COPT Defense Properties

Supplemental Information + Earnings Release - Unaudited

For the Period Ended 3/31/24

| | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | |

| | | |

| | | | Please refer to the section entitled “Definitions” for definitions of non-GAAP measures and other terms we use herein that may not be customary or commonly known. |

| | | | |

| | | | |

| | | | |

|

| | | |

| | | | |

| | | | |

COPT Defense Properties

Summary Description

THE COMPANY

COPT Defense Properties (the “Company” or “COPT Defense”), an S&P MidCap 400 Company, is a self-managed real estate investment trust (“REIT”) focused on owning, operating and developing properties in locations proximate to, or sometimes containing, key U.S. Government (“USG”) defense installations and missions (which we refer to herein as our Defense/IT Portfolio). Our tenants include the USG and their defense contractors, who are primarily engaged in priority national security activities, and who generally require mission-critical and high security property enhancements. The ticker symbol under which our common shares are publicly traded on the New York Stock Exchange is “CDP”. As of March 31, 2024, our Defense/IT Portfolio of 193 properties, including 24 owned through unconsolidated joint ventures, encompassed 22.0 million square feet and was 96.8% leased.

| | | | | | | | | | | | | | |

| | | | |

| MANAGEMENT | Stephen E. Budorick, President + CEO | | INVESTOR RELATIONS | Venkat Kommineni, VP |

| Britt A. Snider, EVP + COO | | 443.285.5587 | venkat.kommineni@copt.com |

| Anthony Mifsud, EVP + CFO | | |

| | | Michelle Layne, Manager |

| | | 443.285.5452 | michelle.layne@copt.com |

CORPORATE CREDIT RATING

Fitch: BBB- Stable | Moody’s: Baa3 Stable | S&P: BBB- Stable

DISCLOSURE STATEMENT

This supplemental package contains forward-looking statements within the meaning of the Federal securities laws. Forward-looking statements can be identified by the use of words such as “may,” “will,” “should,” “could,” “believe,” “anticipate,” “expect,” “estimate,” “plan” or other comparable terminology. Forward-looking statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although we believe that the expectations, estimates and projections reflected in such forward-looking statements are based on reasonable assumptions at the time made, we can give no assurance that these expectations, estimates and projections will be achieved. Future events and actual results may differ materially from those discussed in the forward-looking statements and we undertake no obligation to update or supplement any forward-looking statements. The areas of risk that may affect these expectations, estimates and projections include, but are not limited to, those risks described in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023.

COPT Defense Properties

Equity Research Coverage

| | | | | | | | | | | | | | | | | | | | |

|

| Firm | | Senior Analyst | | Phone | | Email |

| Bank of America Securities | | Camille Bonnel | | 416.369.2140 | | camille.bonnel@bofa.com |

| BTIG | | Tom Catherwood | | 212.738.6410 | | tcatherwood@btig.com |

| Citigroup Global Markets | | Michael Griffin | | 212.816.5871 | | michael.a.griffin@citi.com |

| Evercore ISI | | Steve Sakwa | | 212.446.9462 | | steve.sakwa@evercoreisi.com |

| Green Street | | Dylan Burzinski | | 949.640.8780 | | dburzinski@greenstreet.com |

| Jefferies & Co. | | Peter Abramowitz | | 212.336.7241 | | pabramowitz@jefferies.com |

| JP Morgan | | Tony Paolone | | 212.622.6682 | | anthony.paolone@jpmorgan.com |

| Raymond James | | Bill Crow | | 727.567.2594 | | bill.crow@raymondjames.com |

| Truist Securities | | Michael Lewis | | 212.319.5659 | | michael.r.lewis@truist.com |

| Wedbush Securities | | Richard Anderson | | 212.938.9949 | | richard.anderson@wedbush.com |

| Wells Fargo Securities | | Blaine Heck | | 410.662.2556 | | blaine.heck@wellsfargo.com |

With the exception of Green Street, the above-listed firms are those whose analysts publish research material on the Company and whose estimates of our FFO per share can be tracked through FactSet. Any opinions, estimates or forecasts the above analysts make regarding COPT Defense’s future performance are their own and do not represent the views, estimates or forecasts of COPT Defense’s management.

COPT Defense Properties

Selected Financial Summary Data

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Page | | Three Months Ended | | |

| SUMMARY OF RESULTS | | Refer. | | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Net income (loss) | | 7 | | $ | 33,671 | | | $ | 34,820 | | | $ | (221,207) | | | $ | 31,642 | | | $ | 80,398 | | | | | |

| NOI from real estate operations | | 13 | | $ | 101,657 | | | $ | 98,656 | | | $ | 96,494 | | | $ | 95,024 | | | $ | 93,903 | | | | | |

| Same Property NOI | | 17 | | $ | 95,403 | | | $ | 94,854 | | | $ | 95,039 | | | $ | 94,223 | | | $ | 92,723 | | | | | |

| Same Property cash NOI | | 18 | | $ | 91,619 | | | $ | 89,493 | | | $ | 88,793 | | | $ | 87,989 | | | $ | 86,391 | | | | | |

| Adjusted EBITDA | | 11 | | $ | 95,841 | | | $ | 93,934 | | | $ | 90,260 | | | $ | 89,044 | | | $ | 87,443 | | | | | |

| | | | | | | | | | | | | | | | |

| FFO per NAREIT | | 8 | | $ | 72,799 | | | $ | 72,360 | | | $ | 70,016 | | | $ | 70,033 | | | $ | 68,816 | | | | | |

| Diluted AFFO avail. to common share and unit holders | | 10 | | $ | 59,269 | | | $ | 54,280 | | | $ | 64,122 | | | $ | 46,003 | | | $ | 38,616 | | | | | |

| Dividend per common share | | N/A | | $ | 0.295 | | | $ | 0.285 | | | $ | 0.285 | | | $ | 0.285 | | | $ | 0.285 | | | | | |

| | | | | | | | | | | | | | | | |

| Per share - diluted: | | | | | | | | | | | | | | | | |

| EPS | | 9 | | $ | 0.29 | | | $ | 0.30 | | | $ | (1.94) | | | $ | 0.27 | | | $ | 0.70 | | | | | |

| FFO - Nareit | | 9 | | $ | 0.62 | | | $ | 0.62 | | | $ | 0.60 | | | $ | 0.60 | | | $ | 0.59 | | | | | |

| FFO - as adjusted for comparability | | 9 | | $ | 0.62 | | | $ | 0.62 | | | $ | 0.60 | | | $ | 0.60 | | | $ | 0.59 | | | | | |

| | | | | | | | | | | | | | | | |

| Numerators for diluted per share amounts: | | | | | | | | | | | | | | | | |

| Diluted EPS | | 7 | | $ | 32,480 | | | $ | 33,552 | | | $ | (217,179) | | | $ | 30,138 | | | $ | 78,467 | | | | | |

| Diluted FFO available to common share and unit holders | | 8 | | $ | 71,892 | | | $ | 70,913 | | | $ | 68,512 | | | $ | 68,323 | | | $ | 67,651 | | | | | |

| Diluted FFO available to common share and unit holders, as adjusted for comparability | | 8 | | $ | 71,969 | | | $ | 71,100 | | | $ | 68,593 | | | $ | 68,569 | | | $ | 67,651 | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

