a shareholder of record at the close of business on March 8, 2024.

For information about how to attend and vote at the meeting, see “Questions and Answers—How do I attend the meeting and vote?” in the proxy statement accompanying this notice. Additional information regarding the ability of shareholders to ask questions during the 2024 Annual Meeting, related rules of conduct and other materials for the 2024 Annual Meeting will be available at www.virtualshareholdermeeting.com/CDP2024.

Technical support will be available beginning at 9:00 a.m. Eastern Time on May 9, 2024, through the conclusion of the Annual Meeting by contacting Broadridge at the phone number that will be provided on the website for the virtual meeting.

By order of the Board of Trustees,

David L. Finch

Vice President, General Counsel + Secretary

YOUR VOTE IS IMPORTANT.

Please consider the issues presented in this Proxy Statement and vote your shares as promptly as possible.

Table of Contents

Proxy Statement Summary

This summary highlights selected information contained in this proxy statement, but it does not contain all the information you should consider. We urge you to read the whole proxy statement before you vote. This proxy statement is being made available to shareholders on or about March 28, 2024.

| | | | | | | | | | | | | | | | | |

| SHAREHOLDERS WILL BE VOTING ON THE FOLLOWING MATTERS: |

| Agenda Item | | Voting Recommendation | | More Information |

| 1. | | | | | |

| | | | | |

| 2. | | | | | |

3. | | | | | |

4. | | | | | |

TRUSTEE NOMINEES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Board Committees |

| | Age | | Trustee Since | | Audit | | Compensation | | Investment | | Nominating and Corporate Governance |

| | ROBERT L. DENTON, SR. Chairman of the Board as of January 1, 2024 | | 71 | | 1999 | | | | | | | | |

| | THOMAS F. BRADY | | 74 | | 2002 | | | | | | | | |

| | STEPHEN E. BUDORICK President + Chief Executive Officer | | 63 | | 2016 | | | | | | | | |

| | PHILIP L. HAWKINS | | 68 | | 2014 | | | | | | | | |

| | LETITIA A. LONG | | 65 | | 2020 | | | | | | | | |

| | ESSYE B. MILLER | | 60 | | 2022 | | | | | | | | |

| | RAYMOND L. OWENS | | 65 | | 2021 | | | | | | | | |

| | C. TAYLOR PICKETT | | 62 | | 2013 | | | | | | | | |

| | LISA G. TRIMBERGER | | 63 | | 2017 | | | | | | | | |

2023 BUSINESS HIGHLIGHTS

| | | | | | | | | | | | | | |

95% leased / 94% occupied | |

80% tenant retention rate | |

747,000 square feet of development leasing |

| | | | |

848,000 square feet developed, with 817,000 square feet under development at year end | | $190 million raised from sale of interests in properties | | $345 million in debt issued at 5.25% |

Our 2023 business highlights included:

>near-record year-end occupancy and leased rates, and tenant retention rate, driven by strong demand across our Defense/IT Portfolio sub-segments;

>continued growth through substantially pre-leased development, with space placed in service during the year that was virtually full and a pipeline of substantially pre-leased properties under development at year end;

>capital raised from disposition of interests in data center shell properties, which created borrowing capacity to fund development activities;

>an opportunistic issuance of debt in the form of Exchangeable Senior Notes, which pre-funded our expected borrowings needed to fund forecasted development activities for the next three years; and

>strong liquidity and financial position at year end, with most of the borrowing capacity available under our Revolving Credit Facility, significant cash on hand and no significant debt maturities until 2026.

These highlights positioned the Company to meet or exceed virtually all of the objectives established in its 2023 corporate scorecard used under our executive compensation program, as described below under “Compensation Discussion and Analysis.”

ANNUAL SHAREHOLDER SAY-ON-PAY VOTES

| | | | | |

Shareholder Support | Shareholders will have the opportunity at our 2024 Annual Meeting of Shareholders to cast an advisory vote on the compensation of our named executive officers (“NEOs”) as disclosed in this proxy statement, which is referred to as a “say-on-pay proposal.” At our 2023 Annual Meeting of Shareholders, our shareholders overwhelmingly approved our say-on-pay proposal, casting 97.7% of the votes in favor of the proposal. Our Compensation Committee believes that our shareholders’ substantial approval indicated strong support for our approach to executive compensation. The Committee considers shareholder feedback and the outcome of our shareholder say-on-pay proposal votes when making future NEO compensation decisions. |

COMPENSATION HIGHLIGHTS

We design our compensation programs to link executive compensation to annual financial results and long-term total shareholder return (“TSR”). Our executive compensation program is designed to:

>align pay to performance;

>be commensurate to the compensation levels of executives performing similar responsibilities for an appropriate group of peer companies; and

>provide an appropriate balance between the various components of our executives’ compensation.

Our executive compensation includes:

>base salary as the fixed component intended to attract and retain executives;

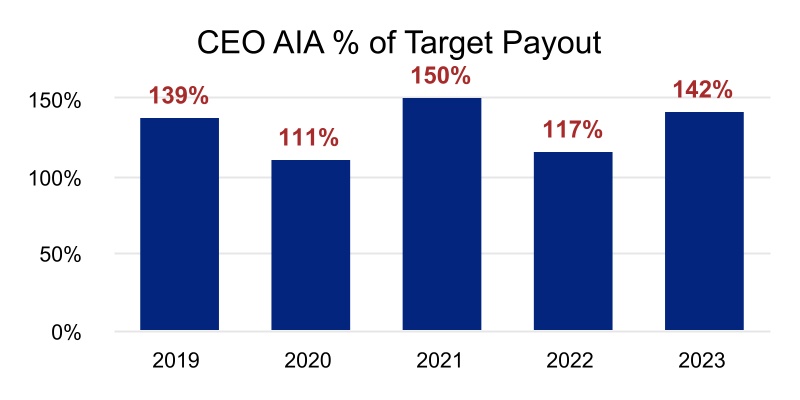

>annual incentive award (“AIA”) cash bonuses that are formulaic and based on achievement of objectives established at the beginning of each year, approved by the Compensation Committee, and set forth in our annual corporate scorecard; and

>annual long-term equity incentive plan (“LTIP”) awards.

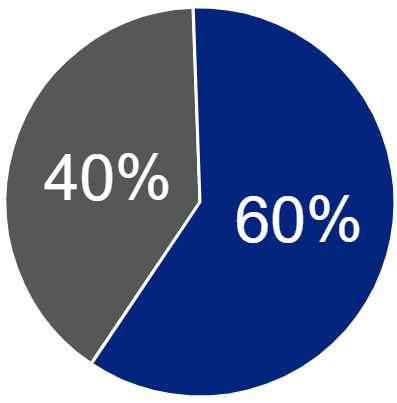

The compensation of our NEOs is predominantly performance-based, including AIAs and LTIP awards that are subject to objective performance thresholds, as reflected in the graphic below:

| | | | | | | | | | | | | | | | | | | | | | | |

| | AIAs

100% of NEO AIAs are formulaic and based on achievement of established corporate objectives. | | | | LTIP Awards

60% of NEO LTIP awards are performance-based, with payout tied to the TSR of our common shares for a three-year period, and 40% are time-based awards. | |

SHAREHOLDER OUTREACH

We place a high value on our Investor Relations function, as we routinely engage with existing and prospective shareholders and sell-side analysts throughout the year in a variety of forums. In 2023, we held nearly 100 meetings, amounting to approximately 250 touchpoints with investors and sell-side analysts in person or virtually. Notably, we held our first Investor Day event in over a decade, which featured management presentations and a property tour of three of our business parks; this event enabled us to provide in-depth explanations regarding our corporate strategy, demand drivers, growth outlook and the secure nature of our portfolio, and highlight the depth of our team. We also participated in a variety of investor events, including the National Association of Real Estate Investment Trust (“Nareit”) REITweek and REITworld conferences in June and November 2023, five sell-side analyst conferences and several individual meetings and property tours.