COPT Defense Properties

Selected Financial Summary Data (continued)

(in thousands, except ratios)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Page | | As of or for Three Months Ended | | |

| PAYOUT RATIOS AND CAPITALIZATION | | Refer. | | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| GAAP | | | | | | | | | | | | | | | | |

| Payout ratio: | | | | | | | | | | | | | | | | |

| Net income | | N/A | | 100.7% | | 93.7% | | N/A | | 103.1% | | 40.6% | | | | |

| | | | | | | | | | | | | | | | |

| Capitalization and debt ratios: | | | | | | | | | | | | | | | | |

| Total assets | | 6 | | $ | 4,232,895 | | | $ | 4,246,966 | | | $ | 4,239,257 | | | $ | 4,246,346 | | | $ | 4,177,992 | | | | | |

| | | | | | | | | | | | | | | | |

| Total equity | | 6 | | $ | 1,526,046 | | | $ | 1,523,755 | | | $ | 1,525,873 | | | $ | 1,776,695 | | | $ | 1,768,814 | | | | | |

| Debt per balance sheet | | 6 | | $ | 2,416,873 | | | $ | 2,416,287 | | | $ | 2,415,783 | | | $ | 2,176,174 | | | $ | 2,123,012 | | | | | |

| Debt to assets | | 31 | | 57.1% | | 56.9% | | 57.0% | | 51.2% | | 50.8% | | | | |

| Net income to interest expense ratio | | 31 | | 1.6x | | 1.7x | | N/A | | 1.9x | | 4.9x | | | | |

| Debt to net income ratio | | 31 | | 17.9x | | 17.3x | | N/A | | 17.2x | | 6.6x | | | | |

| | | | | | | | | | | | | | | | |

| Non-GAAP | | | | | | | | | | | | | | | | |

| Payout ratios: | | | | | | | | | | | | | | | | |

| Diluted FFO | | N/A | | 46.8% | | 45.7% | | 47.3% | | 47.5% | | 47.9% | | | | |

| Diluted FFO - as adjusted for comparability | | N/A | | 46.7% | | 45.6% | | 47.3% | | 47.3% | | 47.9% | | | | |

| Diluted AFFO | | N/A | | 56.8% | | 59.7% | | 50.6% | | 70.5% | | 83.9% | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Capitalization and debt ratios: | | | | | | | | | | | | | | | | |

| Total Market Capitalization | | 28 | | $ | 5,218,681 | | | $ | 5,377,815 | | | $ | 5,172,058 | | | $ | 4,914,516 | | | $ | 4,856,761 | | | | | |

| Total Equity Market Capitalization | | 28 | | $ | 2,774,450 | | | $ | 2,932,815 | | | $ | 2,726,295 | | | $ | 2,717,000 | | | $ | 2,711,499 | | | | | |

| Net debt | | 36 | | $ | 2,372,747 | | | $ | 2,328,941 | | | $ | 2,293,005 | | | $ | 2,234,633 | | | $ | 2,181,408 | | | | | |

| Net debt to adjusted book | | 31 | | 40.9% | | 40.6% | | 40.5% | | 38.4% | | 38.1% | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Adjusted EBITDA fixed charge coverage ratio | | 31 | | 4.5x | | 4.4x | | 4.6x | | 4.9x | | 5.0x | | | | |

| | | | | | | | | | | | | | | | |

| Net debt to in-place adj. EBITDA ratio | | 31 | | 6.1x | | 6.1x | | 6.2x | | 6.3x | | 6.2x | | | | |

| | | | | | | | | | | | | | | | |

| Net debt adjusted for fully-leased development to in-place adj. EBITDA ratio | | 31 | | 6.0x | | 6.0x | | 5.9x | | 5.7x | | 5.8x | | | | |

| | | | | | | | | | | | | | | | |

COPT Defense Properties

Selected Portfolio Data (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | |

| # of Properties | | | | | | | | | | |

| Total Portfolio | 201 | | 198 | | 196 | | 194 | | 194 | |

| Consolidated Portfolio | 177 | | 174 | | 172 | | 170 | | 170 | |

| Defense/IT Portfolio | 193 | | 190 | | 188 | | 186 | | 186 | |

| Same Property | 189 | | 189 | | 189 | | 189 | | 189 | |

| | | | | | | | | | |

| % Occupied | | | | | | | | | | |

| Total Portfolio | 93.6 | % | | 94.2 | % | | 94.1 | % | | 93.4 | % | | 92.8 | % | |

| Consolidated Portfolio | 92.2 | % | | 92.9 | % | | 92.7 | % | | 91.9 | % | | 91.2 | % | |

| Defense/IT Portfolio | 95.6 | % | | 96.2 | % | | 95.9 | % | | 95.3 | % | | 94.4 | % | |

| Same Property | 93.5 | % | | 93.8 | % | | 93.8 | % | | 93.3 | % | | 92.6 | % | |

| | | | | | | | | | |

| % Leased | | | | | | | | | | |

| Total Portfolio | 94.9 | % | | 95.3 | % | | 95.1 | % | | 94.9 | % | | 95.0 | % | |

| Consolidated Portfolio | 93.8 | % | | 94.3 | % | | 94.0 | % | | 93.7 | % | | 93.9 | % | |

| Defense/IT Portfolio | 96.8 | % | | 97.2 | % | | 97.0 | % | | 96.8 | % | | 96.7 | % | |

| Same Property | 95.0 | % | | 95.1 | % | | 94.9 | % | | 94.7 | % | | 94.9 | % | |

| | | | | | | | | | |

| Square Feet (in thousands) | | | | | | | | | | |

| Total Portfolio | 24,137 | | 23,859 | | 23,479 | | 23,035 | | 23,020 | |

| Consolidated Portfolio | 19,841 | | 19,563 | | 19,184 | | 18,740 | | 18,725 | |

| Defense/IT Portfolio | 21,993 | | 21,719 | | 21,339 | | 20,895 | | 20,878 | |

| Same Property | 22,227 | | 22,227 | | 22,227 | | 22,227 | | 22,227 | |

| | | | | | | | | | |

(1)Except for the Consolidated Portfolio, includes properties owned through unconsolidated real estate joint ventures (see page 33).