Frequently discussed topics through our shareholder outreach include:

>outlook for the 2024 fiscal year’s U.S. Department of Defense budget and implications for tenant demand;

>leasing environment;

>market rent growth;

>progress towards vacancy and development leasing goals;

>external growth opportunities from development and acquisitions;

>sources and uses of capital;

>capital markets risk and exposure;

>financial position; and

>earnings and dividends growth outlook.

SUSTAINABILITY

As further detailed in the section below entitled “Company’s Commitment to Environmental and Social Responsibility and Governance,” we remain committed to maintaining and enhancing our sustainable development and building operations programs, thereby creating a more resilient and efficient portfolio that benefits our tenants and our shareholders. Our governance structure positions the Board to provide oversight with respect to the Company’s environmental risks.

| | | | | | | | |

| | Recent Achievements |

| | Received Green Star recognition from GRESB for the ninth consecutive year. |

| | Further refined the Company’s climate risk assessment aligning with the Task Force on Climate-related Financial Disclosures (“TCFD”) identifying our strategy, risk management, metrics and targets, and opportunities. |

| | Reported information with respect to the Company’s risks and emissions data to align with applicable frameworks under both SASB and Global Reporting Initiative. |

| | Reported on our contribution to 13 of the 17 United Nations Sustainable Development Goals in our Corporate Sustainability Report. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Proposal

1 | ELECTION OF NINE TRUSTEES | Our Board

recommends

a vote FOR

each of the

nine Trustee

nominees.

|

Our Bylaws provide for the annual election of Trustees at the Annual Meeting of Shareholders. Our Board, at the recommendation of its Nominating and Corporate Governance Committee, has nominated nine of our current Trustees for election at the Annual Meeting. Each nominee has agreed to serve a one-year term. If any nominee is unable to stand for election, the Board may provide for a lesser number of Trustees or designate a substitute. In the latter event, shares represented by proxies will be voted for a substitute nominee. |

1.Robert L. Denton, Sr. | | 4.Philip L. Hawkins | | 7.Raymond L. Owens |

2.Thomas F. Brady | | 5.Letitia A. Long | | 8.C. Taylor Pickett |

3.Stephen E. Budorick | | 6.Essye B. Miller | | 9.Lisa G. Trimberger |

| | | | |

Vote Required

In an uncontested election, to be elected to the Board, a nominee for Trustee must receive the affirmative vote of the majority of the votes cast for and against such nominee. The majority voting standard does not apply in contested elections. Broker non-votes, if any, and abstentions will not be treated as votes cast for or against the election of a nominee for Trustee and will have no effect on the outcome of the vote. Additional information with respect to voting procedures and the election of the Trustees are available in the Questions and Answers section of this proxy statement. The term of Steven D. Kesler, a member of our Board since September 1998, will expire on May 9, 2024 at the Annual Meeting, and he will not stand for re-election.

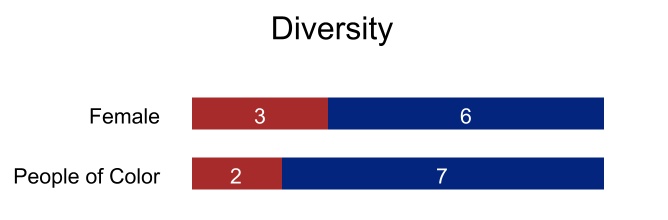

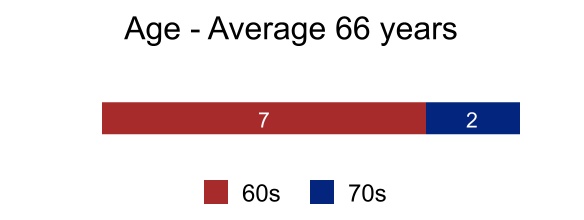

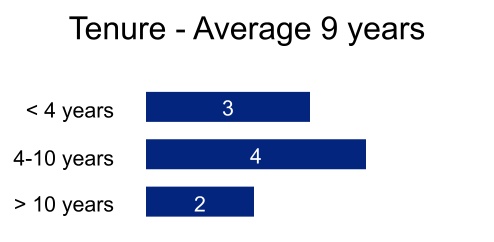

SNAPSHOT OF TRUSTEE NOMINEES

BOARD QUALIFICATIONS, TENURE AND REFRESHMENT

Our Board represents a balance of longer-tenured members with in-depth knowledge of our business and newer members who bring valuable additional attributes, skills, and experience. The specific experience, qualifications, attributes, and skills that led the Board to nominate Trustees for election are set forth in their bios below. We have been regularly refreshing our Board, with three of the nominated Trustees having joined within the last four years. We believe this activity aligns the Board’s composition to our long-term strategy and broadens the Board’s perspectives to enhance its performance. Effective January 1, 2024, and in anticipation of Mr. Brady’s retirement in 2025 pursuant to our Corporate Governance Guidelines, we appointed a new Chairman of the Board, further refreshing our governance and Board. Through continued refreshment and trustee succession planning and development, we believe that our Board is well positioned for the future.

Proposal 1 - Election of Trustees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Trustee Skills and Experience | Robert L. Denton, Sr. | Thomas F. Brady | Stephen E. Budorick | Philip L. Hawkins | Letitia A. Long | Essye B. Miller | Raymond L. Owens | C. Taylor Pickett | Lisa G. Trimberger |

| | Executive Leadership | | | | | | | | | |

| | Public Company Board Service | | | | | | | | | |

| | Financial Literacy/Accounting | | | | | | | | | |

| | Finance/Capital Markets | | | | | | | | | |

| | Risk Management | | | | | | | | | |

| | Corporate Governance | | | | | | | | | |

| | Real Estate Investment | | | | | | | | | |

| | Strategic Planning + Leadership | | | | | | | | | |

| | Technology/Cybersecurity Experience | | | | | | | | | |

| | Government/Regulatory Affairs | | | | | | | | | |

| | Audit Committee Financial Expert | | | | | | | | | |

Proposal 1 - Election of Trustees

BIOGRAPHICAL INFORMATION

Set forth below is certain biographical information with respect to the nominees for election as Trustees, including professional experience, Board Committee memberships, skills and qualifications.

| | | | | | | | | | | | | | | | | |

| | Robert L. Denton, Sr. | Age: 71 |

| Independent Trustee Since: 1999 |

| BACKGROUND The Shidler Group >Managing Partner—New York (1994-2013) Providence Capital, Inc. >Co-Founder and Managing Director (1991-1994) Jefferies Group LLC (f/k/a Jefferies & Co.) >Co-Head Mergers and Acquisitions (1987-1991) Pacific Equity Ltd. >Head of Investment Research (1985-1987) Booz Allen & Hamilton, Inc. >Consulting-Principal (1980-1985) OTHER EXPERIENCE Co-Founder of several organizations sponsored by The Shidler Organization, including: >COPT Defense Properties (NYSE: CDP) >First Industrial Realty Trust, Inc. (NYSE: FR) >Primus Guaranty, Ltd. (formerly NYSE: PRS) Structured execution of initial public offering for TriNet Corporate Realty Trust (formerly NYSE: TRI) Co-Inventor: Business process patent to create, price and manage electronic trading and distribution of credit risk transfer products (U.S. Pat. Appl. 20020055897) EDUCATION >BS in Economics—University of Pennsylvania >MBA—Wharton School of the University of Pennsylvania COPT BOARD SERVICE Mr. Denton’s extensive real estate, financial, and consulting career, including as a senior executive in a well-known private real estate investment and acquisition company, enables him to provide meaningful insight and leadership into our strategic initiatives, with specific focus on the analysis of our proposed investment, development and capital market initiatives. His professional experience and history with the Company, including being the former chair of the Nominating and Corporate Governance Committee, make Mr. Denton ideally suited as Chairman of the Board. |

| CHAIRMAN OF THE BOARD SINCE JANUARY 2024 | |

COMMITTEES Audit, Investment,

Nominating and Corporate Governance | |

| Skills and Qualifications | |

| | Public Company Board Service | |

| | Financial Literacy/

Accounting | |

| | Finance/Capital Markets | |

| | Corporate Governance | |

| | Real Estate Investment | |

| | Strategic Planning + Leadership | |

| | Audit Committee Financial Expert | |

Proposal 1 - Election of Trustees

| | | | | | | | | | | | | | | | | |

| | Thomas F. Brady | Age: 74 |

| Independent Trustee Since: 2002 |

| BACKGROUND Opower, Inc. (formerly NYSE: OPWR) >Former Chairman, Advisory Board (2009-2016) Constellation Energy Group (NYSE: CEG) >Former Executive Vice President-Corporate Strategy Baltimore Gas & Electric Company >Various Positions, including Vice President and Chief Accounting Officer OTHER EXPERIENCE Baltimore Gas & Electric Company >Former Chairman Board of Directors Stevenson University >Former Trustee and Treasurer of the Board Maryland Public Broadcasting Commission and Maryland Public Television >Former Chairman Maryland Chamber of Commerce >Former Member Board of Directors EDUCATION >BS in Accounting—University of Baltimore >MBA in Finance—Loyola University >Advanced Executive Program—Penn State University >Certified Public Accountant COPT BOARD SERVICE Mr. Brady served as our Board’s Chairman from May 2013 until stepping down from that role effective December 31, 2023. His extensive career in key financial and strategic executive positions at a larger public company, and experiences with privately-owned, venture capital funded start-up companies, qualifies him to contribute to our Board and assess our strategic initiatives, both qualitatively and quantitatively. Mr. Brady’s utility operations experience and significant civic involvement also complement and enhance the perspectives he brings to his role as a member of our Board. |

COMMITTEES Compensation, Investment,

Nominating and Corporate Governance | |

| Skills and Qualifications | |

| | Executive Leadership | |

| | Public Company Board Service | |

| | Financial Literacy/

Accounting | |

| | Finance/Capital Markets | |

| | Corporate Governance | |

| | Strategic Planning + Leadership | |

| | | |

| | | | | | | | | | | | | | | | | |

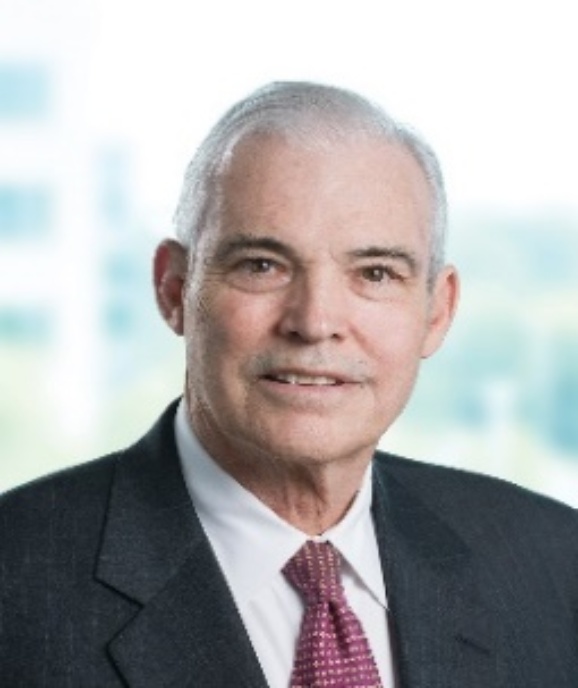

| | Stephen E. Budorick | Age: 63 |

| Trustee Since: 2016 |

| BACKGROUND COPT Defense Properties >President + Chief Executive Officer (“CEO”) (2016-Present) >Executive Vice President + Chief Operating Officer (“COO”) (2011-2016) Callahan Capital Partners, LLC >Executive Vice President of Asset Management (2006-2011) Trizec Properties, Inc. >Executive Vice President Central Region (1997-2006) Miglin Beitler Management Company >Executive Vice President (1991-1997) Lasalle Partners, Ltd. (now known as Jones Lang LaSalle, Inc.) >Vice President Asset Management (1988-1991) American Hospital Association >Facilities management and planning (1983-1988) EDUCATION >BS in Industrial Engineering—University of Illinois >MBA—University of Chicago COPT BOARD SERVICE Mr. Budorick’s experience as our President + CEO and his prior experience as our COO, as well as his depth of both operational and financial expertise, make him highly qualified to serve as a valued member of our Board. In his role as CEO, Mr. Budorick is a critical link between the Board and management. His experience at initiating and implementing strategic initiatives and continued engagement in the commercial real estate community are valuable assets to the Board. |

PRESIDENT + CHIEF

EXECUTIVE OFFICER

(“CEO”) SINCE MAY 2016 | |

COMMITTEES

None | |

| Skills and Qualifications | |

| | Executive Leadership | |

| | Financial Literacy/ Accounting | |

| | Finance/Capital Markets | |

| | Corporate Governance | |

| | Real Estate Investment | |

| | Strategic Planning + Leadership | |

Proposal 1 - Election of Trustees

| | | | | | | | | | | | | | | | | |

| | Philip L. Hawkins | Age: 68 |

| Independent Trustee Since: 2014 |

| BACKGROUND DCT Industrial Trust (formerly NYSE: DCT) >President and Chief Executive Officer (2006-2018) CarrAmerica Realty Corporation (formerly NYSE: CRE) >Various positions, including President and Chief Operating Officer (1996-2006) LaSalle Partners, Ltd. (now known as Jones Lang LaSalle, Inc.) >Various senior executive positions in real estate investment, development, leasing and management (1982-1996) OTHER PUBLIC COMPANY BOARDS Current >Welltower (NYSE: WELL) Former (past 5 years) >DCT Industrial Trust (formerly NYSE: DCT) >Prologis Inc. (NYSE: PLD) OTHER EXPERIENCE Pure Industrial >Board Member (2022-Present) WPG (formerly Washington Prime Group, Inc.; formerly NYSE: WPG) >Board Member (2022-Present) Link Logistics Real Estate >Executive Chairman (2020-Present) Hamilton College >Trustee (2012-Present) EDUCATION >BA in Economics—Hamilton College >MBA—University of Chicago COPT BOARD SERVICE Mr. Hawkins’ lengthy real estate career and current and past executive positions, both in the office and industrial sectors, with publicly traded companies, qualifies him to provide an experienced perspective on our strategic initiatives, to assess capital allocation and other investment decisions, as well as to evaluate compensation matters. In addition, Mr. Hawkins’ extensive public company board service enhances the insights he brings as a Board member. |