COPT Defense Properties

Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 |

| Assets | | | | | | | | | |

| Properties, net: | | | | | | | | | |

| Operating properties, net | $ | 3,272,452 | | | $ | 3,246,806 | | | $ | 3,148,434 | | | $ | 3,272,670 | | | $ | 3,272,873 | |

| Development and redevelopment in progress, including land (1) | 76,931 | | | 82,972 | | | 141,854 | | | 206,130 | | | 151,910 | |

| Land held (1) | 168,495 | | | 173,900 | | | 177,909 | | | 193,435 | | | 189,292 | |

| Total properties, net | 3,517,878 | | | 3,503,678 | | | 3,468,197 | | | 3,672,235 | | | 3,614,075 | |

| Property - operating right-of-use assets | 40,368 | | | 41,296 | | | 40,487 | | | 41,652 | | | 42,808 | |

| | | | | | | | | |

| | | | | | | | | |

| Cash and cash equivalents | 123,144 | | | 167,820 | | | 204,238 | | | 14,273 | | | 15,199 | |

| Investment in unconsolidated real estate joint ventures | 40,597 | | | 41,052 | | | 41,495 | | | 41,928 | | | 42,279 | |

| Accounts receivable, net | 50,088 | | | 48,946 | | | 40,211 | | | 47,363 | | | 46,149 | |

| Deferred rent receivable | 153,788 | | | 149,237 | | | 142,041 | | | 136,382 | | | 130,153 | |

| Lease incentives, net | 61,150 | | | 61,331 | | | 60,506 | | | 59,541 | | | 49,679 | |

| Deferred leasing costs, net | 70,902 | | | 70,057 | | | 68,033 | | | 69,218 | | | 68,930 | |

| Investing receivables, net | 82,523 | | | 81,512 | | | 87,535 | | | 86,708 | | | 85,499 | |

| | | | | | | | | |

| | | | | | | | | |

| Prepaid expenses and other assets, net | 92,457 | | | 82,037 | | | 86,514 | | | 77,046 | | | 83,221 | |

| Total assets | $ | 4,232,895 | | | $ | 4,246,966 | | | $ | 4,239,257 | | | $ | 4,246,346 | | | $ | 4,177,992 | |

| Liabilities and equity | | | | | | | | | |

| Liabilities: | | | | | | | | | |

| Debt | $ | 2,416,873 | | | $ | 2,416,287 | | | $ | 2,415,783 | | | $ | 2,176,174 | | | $ | 2,123,012 | |

| Accounts payable and accrued expenses | 111,981 | | | 133,315 | | | 135,605 | | | 135,784 | | | 128,509 | |

| Rents received in advance and security deposits | 37,557 | | | 35,409 | | | 32,063 | | | 32,021 | | | 34,653 | |

| Dividends and distributions payable | 33,906 | | | 32,644 | | | 32,645 | | | 32,636 | | | 32,630 | |

| Deferred revenue associated with operating leases | 34,019 | | | 29,049 | | | 24,590 | | | 9,199 | | | 9,022 | |

| | | | | | | | | |

| Property - operating lease liabilities | 33,141 | | | 33,931 | | | 32,940 | | | 33,923 | | | 34,896 | |

| | | | | | | | | |

| | | | | | | | | |

| Other liabilities | 16,406 | | | 18,996 | | | 17,936 | | | 27,699 | | | 21,008 | |

| Total liabilities | 2,683,883 | | | 2,699,631 | | | 2,691,562 | | | 2,447,436 | | | 2,383,730 | |

| Redeemable noncontrolling interests | 22,966 | | | 23,580 | | | 21,822 | | | 22,215 | | | 25,448 | |

| Equity: | | | | | | | | | |

| COPT Defense’s shareholders’ equity: | | | | | | | | | |

| | | | | | | | | |

| Common shares | 1,126 | | | 1,126 | | | 1,125 | | | 1,125 | | | 1,125 | |

| Additional paid-in capital | 2,487,468 | | | 2,489,989 | | | 2,489,717 | | | 2,486,996 | | | 2,484,501 | |

| Cumulative distributions in excess of net income | (1,009,964) | | | (1,009,318) | | | (1,010,885) | | | (762,617) | | | (760,820) | |

| Accumulated other comprehensive income | 3,849 | | | 2,115 | | | 6,094 | | | 5,224 | | | 1,353 | |

| Total COPT Defense’s shareholders’ equity | 1,482,479 | | | 1,483,912 | | | 1,486,051 | | | 1,730,728 | | | 1,726,159 | |

| Noncontrolling interests in subsidiaries: | | | | | | | | | |

| Common units in the Operating Partnership | 29,214 | | | 25,502 | | | 25,337 | | | 29,563 | | | 29,268 | |

| | | | | | | | | |

| Other consolidated entities | 14,353 | | | 14,341 | | | 14,485 | | | 16,404 | | | 13,387 | |

| Total noncontrolling interests in subsidiaries | 43,567 | | | 39,843 | | | 39,822 | | | 45,967 | | | 42,655 | |

| Total equity | 1,526,046 | | | 1,523,755 | | | 1,525,873 | | | 1,776,695 | | | 1,768,814 | |

| Total liabilities, redeemable noncontrolling interests and equity | $ | 4,232,895 | | | $ | 4,246,966 | | | $ | 4,239,257 | | | $ | 4,246,346 | | | $ | 4,177,992 | |

(1)Refer to pages 25 and 27 for detail.