COMMITTEES Compensation,

Investment (Chair) | |

| Skills and Qualifications | |

| | Executive Leadership | |

| | Public Company Board Service | |

| | Financial Literacy/ Accounting | |

| | Finance/Capital Markets | |

| | Real Estate Investment | |

| | Strategic Planning + Leadership | |

| | | |

Proposal 1 - Election of Trustees

| | | | | | | | | | | | | | | | | |

| | Letitia A. Long | Age: 65 |

| Independent Trustee Since: 2020 |

| BACKGROUND US Government >Director, National Geospatial-Intelligence Agency (2010-2014) >Deputy Director, Defense Intelligence Agency (“DIA”) (2006-2010) >Deputy Undersecretary of Defense for Intelligence (2003-2006) >Deputy Director, Naval Intelligence (2000-2003) >Various positions with US Intelligence (1978-2000) OTHER PUBLIC COMPANY BOARDS Current >T-Mobile US, Inc. (NASDAQ: TMUS) >Parsons Corporation (NYSE: PSN) Former (past 5 years) >Raytheon Company (NYSE: RTX) >Urthecast (TSX: UR) >Chain Bridge I (SPAC) OTHER EXPERIENCE Noblis, Inc. >Vice Chair of the Board of Trustees Virginia Polytechnic Institute and State University >Virginia Tech Board of Visitors EDUCATION >BS in Electrical Engineering—Virginia Polytechnic Institute and State University >MS in Engineering—Catholic University of America COPT BOARD SERVICE Ms. Long’s experience in the U.S. Department of Defense and multiple intelligence agencies, as well as her experience as a public company board member, positions her to contribute to our strategy and governance matters. |

COMMITTEES Audit, Nominating and Corporate Governance (Chair) | |

| Skills and Qualifications | |

| | Executive Leadership | |

| | Public Company Board Service | |

| | Financial Literacy/Accounting | |

| | Risk Management | |

| | Corporate Governance | |

| | Strategic Planning + Leadership | |

| | Technology/Cybersecurity Experience | |

| | Government,

Regulatory Affairs | |

| | | | | | | | | | | | | | | | | |

| | Essye B. Miller | Age: 60 |

| Independent Trustee Since: 2022 |

| BACKGROUND Executive Business Management LLC >President and Chief Executive Officer (2020 to present) US Government >Department of Defense (“DOD”) >Principal Deputy Chief Information Officer (“CIO”) (2018-2020) >Deputy CIO for Cybersecurity (“CISO”) (2016-2018) >Acting CIO (December 2017-May 2018) >Department of U.S. Army >CISO and Cybersecurity (2015-2017) >Department of U.S. Air Force >Director of Information Management (2006-2014) OTHER EXPERIENCE Concordance Academy and the National Cyber Scholarship Foundation >Non-Profit Board Member EDUCATION >Honorary Doctor of Science—Talladega College >MBA in Business Administration—Troy State University >Master of Strategic Studies—U.S. Air Force, Air University COPT BOARD SERVICE Ms. Miller’s experience in the U.S. Government, and experience information technology and cyber security positions her to contribute to our strategy and risk management matters. |

COMMITTEES Audit, Nominating and Corporate Governance | |

Skills and Qualifications | |

| | Executive Leadership | |

| | Risk Management | |

| | Corporate Governance | |

| | Strategic Planning + Leadership | |

| | Technology/Cybersecurity Experience | |

| | Government,

Regulatory Affairs | |

| | | | | | | | |

10 | COPT Defense Properties | |

Proposal 1 - Election of Trustees

| | | | | | | | | | | | | | | | | |

| | Raymond L. Owens | Age: 65 |

| Independent Trustee Since: 2021 |

| BACKGROUND Piedmont Office Realty Trust (NYSE: PDM) >Chief Investment Officer and Executive Vice President of Capital Markets (2016-2017) >Executive Vice President, Capital Markets (2007-2016) Wells Real Estate Funds >Managing Director and Executive Vice President of Capital Markets (2002-2007) PM Realty Group, LP >Senior Vice President (1997-2002) Various Roles, Capital Markets and Real Estate Investment >General Electric Investments, HPI Realty Partners, Travelers Realty Investment Company and Aetna Realty Investors (1982-1997) OTHER EXPERIENCE Stephen M. Ross School of Business at the University of Michigan >Member, Advisory Board Ross Real Estate Fund (2016-2020) >Member, Alumni Board of Governors (2010-2016) EDUCATION >BA in Economics—University of Michigan, Ann Arbor >MBA in Marketing and Real Estate—Stephen M. Ross School of Business at the University of Michigan, Ann Arbor COPT BOARD SERVICE Mr. Owens’ lengthy real estate career and past executive positions at both publicly traded and private companies qualifies him to provide an experienced perspective on our strategic initiatives and to assess capital allocation and other investment decisions. |

COMMITTEES Compensation, Investment | |

| Skills and Qualifications | |

| | Executive Leadership | |

| | Financial Literacy/Accounting | |

| | Finance/Capital Markets | |

| | Real Estate Investment | |

| | Strategic Planning + Leadership | |

| | | |

| | | | | | | | | | | | | | | | | |

| | C. Taylor Pickett | Age: 62 |

| Independent Trustee Since: 2013 |

| BACKGROUND Omega Healthcare Investors, Inc. (NYSE: OHI) >Chief Executive Officer (2001-Present) Integrated Health Services, Inc. >Executive Vice President and Chief Financial Officer (1998-2001) >Various executive positions (1993-1998) PHH Corporation >Vice President of Taxes (1991-1993) KPMG >Certified public accountant (1984-1991) OTHER PUBLIC COMPANY BOARDS Current >Omega Healthcare Investors, Inc. (NYSE: OHI) EDUCATION >BA in Accounting—University of Delaware >JD—University of Maryland School of Law >Certified Public Accountant COPT BOARD SERVICE Mr. Pickett’s extensive executive experience at various public companies and his financial expertise are assets to considering our strategic initiatives, capital allocation decisions and compensation matters, and supplement our financial oversight. In addition, his active role as a chief executive officer serves as a valuable resource for both management and the Board. |

COMMITTEES Compensation (Chair),

Investment | |

| Skills and Qualifications | |

| | Executive Leadership | |

| | Public Company Board Service | |

| | Financial Literacy/Accounting | |

| | Finance/Capital Markets | |

| | Real Estate Investment | |

| | Strategic Planning + Leadership | |

Proposal 1 - Election of Trustees

| | | | | | | | | | | | | | | | | |

| | Lisa G. Trimberger | Age: 63 |

| Independent Trustee Since: 2017 |

| BACKGROUND Mack Capital Investments LLC >Principal and owner (2014-Present) Deloitte & Touche LLP >Audit partner and other positions (1983-2014) >Co-chair of the Nominating Committee of the Board of Directors >Leader of the firm’s National Women’s Initiative for development and retention of women professionals OTHER PUBLIC COMPANY BOARDS Current >EPR Properties (NYSE: EPR) >Luxfer Holdings PLC (NYSE: LXFR) OTHER EXPERIENCE NACD >Member and Board Leadership Fellow National Association of Real Estate Investment Trusts >Member EDUCATION >BS in Accounting—St. Cloud State University >Certified Public Accountant >CERT Certificate in Cybersecurity Oversight—NACD, Ridge Global and Carnegie Mellon University’s CERT division >Women’s Director Development Executive Program—J.L. Kellogg School of Management of Northwestern University COPT BOARD SERVICE Ms. Trimberger’s experience as an audit partner in a Big Four firm positions her to contribute significantly as a financial expert in areas including financial and audit oversight, corporate governance and risk

management matters. |

COMMITTEES Audit (Chair),

Nominating and Corporate Governance | |

| Skills and Qualifications | |

| | Public Company Board Service | |

| | Financial Literacy/Accounting | |

| | Risk Management | |

| | Corporate Governance | |

| | Strategic Planning + Leadership | |

| | Audit Committee Financial Expert | |

| | | |

| | | | | | | | |

12 | COPT Defense Properties | |

Our Board of Trustees

TRUSTEE INDEPENDENCE

We believe that for our Board to effectively serve in its capacity, it is important, and the New York Stock Exchange (“NYSE”) requires, that at least a majority of our Trustees be independent as defined by the applicable rules of the NYSE. Therefore, we require that a substantial majority of the Board be independent, as so defined. No Trustee will be considered independent unless the Board affirmatively determines that the Trustee has no material relationship with the Company (directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). A Trustee will not be deemed independent if:

>the Trustee is, or within the last three years, has been, employed by the Company or a member of his/her immediate family is, or within the last three years has been, an executive officer of the Company;

>the Trustee or a member of his/her immediate family receives, or during any 12-month period within the last three years received, more than $120,000 in direct compensation from the Company (other than Trustee and committee fees and pension or other forms of deferred compensation for prior service, provided such compensation is not contingent in any way on continued service);

>the Trustee is a current partner or employee of the Company’s internal auditors or outside independent registered public accounting firm serving as the Company’s auditors, or a member of the Trustee’s immediate family is a current partner of such auditors or firm, or is a current employee of such auditors or such firm and personally works on the Company’s audit, or the Trustee or a member of the Trustee’s immediate family was within the last three years a partner or employee of such auditors or firm and personally worked on the Company’s audit during that time;

>the Trustee or a member of his/her immediate family is, or within the last three years has been, employed as an executive officer of another entity of which any of the Company’s present executive officers at the time serves or served on that other entity’s compensation committee;

>the Trustee is a current employee, or a member of his/her immediate family is a current executive officer, of another company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeded the greater of $1 million or 2% of such other company’s consolidated gross revenues; or

>the Trustee is a current executive officer or compensated employee, or an immediate family member of the Trustee is a current executive officer, of a charitable organization to which the Company has made donations in an amount which, in any of the last three fiscal years, exceeded the greater of $1 million or 2% of such charitable organization’s donations.

The Board has determined that each of our nominees for Trustee meets the independence guidelines described above except for Mr. Budorick, our President + CEO. The Board has also determined that Mr. Kesler met such guidelines during his service on the Board, and also that Mr. Kesler has, during the course of his service on the Audit Committee, met the requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and qualified as an "audit committee financial expert" as that term is defined in Item 407(d) of the Securities and Exchange Commission (“SEC”) Regulation S-K.

LEADERSHIP STRUCTURE OF THE BOARD OF TRUSTEES

Our governance documents provide the Board with flexibility to select the appropriate leadership structure for the Company. In making leadership structure determinations, the Board considers many factors, including the specific needs of our business and what is in the best interests of the Company’s shareholders. Our current leadership structure is comprised of an independent Chairman of the Board separate from the CEO. Among other things, the Board believes that having an independent Chairman enhances the ability of non-management Trustees to raise issues and concerns for Board consideration without immediately involving management and has determined that separating the Chairmanship and CEO roles is the most appropriate structure at this time.

Under our Bylaws, the Chairman of the Board presides over the meetings of the Board and of the shareholders at which he or she is present and shall in general oversee all of the business and affairs of the Company. In the absence of the Chairman, the Chair of the Nominating and Corporate Governance Committee shall preside over the

meetings of the Trustees and of the shareholders at which he shall be present. The Chairman, with the CEO’s input, prepares the agenda for each Board meeting and, with input from the Chairman of the Nominating and Corporate Governance Committee, reviews and sets the master calendar for the meetings of the Board in a given year. Such agenda and master calendar include a regular review of our Enterprise Risk Management program and provides for updates to that program as reviewed by the Audit Committee and then the entire Board. The Chairman of the Board and the CEO establish standards for effective communications with our shareholders, and while the Chairman may be involved in meetings with shareholders, we typically have our NEOs and our Investor Relations team communicate directly with shareholders. The Chairman of the Board shall also perform such other duties as may be assigned by the Trustees. Our NEOs shall have responsibility for implementation of the policies of the Company, as determined by the Board, and for the administration of the business affairs of the Company.

TRUSTEE ATTENDANCE POLICY

The Board holds a minimum of four regularly scheduled meetings per year, including the meeting of the Board held in conjunction with our annual meeting of shareholders. Trustees are expected to attend all regularly scheduled meetings and to have reviewed, prior to the meetings, all meeting materials distributed to them. Trustees are expected to participate in all regularly scheduled meetings, and a Trustee who is unable to participate in a meeting is expected to notify the Chairman of the Board in advance of such meeting. If a Trustee participates in a regularly scheduled meeting via teleconference, videoconference, or such other similar means for the entire meeting, such Trustee shall be deemed to have attended the meeting for the purposes of determining whether a quorum exists and for voting purposes. A Trustee may not send a representative with a proxy to vote on his or her behalf if such Trustee is not able to attend a scheduled meeting.

Trustees are expected to participate in our annual meeting of shareholders. All of our Trustees who were nominated for election at the time of the 2023 Annual Meeting of Shareholders were in attendance at the meeting.

MEETINGS OF INDEPENDENT TRUSTEES

The independent Trustees meet in executive session at each of the regularly scheduled meetings. The Chairman of the Board presides over the executive sessions. The independent Trustees may meet in executive session at any time to consider issues that they deem important to address without management present.

TRUSTEE COMPENSATION

Employee Trustees receive no compensation other than their compensation as an employee for serving on the Board or its committees. During 2023, non-employee Trustees received the following:

>Fees, paid in cash, set forth below:

| | | | | | | | |

| Annual Trustee Fee | | $ | 70,000 | |

| Annual Chair of Board fee | | $ | 70,000 | |

| Annual committee chair fee | | |

| Audit | | $ | 17,500 | |

| Compensation | | $ | 15,000 | |

| Investment | | $ | 13,000 | |

| Nominating and Corporate Governance | | $ | 15,000 | |

| Annual committee fees | | |

| Audit | | $ | 14,000 | |

| Compensation | | $ | 12,000 | |

| Investment | | $ | 10,000 | |

| Nominating and Corporate Governance | | $ | 12,000 | |

| Fee for each Board meeting attended after first 12 per calendar year | | $ | 2,000 | |

The fees set forth above have not changed from 2022. Our Trustee compensation is reviewed against market and our peers bi-annually in consultation with our external compensation consultant.

| | | | | | | | |

14 | COPT Defense Properties | |

>Annual grants of restricted shares (“RSs”), restricted share units (also referred to herein as “deferred share awards”), or time-based profit interest units in COPT Defense Properties, L.P., our operating partnership, in an award value of $105,000, calculated utilizing the 15-day trailing average share price as of the grant date. Forfeiture restrictions for the aforementioned award types lapse on the first anniversary of the grant date, provided that the Trustee remains in his or her position. With respect to RSs and deferred share awards, the resulting common shares are issued either on the first anniversary of the grant date for RSs or on a later date selected by the Trustee for deferred share awards. Holders of RSs and deferred share awards are entitled to receive dividends on such shares. Prior to vesting and occurrence of a book-up event (as defined under income tax regulations), the time-based profit interest units carry substantially the same rights to distributions as non-profit interest unit common units but carry no redemption rights. Holders of RSs can cast votes for such shares, while holders of the other award types cannot cast votes for such units; and

>Reimbursement for out-of-pocket expenses, such as travel and lodging costs incurred in connection with meeting attendance.

The table below sets forth the total amounts of compensation earned by our non-employee Trustees during 2023:

| | | | | | | | | | | | | | | | | | | | |

| Name of Trustee | | Fees Earned (Paid in Cash)(1) | | Equity Awards(2) | | Total |

| Robert L. Denton, Sr. | | $ | 121,000 | | | $ | 107,421 | | | $ | 228,421 | |

| Thomas F. Brady | | $ | 174,000 | | | $ | 107,421 | | | $ | 281,421 | |

| Philip L. Hawkins | | $ | 105,000 | | | $ | 107,421 | | | $ | 212,421 | |

| Steven D. Kesler | | $ | 94,000 | | | $ | 107,421 | | | $ | 201,421 | |

| Letitia A. Long | | $ | 96,000 | | | $ | 107,421 | | | $ | 203,421 | |

| Essye B. Miller | | $ | 86,000 | | | $ | 107,421 | | | $ | 193,421 | |

| Raymond L. Owens | | $ | 92,000 | | | $ | 107,421 | | | $ | 199,421 | |

| C. Taylor Pickett | | $ | 107,000 | | | $ | 107,421 | | | $ | 214,421 | |

| Lisa G. Trimberger | | $ | 113,500 | | | $ | 107,421 | | | $ | 220,921 | |

(1)This column reports the amount of cash compensation earned in 2023 for Board and committee service.

(2)Includes the annual grant of RSs, deferred share awards or time-based profits interest units awarded to the Trustees on May 11, 2023 at a grant date fair value of $23.75 per share/unit. See Notes 2 and 12 to our consolidated financial statements included in our Annual Report on Form 10-K for additional information regarding share-based compensation, including assumptions made in determining values for awards. As of December 31, 2023, none of our trustees held outstanding stock options.

We formerly offered our Trustees the ability to participate in a nonqualified deferred compensation plan but, effective December 31, 2019, froze additional entry into that plan. Prior to that time, this plan allowed for the deferral of up to 100% of a participant’s cash compensation on a pre-tax basis and enabled such participants to receive a tax-deferred return on such deferrals. The plan does not guarantee a return on or above amounts deferred or provide for above-market preferential earnings. The plan is not qualified under the Employee Retirement and Income Security Act of 1974. Participants may elect that upon the participants’ death, payments will be made in lump sum to parties designated by the participant. Participant account balances are fully vested and participation in the deferred compensation plan was voluntary.

BOARD COMMITTEES

The Board has four committees: (1) the Audit Committee; (2) the Compensation Committee; (3) the Investment Committee; and (4) the Nominating and Corporate Governance Committee. Descriptions of these committees are set forth below:

>The Audit Committee oversees the following:

>integrity of our financial statements and other financial information provided to shareholders and the investment community;

>compliance with certain legal and financial regulatory requirements and our ethics policies;

>retention of our Independent Auditor, including oversight of its performance, qualifications and independence, approval of the scope of the audit and non-audit services and associated fees and input into the selection of the lead engagement partner with each rotation;

>accounting and financial reporting processes, internal control systems and the internal audit function; and

>risk management activities, including oversight of cybersecurity risks.

The Committee also provides an avenue for communication among our Independent Auditor, internal auditors, management, and the Board.

>The Compensation Committee’s primary responsibilities are set forth below:

>establish and periodically review our compensation philosophy and the adequacy of compensation plans and programs for executive officers and to make recommendations to the Board with respect to such compensation;

>establish compensation arrangements and incentive goals (Company financial measures, business metrics and individual goals) for executive officers and to administer such compensation plans and programs;

>review and approve goals and objectives relevant to the CEO’s compensation, evaluate the CEO’s performance in light of those goals and objectives and, either as a Committee or together with the other independent Trustees (as directed by the Board), recommend to the Board for approval the CEO’s compensation level based on this evaluation;

>review the performance of all other executive officers and award incentive compensation and adjust compensation arrangements as appropriate based upon performance;

>review and consider risks relating to our compensation policies; and

>review compensation arrangements for Trustees and make appropriate recommendations to the Board for approval.

>The Investment Committee is authorized to:

>oversee and approve acquisitions, dispositions, development/redevelopment projects, financings, joint ventures and other investments provided each individual transaction does not exceed $200 million;

>assess such proposed transactions in light of the Company’s strategic goals and objectives, balancing the risks and the benefits; and

>delegate certain of its authority to our management team and oversee management’s implementation of such delegated authority.

>The Nominating and Corporate Governance Committee serves the following purposes:

>recommend to the Board the structure and operations of the Board;

>identify individuals qualified to serve as Trustees and recommend that the Board select the Trustee nominees identified by the Committee for election at the next annual meeting of shareholders;

>recommend to the Board the responsibilities of each Board committee, the structure and operation of each committee and the Trustee nominees for assignment to each committee, including the recommendation of the chair for each Board committee;

>oversee the Board’s annual evaluation of its performance and the performance of all Board committees;

>develop and recommend to the Board for adoption a set of Corporate Governance Guidelines applicable to the Company and periodically review the same;

>review and monitor management development and succession plans and activities; and

>oversee the Company’s strategies, activities, and risks and opportunities relating to environmental, social, and governance matters affecting the Company.

All members of the Board’s committees are independent Trustees and meet the applicable requirements for committee membership under the NYSE rules. The practices of our Board’s committees are outlined in their

| | | | | | | | |

16 | COPT Defense Properties | |

respective charters, which are available in the Investors section of our website in the subsection entitled “Governance” (https://investors.copt.com/corporate-governance/board-committees), and are also available in printed form to any shareholder upon request. To the extent modifications are made to the charters, such modifications will be reflected on our Internet website.

The committees on which Trustees served and the number of meetings held during 2023 are set forth below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Board Member | Audit | | Compensation | | Investment | | Nominating and Corporate Governance |

Robert L. Denton, Sr. (1) | | | | | | | |

| Thomas F. Brady | | | | | | | |

| Philip L. Hawkins | | | | | | | |

| Steven D. Kesler | | | | | | | |

Letitia A. Long (1) | | | | | | | |

Essye B. Miller(2) | | | | | | | |

| Raymond L. Owens | | | | | | | |

| C. Taylor Pickett | | | | | | | |

| Lisa G. Trimberger | | | | | | | |

Meetings Held in 2023 | 10 | | 4 | | 4 | | 5 |

(1)Effective February 21, 2024, Mr. Denton stepped down as Chair of the Nominating and Corporate Governance Committee and Ms. Long was was appointed as Chair of that committee.

(2)Effective November 9, 2023, Ms. Miller was appointed to the Nominating and Corporate Governance Committee.

During 2023, the Board held a total of five meetings, including its four quarterly meetings. Each incumbent Trustee in 2023 attended at least 75% of the aggregate of the meetings of the Board and meetings held by all committees on which such Trustee served.

TRUSTEE EVALUATION

The Board recognizes that a robust and constructive evaluation process is an essential part of good corporate governance and board effectiveness. The evaluation processes utilized by the Board are designed and implemented under the direction of the Nominating and Corporate Governance Committee and aim to assess Board and committee effectiveness as well as individual Trustee performance and contribution levels. The Nominating and Corporate Governance Committee and full Board consider the results of the annual evaluations in connection with their review of Trustee nominees to ensure the Board continues to operate effectively. Each year, our Trustees complete anonymous governance questionnaires and self-assessments. These questionnaires and assessments facilitate a candid assessment of: (i) the Board’s performance in areas such as business strategy, risk oversight, talent development and succession planning and corporate governance; (ii) the Board’s structure, composition and culture; and (iii) the mix of skills, qualifications and experiences of our Trustees. The results of the survey are then reviewed by the Nominating and Corporate Governance Committee with the whole Board.