COPT Defense Properties

Consolidated Statements of Operations

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Revenues | | | | | | | | | | | | | |

| Lease revenue | $ | 165,433 | | | $ | 160,337 | | | $ | 155,268 | | | $ | 153,682 | | | $ | 150,560 | | | | | |

| Other property revenue | 1,230 | | | 1,225 | | | 1,339 | | | 1,271 | | | 1,121 | | | | | |

| Construction contract and other service revenues | 26,603 | | | 18,167 | | | 11,949 | | | 14,243 | | | 15,820 | | | | | |

| Total revenues | 193,266 | | | 179,729 | | | 168,556 | | | 169,196 | | | 167,501 | | | | | |

| Operating expenses | | | | | | | | | | | | | |

| Property operating expenses | 66,746 | | | 64,577 | | | 61,788 | | | 61,600 | | | 59,420 | | | | | |

| Depreciation and amortization associated with real estate operations | 38,351 | | | 36,735 | | | 37,620 | | | 37,600 | | | 36,995 | | | | | |

| Construction contract and other service expenses | 26,007 | | | 17,167 | | | 11,493 | | | 13,555 | | | 15,201 | | | | | |

| Impairment losses | — | | | — | | | 252,797 | | | — | | | — | | | | | |

| General and administrative expenses | 8,378 | | | 8,240 | | | 7,582 | | | 7,287 | | | 7,996 | | | | | |

| Leasing expenses | 2,187 | | | 2,308 | | | 2,280 | | | 2,345 | | | 1,999 | | | | | |

| Business development expenses and land carry costs | 1,182 | | | 797 | | | 714 | | | 726 | | | 495 | | | | | |

| Total operating expenses | 142,851 | | | 129,824 | | | 374,274 | | | 123,113 | | | 122,106 | | | | | |

| Interest expense | (20,767) | | | (20,383) | | | (17,798) | | | (16,519) | | | (16,442) | | | | | |

| Interest and other income, net | 4,122 | | | 5,659 | | | 2,529 | | | 2,143 | | | 2,256 | | | | | |

| Gain on sales of real estate | — | | | — | | | — | | | 14 | | | 49,378 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Income (loss) before equity in income (loss) of unconsolidated entities and income taxes | 33,770 | | | 35,181 | | | (220,987) | | | 31,721 | | | 80,587 | | | | | |

| Equity in income (loss) of unconsolidated entities | 69 | | | (240) | | | (68) | | | 111 | | | (64) | | | | | |

| Income tax expense | (168) | | | (121) | | | (152) | | | (190) | | | (125) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income (loss) | 33,671 | | | 34,820 | | | (221,207) | | | 31,642 | | | 80,398 | | | | | |

| Net (income) loss attributable to noncontrolling interests: | | | | | | | | | | | | | |

| Common units in the Operating Partnership | (608) | | | (576) | | | 3,691 | | | (516) | | | (1,293) | | | | | |

| | | | | | | | | | | | | |

| Other consolidated entities | (454) | | | (592) | | | 1,329 | | | (839) | | | (326) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income (loss) attributable to common shareholders | $ | 32,609 | | | $ | 33,652 | | | $ | (216,187) | | | $ | 30,287 | | | $ | 78,779 | | | | | |

| Amount allocable to share-based compensation awards | (129) | | | (100) | | | (992) | | | (98) | | | (248) | | | | | |

| Redeemable noncontrolling interests | — | | | — | | | — | | | (51) | | | (64) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Numerator for diluted EPS | $ | 32,480 | | | $ | 33,552 | | | $ | (217,179) | | | $ | 30,138 | | | $ | 78,467 | | | | | |

COPT Defense Properties

Funds from Operations

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Net income (loss) | $ | 33,671 | | | $ | 34,820 | | | $ | (221,207) | | | $ | 31,642 | | | $ | 80,398 | | | | | |

| Real estate-related depreciation and amortization | 38,351 | | | 36,735 | | | 37,620 | | | 37,600 | | | 36,995 | | | | | |

| Impairment losses on real estate | — | | | — | | | 252,797 | | | — | | | — | | | | | |

| Gain on sales of real estate | — | | | — | | | — | | | (14) | | | (49,378) | | | | | |

| Depreciation and amortization on unconsolidated real estate JVs (1) | 777 | | | 805 | | | 806 | | | 805 | | | 801 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| FFO - per Nareit (2) | 72,799 | | | 72,360 | | | 70,016 | | | 70,033 | | | 68,816 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| FFO allocable to other noncontrolling interests (3) | (836) | | | (972) | | | (1,059) | | | (1,239) | | | (708) | | | | | |

| Basic FFO allocable to share-based compensation awards | (587) | | | (513) | | | (481) | | | (480) | | | (466) | | | | | |

| Basic FFO available to common share and common unit holders (2) | 71,376 | | | 70,875 | | | 68,476 | | | 68,314 | | | 67,642 | | | | | |

| | | | | | | | | | | | | |

| Redeemable noncontrolling interests | 469 | | | — | | | — | | | (28) | | | (30) | | | | | |

| Diluted FFO adjustments allocable to share-based compensation awards | 47 | | | 38 | | | 36 | | | 37 | | | 39 | | | | | |

| Diluted FFO available to common share and common unit holders - per Nareit (2) | 71,892 | | | 70,913 | | | 68,512 | | | 68,323 | | | 67,651 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Executive transition costs | 77 | | | 188 | | | 82 | | | 248 | | | — | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Diluted FFO comparability adjustments allocable to share-based compensation awards | — | | | (1) | | | (1) | | | (2) | | | — | | | | | |

| Diluted FFO available to common share and common unit holders, as adjusted for comparability (2) | $ | 71,969 | | | $ | 71,100 | | | $ | 68,593 | | | $ | 68,569 | | | $ | 67,651 | | | | | |

(1)See page 33 for additional disclosure regarding our unconsolidated real estate JVs.

(2)Refer to the section entitled “Definitions” for a definition of this measure.

(3)Pertains to noncontrolling interests in consolidated real estate JVs reported on page 32.