NOMINATION OF TRUSTEES

The Nominating and Corporate Governance Committee of the Board is responsible for recommending nominations to the Board and shareholders. In arriving at nominations, the Nominating and Corporate Governance Committee reviews with the Board the size, function and needs of the Board and, in doing so, takes into account the principle that the Board as a whole should be competent in the following areas: (1) industry knowledge; (2) accounting and finance; (3) business judgment; (4) management and communication skills; (5) leadership; (6) public real estate investment trusts (“REITs”) and commercial real estate business; (7) business strategy; (8) crisis management; (9) corporate governance; and (10) risk management. The Board also seeks members from diverse backgrounds. Trustees should have experience in positions with a high degree of responsibility, be leaders in the companies or institutions with which they are or were affiliated and be selected based upon contributions that they can make to the Company. In determining whether to recommend a Trustee for re-election, the Nominating and Corporate

Governance Committee also considers the Trustee’s past attendance at meetings and participation in, and contributions to, the activities of the Board and its committees.

Consistent with our Corporate Governance Guidelines, the Board considers professional experience and diversity of race, ethnicity, gender, age and cultural background in evaluating candidates for nomination. The Board pursues candidates with diverse backgrounds and experience to ensure we benefit from a broad spectrum of expertise which contributes to a more effective decision-making process.

The Nominating and Corporate Governance Committee has a policy regarding consideration of shareholder recommendations for Trustee nominees, which is set forth below:

The Committee considers nominees recommended by our common shareholders using the same criteria it employs in identifying its own nominees. Any shareholder wishing to make a recommendation should send the following information to the Chairman of the Nominating and Corporate Governance Committee, care of David L. Finch, Vice President, General Counsel and Secretary, at our mailing address set forth on the first page of this proxy statement, no later than the date that is 120 days prior to the one-year anniversary of the date of the mailing of the proxy statement for our most recent annual meeting of shareholders:

>the name of the candidate and the information about the individual that would be required to be included in a proxy statement under the rules of the SEC;

>information about the relationship between the candidate and the nominating shareholder;

>the consent of the candidate being recommended to serve as a Trustee;

>proof of the number of common shares in the Company that the nominating shareholder owns and the length of time the shares have been owned; and

>a separate statement of the candidate’s qualifications relating to the Board’s membership criteria.

BOARD’S APPROACH TO RISK OVERSIGHT

The Board plays an important role in our risk oversight. While the Board and its Committees rely on management to bring significant matters to its attention, the Board monitors our risk tolerance and oversees our risk management activities primarily by:

>approving annually our business strategy, budget and capital plan;

>maintaining for itself and its committees direct decision-making authority with respect to matters with significant inherent risks, including material acquisitions, dispositions, development and financing activities, matters involving environmental, social and governance strategy and the appointment, retention and compensation of executive officers;

>reviewing and discussing regular periodic reports relating to our performance and achievement of objectives;

>reviewing and discussing with management the Company’s enterprise risk assessments; and

>overseeing specific areas of our business conducted by the Board’s committees.

Pursuant to its charter, the Audit Committee is responsible for the oversight of our risk assessment and management activities, including our enterprise risk management (“ERM”) assessment. The Committee discharges these responsibilities by reviewing and discussing with management, our internal audit and information technology functions and our Independent Auditor any significant risks or exposures faced by the Company, the steps taken to identify, minimize, monitor, or control such risks or exposures and our underlying policies with respect to risk assessment and risk management. Management, including those from our information technology function, reports to the Audit Committee with respect to management’s assessment of our cybersecurity and information security risks and actions taken by us to manage and/or mitigate such risks. Consistent with NYSE Rules, the Audit Committee also provides oversight with respect to risk assessment and risk management, particularly regarding the activities of our internal audit function and integrity of our financial statements and internal controls over financial reporting. Our internal audit function reports to the Audit Committee regarding such activities on an ongoing basis, including at in-person and most telephonic meetings of the Audit Committee. Each year, management re-evaluates the business risks covered by its ERM assessment to determine whether the proper risks are being evaluated. This assessment is then discussed with the Audit Committee and further refined with the Committee’s input. Once the ERM

| | | | | | | | |

18 | COPT Defense Properties | |

assessment is further refined, the CEO and Chairman of the Board present to the entire Board the final ERM assessment for the year. Each quarter, management and the Audit Committee reviews the ERM assessment, including refinements thereof, and the Audit Committee reviews the assessment with the entire Board.

Company’s Commitment to Environmental and Social Responsibility and Governance

As we celebrated our 25th anniversary as a publicly-traded company, we published our ninth straight Corporate Sustainability Report, which can be found on our website under the “Investors” tab. We remain committed to furthering our goal to create value for our investors while developing workable solutions to integrate sustainable efficiencies in the construction and operation of our assets. Our Corporate Sustainability Report discloses the metrics, targets and risks that we believe are most relevant to our business and provide our investors with greater insight into our environmental, social and governance (“ESG”) practices to address the systemic risks our Company faces. Below is a summary of some of our ESG programs and achievements. Information on, or accessible through, our Company website is not and should not be deemed part of this proxy statement.

Our “RITE” principles guide our approach to addressing climate risk and our ESG program. These principles provide that we will seek to:

>Reduce — consumption of energy and water resources and our GHG intensity, water use, and non-recyclable waste.

>Innovate — adapt building operations, technologies, and designs.

>Thrive — manage risks while generating resilient cash flows for our shareholders.

>Engage — develop a talented work force, retain high-credit tenants and support the communities where we operate.

With the Board’s oversight and input, we continue to refine and improve on our ESG strategy.

ENVIRONMENT

We continue to develop and operate our buildings to minimize their environmental impact and to enhance our tenants’ experience. Noting that a large segment of our portfolio is operationally controlled by our tenants, we collect and aggregate data with respect to emissions, energy and water consumption and waste management for the portion of our assets that we do operationally control. We believe that our commitment to sound ESG practices is demonstrated by the following:

>GRESB: In 2015, we began participating in the Global Real Estate Sustainability Benchmark (“GRESB”) survey. Each year since, we have earned GRESB’s “Green Star” rating, the highest quadrant of achievement.

Company’s Commitment to Environmental and Social Responsibility and Governance

>LEED Certification Criteria in New Construction: Since 2003, we have sought to construct our office properties to meet certification standards under the U.S. Green Building Council’s Leadership in Energy and Environmental Design (“LEED”) program or, when not possible, strived to otherwise incorporate LEED criteria into property designs. We task architects and engineers to develop the most energy efficient design for our buildings and we use construction materials that prioritize tenant health and energy efficiency.

>LEED-Driven Property Operations: Operationally, since 2010, we have embraced the LEED Existing Building-Operations and Maintenance (“LEED-EBOM”) prerequisites, including energy efficiency, green cleaning, recycling, no smoking and other operations and maintenance policies, to ensure our tenants and employees work in healthy environments. We invest in energy systems and equipment that reduce our energy consumption and operating costs, which has enabled certain of our properties to achieve certifications through the U.S. Environmental Protection Agency’s ENERGY STAR program.

>Environmental Policy: We adhere to an environmental policy that outlines our approach to protecting the environment, addressing relevant climate risks, and promoting sustainable development practices.

>Environmental Goals 2025: We established target environmental goals for 2025 that we disclose in our Corporate Sustainability Report, including ones for reducing our energy intensity by 5% and our Scope 1 and Scope 2 GHG emissions by 5% and capping our water use intensity at 2019 levels.

>United Nations (“U.N.”) Sustainable Development Goals: We continue to align many of our development practices with the U.N. Sustainable Development Goals, adhering to 13 of the 17 U.N. goals.