COPT Defense Properties

Diluted Share + Unit Computations

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| EPS Denominator: | | | | | | | | | | | | | |

| Weighted average common shares - basic | 112,231 | | | 112,199 | | | 112,196 | | | 112,188 | | | 112,127 | | | | | |

| Dilutive effect of share-based compensation awards | 509 | | | 432 | | | — | | | 426 | | | 410 | | | | | |

| | | | | | | | | | | | | |

| Dilutive effect of redeemable noncontrolling interests | — | | | — | | | — | | | 62 | | | 91 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Weighted average common shares - diluted | 112,740 | | | 112,631 | | | 112,196 | | | 112,676 | | | 112,628 | | | | | |

| Diluted EPS | $ | 0.29 | | | $ | 0.30 | | | $ | (1.94) | | | $ | 0.27 | | | $ | 0.70 | | | | | |

| | | | | | | | | | | | | |

| Weighted Average Shares for period ended: | | | | | | | | | | | | | |

| Common shares | 112,231 | | | 112,199 | | | 112,196 | | | 112,188 | | | 112,127 | | | | | |

| Dilutive effect of share-based compensation awards | 509 | | | 432 | | | 429 | | | 426 | | | 410 | | | | | |

| Common units | 1,625 | | | 1,514 | | | 1,520 | | | 1,514 | | | 1,489 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Redeemable noncontrolling interests | 947 | | | — | | | — | | | 62 | | | 91 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Denominator for diluted FFO per share and as adjusted for comparability | 115,312 | | | 114,145 | | | 114,145 | | | 114,190 | | | 114,117 | | | | | |

| Weighted average common units | (1,625) | | | (1,514) | | | (1,520) | | | (1,514) | | | (1,489) | | | | | |

| Redeemable noncontrolling interests | (947) | | | — | | | — | | | — | | | — | | | | | |

| Dilutive effect of additional share-based compensation awards | — | | | — | | | (429) | | | — | | | — | | | | | |

| | | | | | | | | | | | | |

| Denominator for diluted EPS | 112,740 | | | 112,631 | | | 112,196 | | | 112,676 | | | 112,628 | | | | | |

| Diluted FFO per share - Nareit (1) | $ | 0.62 | | | $ | 0.62 | | | $ | 0.60 | | | $ | 0.60 | | | $ | 0.59 | | | | | |

| Diluted FFO per share - as adjusted for comparability (1) | $ | 0.62 | | | $ | 0.62 | | | $ | 0.60 | | | $ | 0.60 | | | $ | 0.59 | | | | | |

(1)Refer to the section entitled “Definitions” for a definition of this measure.

COPT Defense Properties

Adjusted Funds from Operations

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Diluted FFO available to common share and common unit holders, as adjusted for comparability (1) | $ | 71,969 | | | $ | 71,100 | | | $ | 68,593 | | | $ | 68,569 | | | $ | 67,651 | | | | | |

| Straight line rent adjustments and lease incentive amortization | 3,473 | | | 313 | | | 12,882 | | | (3,161) | | | (3,516) | | | | | |

| Amortization of intangibles and other assets included in NOI | 122 | | | 26 | | | 26 | | | 17 | | | (19) | | | | | |

| Share-based compensation, net of amounts capitalized | 2,645 | | | 2,318 | | | 2,280 | | | 2,213 | | | 1,733 | | | | | |

| Amortization of deferred financing costs | 685 | | | 681 | | | 639 | | | 628 | | | 632 | | | | | |

| Amortization of net debt discounts, net of amounts capitalized | 1,014 | | | 1,004 | | | 750 | | | 622 | | | 618 | | | | | |

| | | | | | | | | | | | | |

| Replacement capital expenditures (1) | (20,776) | | | (21,498) | | | (21,122) | | | (22,664) | | | (28,210) | | | | | |

| Other | 137 | | | 336 | | | 74 | | | (221) | | | (273) | | | | | |

| Diluted AFFO available to common share and common unit holders (“diluted AFFO”) (1) | $ | 59,269 | | | $ | 54,280 | | | $ | 64,122 | | | $ | 46,003 | | | $ | 38,616 | | | | | |

| | | | | | | | | | | | | |

| Replacement capital expenditures (1) | | | | | | | | | | | | | |

| Tenant improvements and incentives | $ | 12,776 | | | $ | 7,850 | | | $ | 14,457 | | | $ | 32,619 | | | $ | 19,986 | | | | | |

| Building improvements | 4,953 | | | 14,762 | | | 6,307 | | | 2,766 | | | 2,141 | | | | | |

| Leasing costs | 3,590 | | | 2,440 | | | 1,902 | | | 3,542 | | | 1,750 | | | | | |

| Net additions to (exclusions from) tenant improvements and incentives | 316 | | | (189) | | | (813) | | | (16,007) | | | 4,839 | | | | | |

| Excluded building improvements and leasing costs | (859) | | | (3,365) | | | (731) | | | (256) | | | (506) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Replacement capital expenditures | $ | 20,776 | | | $ | 21,498 | | | $ | 21,122 | | | $ | 22,664 | | | $ | 28,210 | | | | | |

(1)Refer to the section entitled “Definitions” for a definition of this measure.

COPT Defense Properties

EBITDAre + Adjusted EBITDA

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Net income (loss) | $ | 33,671 | | | $ | 34,820 | | | $ | (221,207) | | | $ | 31,642 | | | $ | 80,398 | | | | | |

| Interest expense | 20,767 | | | 20,383 | | | 17,798 | | | 16,519 | | | 16,442 | | | | | |

| Income tax expense | 168 | | | 121 | | | 152 | | | 190 | | | 125 | | | | | |

| Real estate-related depreciation and amortization | 38,351 | | | 36,735 | | | 37,620 | | | 37,600 | | | 36,995 | | | | | |

| Other depreciation and amortization | 608 | | | 619 | | | 615 | | | 609 | | | 602 | | | | | |

| Impairment losses on real estate | — | | | — | | | 252,797 | | | — | | | — | | | | | |

| Gain on sales of real estate | — | | | — | | | — | | | (14) | | | (49,378) | | | | | |

| | | | | | | | | | | | | |

| Adjustments from unconsolidated real estate JVs | 1,671 | | | 1,911 | | | 1,743 | | | 1,559 | | | 1,704 | | | | | |

| EBITDAre (1) | 95,236 | | | 94,589 | | | 89,518 | | | 88,105 | | | 86,888 | | | | | |

| Credit loss expense (recoveries) | 22 | | | (1,288) | | | 372 | | | 238 | | | 67 | | | | | |

| Business development expenses | 630 | | | 445 | | | 313 | | | 394 | | | 241 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Executive transition costs | 430 | | | 188 | | | 82 | | | 307 | | | 247 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net gain on other investments | (477) | | | — | | | (25) | | | — | | | — | | | | | |

| Adjusted EBITDA (1) | 95,841 | | | 93,934 | | | 90,260 | | | 89,044 | | | 87,443 | | | | | |

| Pro forma NOI adjustment for property changes within period | 813 | | | 1,341 | | | 1,647 | | | 56 | | | (318) | | | | | |

| Change in collectability of deferred rental revenue | — | | | (198) | | | — | | | 28 | | | 899 | | | | | |

| | | | | | | | | | | | | |

| In-place adjusted EBITDA (1) | $ | 96,654 | | | $ | 95,077 | | | $ | 91,907 | | | $ | 89,128 | | | $ | 88,024 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)Refer to the section entitled “Definitions” for a definition of this measure.

COPT Defense Properties

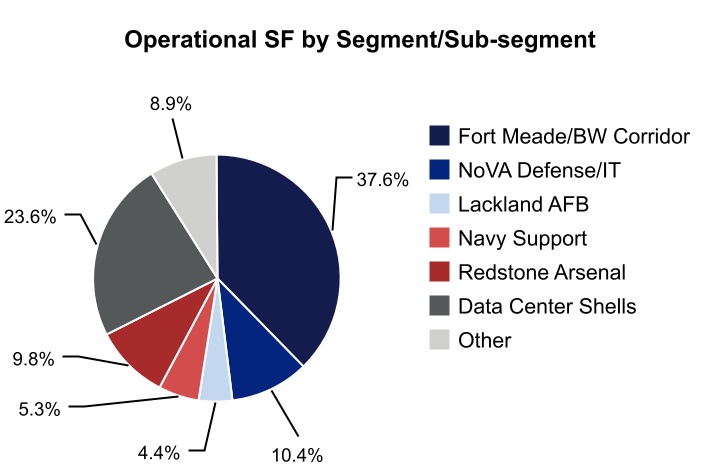

Properties by Segment - 3/31/24

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | # of

Properties | | Operational

Square Feet | | % Occupied | | % Leased |

| | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | |

| Fort Meade/Baltimore Washington (“BW”) Corridor: | | | | | | | | |

| National Business Park | | 34 | | | 4,292 | | | 99.1% | | 99.1% |

| Howard County | | 36 | | | 3,064 | | | 91.4% | | 92.8% |

| Other | | 23 | | | 1,725 | | | 92.9% | | 96.5% |

| Total Fort Meade/BW Corridor | | 93 | | | 9,081 | | | 95.3% | | 96.5% |

| Northern Virginia (“NoVA”) Defense/IT | | 16 | | | 2,500 | | | 88.2% | | 92.6% |

| Lackland AFB (San Antonio, Texas) | | 8 | | | 1,062 | | | 100.0% | | 100.0% |

| Navy Support | | 22 | | | 1,273 | | | 85.9% | | 86.2% |

| Redstone Arsenal (Huntsville, Alabama) | | 24 | | | 2,374 | | | 97.4% | | 98.6% |

| Data Center Shells: | | | | | | | | |

| Consolidated Properties | | 6 | | | 1,408 | | | 100.0% | | 100.0% |

| Unconsolidated JV Properties (1) | | 24 | | | 4,295 | | | 100.0% | | 100.0% |

| Total Defense/IT Portfolio | | 193 | | | 21,993 | | | 95.6% | | 96.8% |

| | | | | | | | |

| Other | | 8 | | | 2,144 | | | 72.5% | | 76.1% |

| Total Portfolio | | 201 | | | 24,137 | | | 93.6% | | 94.9% |

| Consolidated Portfolio | | 177 | | | 19,841 | | | 92.2% | | 93.8% |

(1)See page 33 for additional disclosure regarding our unconsolidated real estate JVs.

(2)Refer to the section entitled “Definitions” for a definition of this measure.

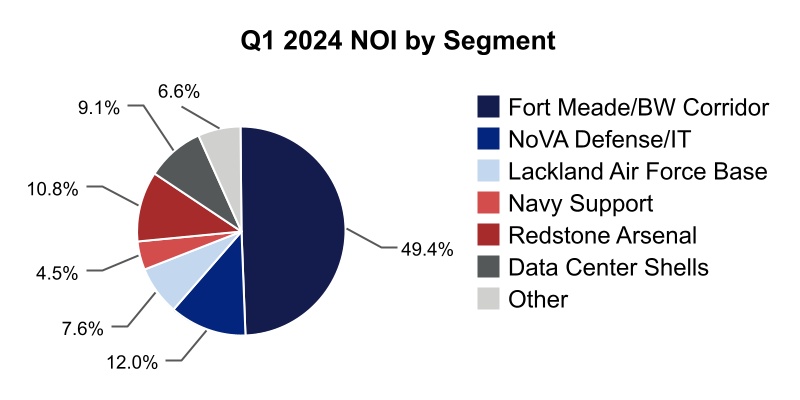

COPT Defense Properties

Consolidated Real Estate Revenues + NOI by Segment

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Consolidated real estate revenues | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 78,068 | | | $ | 74,758 | | | $ | 73,350 | | | $ | 72,176 | | | $ | 69,777 | | | | | |

| NoVA Defense/IT | 21,426 | | | 20,410 | | | 20,333 | | | 19,841 | | | 19,829 | | | | | |

| Lackland Air Force Base | 16,411 | | | 17,861 | | | 16,193 | | | 17,595 | | | 15,605 | | | | | |

| Navy Support | 8,226 | | | 8,405 | | | 8,190 | | | 8,118 | | | 7,925 | | | | | |

| Redstone Arsenal | 16,808 | | | 14,971 | | | 13,768 | | | 12,978 | | | 13,414 | | | | | |

| Data Center Shells-Consolidated | 8,457 | | | 7,654 | | | 6,811 | | | 6,287 | | | 6,692 | | | | | |

| Total Defense/IT Portfolio | 149,396 | | | 144,059 | | | 138,645 | | | 136,995 | | | 133,242 | | | | | |

| Other | 17,267 | | | 17,503 | | | 17,962 | | | 17,958 | | | 18,439 | | | | | |

| Consolidated real estate revenues (1) | $ | 166,663 | | | $ | 161,562 | | | $ | 156,607 | | | $ | 154,953 | | | $ | 151,681 | | | | | |

| | | |

| NOI from real estate operations (2) | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 50,178 | | | $ | 48,894 | | | $ | 48,134 | | | $ | 47,988 | | | $ | 45,257 | | | | | |

| NoVA Defense/IT | 12,164 | | | 11,972 | | | 12,433 | | | 12,158 | | | 12,257 | | | | | |

| Lackland Air Force Base | 7,723 | | | 7,708 | | | 7,626 | | | 7,644 | | | 7,660 | | | | | |

| Navy Support | 4,600 | | | 4,783 | | | 4,257 | | | 4,602 | | | 4,382 | | | | | |