>TCFD Risk Assessment: In 2022, we published our first climate risk assessment pursuant to the Task Force on Climate-related Financial Disclosures (“TCFD”) guidelines, and in 2023, we added further detail with respect to our transition risks, physical risks and opportunities.

>SASB Report: In 2023, we issued our first Sustainability Accounting Standards Board (“SASB”) disclosures associated with the real estate industry, which identified several of the most relevant sustainability-related issues faced by our Company.

SOCIAL

As detailed in our Corporate Sustainability Report, we remain committed to the well-being of our employees, tenants, and the communities in which we operate. We believe that our commitment to social responsibility is demonstrated by the following:

>Workplace Culture: We develop and reinforce our culture by emphasizing our core values, illustrated by the actiiVe acronym. actiiVe stands for: Accountability, Commitment, Teamwork, Integrity, Innovation, Value Creation and Excellence. These values are intended to serve as a compass to our workforce to influence behavior and fuel our success.

>Employee Safety: We take the safety of our employees seriously, which we believe contributes to our continual efforts to lower illness and injury rates. We conduct job-tailored safety training on an ongoing basis. We also monitor our workers’ compensation claims to measure the effectiveness of our safety program.

>Diversity: We believe in equal opportunity for all individuals and do not discriminate on the basis of race, color, religion, national origin, sex, age, disability or other characteristics protected by law. We celebrate diversity in our workforce and incorporate inclusion within our talent recruitment and engagement programs. We are committed to selecting talented individuals while aligning our workforce’s performance to Company objectives.

>Talent Management: We offer robust educational and training programs to all employees, including educational assistance for college-level and vocational degree programs, and cover all expenses for licenses and certifications, management courses, key skills training and industry and professional conferences. Further, we offer internship and mentorship programs to facilitate teaching and learning from others.

>Tenant Relationships: We meet quarterly with our tenants to foster our relationship and create a meaningful partnership in our sustainability efforts. In addition, many of our office parks provide a fitness center for our tenants’ use as a complimentary amenity to promote the health and well-being of their employees.

>Community Involvement: We believe in creating value for all of our stakeholders, including the communities in which our assets are located. We coordinate community events and activities, sponsor health and well-being events, provide monetary contributions and encourage employee volunteerism. Through our Donate 8

| | | | | | | | |

20 | COPT Defense Properties | |

Company’s Commitment to Environmental and Social Responsibility and Governance

program, we provide our employees a full-paid day to volunteer at a charity or community program of their choosing.

>Employee Feedback: In 2023, we conducted a company-wide survey through Fortune’s Great Places to Work and earned a Great Place to Work award due to our strong positive results. Our CEO reviewed the results and then presented the survey results to our Board.

GOVERNANCE

We believe that strong corporate governance enhances our accountability to our stakeholders, resulting in effective oversight and decision making. In addition to the governance matters addressed elsewhere in this proxy statement, below is a list of the attributes of our Board structure, shareholder rights, and shareholder outreach and engagement that we believe further demonstrate our commitment to strong corporate governance:

>Board Structure

>Our Trustees are independent other than our President + CEO.

>We do not combine the roles of the Board Chair with the President + CEO.

>Our Trustees are elected annually.

>The Board Chairman’s role is significant to our Company and Board leadership.

>Our Trustees have open communications and effective working relationships, with regular access to management.

>Uncontested elections of Trustees require that nominees each receive an affirmative vote by a majority of the votes cast for and against such Trustees in order to be elected.

>We have a policy in place under which Trustees nominated for re-election who fail to receive the required number of votes are required to tender their resignations.

>In connection with Board refreshment, each year, the Nominating and Corporate Governance Committee evaluates the makeup of the Board to determine whether the Board has the right individuals in place to oversee the Company. In addition, we have a mandatory retirement policy for Trustees who will be 75 years of age at the time they would be nominated for election.

>Our Trustees are expected to own equity in the Company at levels meeting established share ownership guidelines.

>We have anti-hedging and anti-pledging policies in place for our Trustees. None of our Trustees or Named Executive Officers pledge or hedge any of their shares in the Company or common units in COPT Defense Properties, L.P. (the “Operating Partnership”).

>Our Board’s non-management Trustees meet regularly in executive sessions.

>In 2023, three of our Audit Committee members qualified as “audit committee financial experts” as defined by the SEC.

>Our Board monitors the Company’s risk tolerance and oversees its risk management activities.

>The Nominating and Corporate Governance Committee is specifically tasked with overseeing and addressing the Company’s ESG risks and the manner in which the Company addresses those risks.

>Our Board and its committees conduct annual self-assessments.

>Shareholder Rights

>We do not have in place a poison pill/shareholders rights plan.

>Our shareholders have the right to call a special meeting.

>Our shareholders can amend our bylaws by a simple majority vote.

>Our shareholders can approve a merger by a simple majority vote.

>As a Maryland REIT, we voluntarily opted out of the Maryland Unsolicited Takeover Act (MUTA).

Company’s Commitment to Environmental and Social Responsibility and Governance

>Shareholder Outreach and Engagement

>Our investor relations team proactively reaches out to members of the investment community.

>Our executives regularly participate at REIT and investment analyst conferences and also attend other individual investor meetings throughout the year.

>We typically arrange portfolio tours with members of the investment community several times a year.

>We author and release research materials to assist investors in understanding unique aspects of our business.

Our Executive Officers

Below is information with respect to our executive officers (in addition to Stephen E. Budorick, our President + CEO) (sometimes referred to herein as our “executive officers,” “executives” or “NEOs”).

| | | | | | | | |

Britt A. Snider | | Britt A. Snider, 47, became our Executive Vice President + Chief Operating Officer (“COO”) on December 1, 2023, after being a principal since 2020 at Redbrick LMD, LLC, an active investor, developer, and manager of mixed-use properties in the Washington, D.C. area, where he was responsible for overseeing the company’s development, asset management and leasing activities. From 2019 to 2020, Mr. Snider served as Senior Vice President - Mixed Use at WS Development, a real estate investment and development company based in Chestnut Hill, Massachusetts, where he led certain of the company’s mixed-use development initiatives. Between 2016 and 2019, Mr. Snider served as Executive Vice President, Head of Commercial Asset Management at JBG Smith (NYSE: JBGS), a mixed-use investment and development real estate investment trust, where he oversaw the company’s office portfolio, and from 2006 to 2016 as Principal, Development of The JBG Companies, a predecessor to JBGS, where he oversaw all development and pre-development activities for a portfolio of properties. Previous to The JBG Companies, Mr. Snider worked in the Real Estate Investment Banking Group at Friedman Billings Ramsey. |

| | |

Anthony Mifsud | | Anthony Mifsud, 59, has been our Executive Vice President + Chief Financial Officer (“CFO”) since February 2015, after serving as Senior Vice President, Finance and Treasurer since January 2011 and having joined the Company in 2007 as Vice President, Financial Planning & Analysis. Prior to joining the Company, Mr. Mifsud served as Senior Vice President & Treasurer for Municipal Mortgage & Equity, LLC (formerly NYSE: MMA) and prior to joining MMA, was Vice President, Financial Management at Enterprise Social Investment Corporation. From 1990 to 2005, Mr. Mifsud held various accounting and corporate finance positions at The Rouse Company (formerly NYSE: RSE), culminating as Vice President, Finance from 1999 to 2005. Prior to that time, Mr. Mifsud practiced as a CPA and auditor at KPMG Peat Marwick. |

| | | | | | | | |

| | |

Proposal 2 | ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | Our Board

recommends

a vote FOR

the approval

of this

resolution. |

| The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, enables our shareholders to vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules. This is commonly known as, and is referred to herein as, a “say-on-pay” proposal or resolution. |