| Redstone Arsenal | 11,016 | | | 10,157 | | | 8,820 | | | 8,228 | | | 8,778 | | | | | |

| Data Center Shells: | | | | | | | | | | | | | |

| Consolidated properties | 7,514 | | | 6,966 | | | 6,133 | | | 5,544 | | | 6,098 | | | | | |

| COPT Defense’s share of unconsolidated real estate JVs | 1,740 | | | 1,671 | | | 1,675 | | | 1,671 | | | 1,642 | | | | | |

| Total Defense/IT Portfolio | 94,935 | | | 92,151 | | | 89,078 | | | 87,835 | | | 86,074 | | | | | |

| Other | 6,722 | | | 6,505 | | | 7,416 | | | 7,189 | | | 7,829 | | | | | |

| NOI from real estate operations (1) | $ | 101,657 | | | $ | 98,656 | | | $ | 96,494 | | | $ | 95,024 | | | $ | 93,903 | | | | | |

(1)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(2)Refer to the section entitled “Definitions” for a definition of this measure.

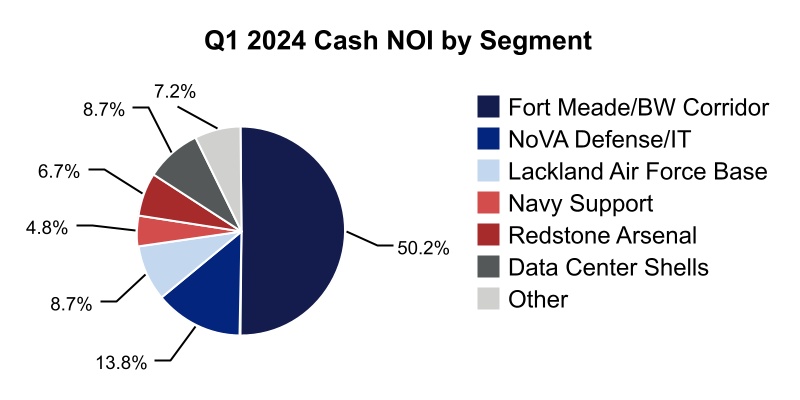

COPT Defense Properties

Cash NOI by Segment

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Cash NOI from real estate operations (1) | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 47,117 | | | $ | 46,173 | | | $ | 45,513 | | | $ | 45,727 | | | $ | 43,662 | | | | | |

| NoVA Defense/IT | 12,933 | | | 12,881 | | | 12,765 | | | 12,642 | | | 11,423 | | | | | |

| Lackland Air Force Base | 8,186 | | | 8,114 | | | 7,913 | | | 7,919 | | | 7,915 | | | | | |

| Navy Support | 4,503 | | | 5,008 | | | 4,621 | | | 4,911 | | | 5,023 | | | | | |

| Redstone Arsenal | 6,308 | | | 4,869 | | | 4,861 | | | 3,707 | | | 4,988 | | | | | |

| Data Center Shells: | | | | | | | | | | | | | |

| Consolidated properties | 6,688 | | | 5,868 | | | 4,904 | | | 4,918 | | | 5,379 | | | | | |

| COPT Defense’s share of unconsolidated real estate JVs | 1,477 | | | 1,400 | | | 1,396 | | | 1,385 | | | 1,351 | | | | | |

| Total Defense/IT Portfolio | 87,212 | | | 84,313 | | | 81,973 | | | 81,209 | | | 79,741 | | | | | |

| Other | 6,723 | | | 6,536 | | | 7,400 | | | 7,350 | | | 7,583 | | | | | |

| Cash NOI from real estate operations (2) | $ | 93,935 | | | $ | 90,849 | | | $ | 89,373 | | | $ | 88,559 | | | $ | 87,324 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)Refer to the section entitled “Definitions” for a definition of this measure.

(2)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

COPT Defense Properties

NOI from Real Estate Operations + Occupancy by Property Grouping - 3/31/24

(dollars and square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of Period End | | NOI from Real Estate Operations (3) |

| | # of

Properties | | Operational Square Feet | | % Occupied (1) | | % Leased (1) | | Annualized

Rental Revenue (2) | | % of Total

Annualized

Rental Revenue (2) | |

| Property Grouping | | | | | | | | Three Months Ended | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | | | | |

| Same Property: (2) | | | | | | | | | | | | | | | | |

| Consolidated properties | | 160 | | | 16,536 | | | 94.8% | | 96.4% | | $ | 553,073 | | | 84.4 | % | | $ | 87,587 | | | |

| Unconsolidated real estate JV | | 21 | | | 3,547 | | | 100.0% | | 100.0% | | 5,821 | | | 0.9 | % | | 1,301 | | | |

| Total Same Property in Defense/IT Portfolio | | 181 | | | 20,083 | | | 95.8% | | 97.0% | | 558,894 | | | 85.3 | % | | 88,888 | | | |

| Properties Placed in Service (4) | | 8 | | | 960 | | | 97.8% | | 97.8% | | 24,976 | | | 3.8 | % | | 5,532 | | | |

| Other unconsolidated JV properties (5) | | 3 | | | 748 | | | 100.0% | | 100.0% | | 1,360 | | | 0.2 | % | | 444 | | | |

| Acquired property (6) | | 1 | | | 202 | | | 55.6% | | 55.6% | | 4,070 | | | 0.6 | % | | 71 | | | |

| Total Defense/IT Portfolio | | 193 | | | 21,993 | | | 95.6% | | 96.8% | | 589,300 | | | 90.0 | % | | 94,935 | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Other | | 8 | | | 2,144 | | | 72.5% | | 76.1% | | 65,622 | | | 10.0 | % | | 6,722 | | | |

| Total Portfolio | | 201 | | | 24,137 | | | 93.6% | | 94.9% | | $ | 654,922 | | | 100.0 | % | | $ | 101,657 | | | |

| Consolidated Portfolio | | 177 | | | 19,841 | | | 92.2% | | 93.8% | | $ | 647,741 | | | 98.9 | % | | $ | 99,917 | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

(1)Percentages calculated based on operational square feet.

(2)Refer to the section entitled “Definitions” for a definition of this measure.

(3)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(4)Newly developed or redeveloped properties placed in service that were not fully operational by 1/1/23.

(5)Includes three data center shell properties in which we sold ownership interests and retained 10% interests through unconsolidated real estate JVs in 2023.

(6)Includes an office property acquired on 3/15/24.

COPT Defense Properties

Same Property (1) Average Occupancy Rates by Segment

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | # of Properties | | Operational Square Feet | | Three Months Ended | | |

| | | | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| | | | | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | 91 | | | 8,693 | | | 96.2 | % | | 96.2 | % | | 95.8 | % | | 94.8 | % | | 93.0 | % | | | | |

| NoVA Defense/IT | 16 | | | 2,500 | | | 87.9 | % | | 88.5 | % | | 89.8 | % | | 89.9 | % | | 90.6 | % | | | | |

| Lackland Air Force Base | 8 | | | 1,062 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Navy Support | 21 | | | 1,244 | | | 85.6 | % | | 87.8 | % | | 87.2 | % | | 87.6 | % | | 88.9 | % | | | | |

| Redstone Arsenal | 20 | | | 2,049 | | | 97.7 | % | | 97.4 | % | | 93.5 | % | | 90.6 | % | | 89.7 | % | | | | |

| Data Center Shells: | | | | | | | | | | | | | | | | | |

| Consolidated properties | 4 | | | 988 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Unconsolidated JV properties | 21 | | | 3,547 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Total Defense/IT Portfolio | 181 | | | 20,083 | | | 95.7 | % | | 95.9 | % | | 95.5 | % | | 94.8 | % | | 94.1 | % | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Other | 8 | | | 2,144 | | | 72.0 | % | | 73.9 | % | | 75.2 | % | | 75.0 | % | | 78.6 | % | | | | |

| Total Same Property | 189 | | | 22,227 | | | 93.4 | % | | 93.8 | % | | 93.5 | % | | 92.9 | % | | 92.6 | % | | | | |

| | | | | | | | | | | | | | | | | |

Same Property (1) Period End Occupancy Rates by Segment (square feet in thousands) |

| # of Properties | | Operational Square Feet | | | | |

| | | | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| | | | | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | 91 | | | 8,693 | | | 96.1 | % | | 96.3 | % | | 96.1 | % | | 95.4 | % | | 93.4 | % | | | | |

| NoVA Defense/IT | 16 | | | 2,500 | | | 88.2 | % | | 88.9 | % | | 89.5 | % | | 89.9 | % | | 90.7 | % | | | | |

| Lackland Air Force Base | 8 | | | 1,062 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Navy Support | 21 | | | 1,244 | | | 86.4 | % | | 88.0 | % | | 87.4 | % | | 87.4 | % | | 88.4 | % | | | | |

| Redstone Arsenal | 20 | | | 2,049 | | | 97.5 | % | | 97.7 | % | | 95.7 | % | | 92.3 | % | | 89.7 | % | | | | |

| Data Center Shells: | | | | | | | | | | | | | | | | | |

| Consolidated properties | 4 | | | 988 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Unconsolidated JV properties | 21 | | | 3,547 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Total Defense/IT Portfolio | 181 | | | 20,083 | | | 95.8 | % | | 96.0 | % | | 95.8 | % | | 95.2 | % | | 94.2 | % | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Other | 8 | | | 2,144 | | | 72.5 | % | | 73.2 | % | | 75.4 | % | | 74.9 | % | | 77.6 | % | | | | |

| Total Same Property | 189 | | | 22,227 | | | 93.5 | % | | 93.8 | % | | 93.8 | % | | 93.3 | % | | 92.6 | % | | | | |

(1)Includes properties stably owned and 100% operational since at least 1/1/23.

COPT Defense Properties

Same Property Real Estate Revenues + NOI by Segment

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Same Property real estate revenues | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 76,082 | | | $ | 74,008 | | | $ | 73,350 | | | $ | 72,177 | | | $ | 69,769 | | | | | |

| NoVA Defense/IT | 21,426 | | | 20,411 | | | 20,333 | | | 19,840 | | | 19,829 | | | | | |

| Lackland Air Force Base | 16,411 | | | 17,860 | | | 16,193 | | | 17,596 | | | 15,605 | | | | | |

| Navy Support | 8,073 | | | 8,251 | | | 8,035 | | | 7,964 | | | 7,771 | | | | | |

| Redstone Arsenal | 14,311 | | | 13,861 | | | 13,520 | | | 12,820 | | | 13,292 | | | | | |

| Data Center Shells-Consolidated | 6,427 | | | 6,186 | | | 6,205 | | | 6,285 | | | 6,293 | | | | | |

| Total Defense/IT Portfolio | 142,730 | | | 140,577 | | | 137,636 | | | 136,682 | | | 132,559 | | | | | |

| Other | 15,262 | | | 15,500 | | | 15,953 | | | 15,964 | | | 16,790 | | | | | |

| Same Property real estate revenues | $ | 157,992 | | | $ | 156,077 | | | $ | 153,589 | | | $ | 152,646 | | | $ | 149,349 | | | | | |

| | | | | | | | | | | | | |

| Same Property NOI from real estate operations (“NOI”) | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 48,330 | | | $ | 48,239 | | | $ | 48,134 | | | $ | 47,988 | | | $ | 45,257 | | | | | |

| NoVA Defense/IT | 12,164 | | | 11,972 | | | 12,433 | | | 12,158 | | | 12,257 | | | | | |

| Lackland Air Force Base | 7,723 | | | 7,708 | | | 7,625 | | | 7,645 | | | 7,660 | | | | | |

| Navy Support | 4,522 | | | 4,702 | | | 4,177 | | | 4,510 | | | 4,293 | | | | | |

| Redstone Arsenal | 9,321 | | | 9,148 | | | 8,665 | | | 8,134 | | | 8,682 | | | | | |

| Data Center Shells: | | | | | | | | | | | | | |

| Consolidated properties | 5,527 | | | 5,538 | | | 5,539 | | | 5,544 | | | 5,753 | | | | | |

| COPT Defense’s share of unconsolidated real estate JVs | 1,301 | | | 1,233 | | | 1,236 | | | 1,232 | | | 1,245 | | | | | |

| Total Defense/IT Portfolio | 88,888 | | | 88,540 | | | 87,809 | | | 87,211 | | | 85,147 | | | | | |

| Other | 6,515 | | | 6,314 | | | 7,230 | | | 7,012 | | | 7,576 | | | | | |

| Same Property NOI (1) | $ | 95,403 | | | $ | 94,854 | | | $ | 95,039 | | | $ | 94,223 | | | $ | 92,723 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

COPT Defense Properties

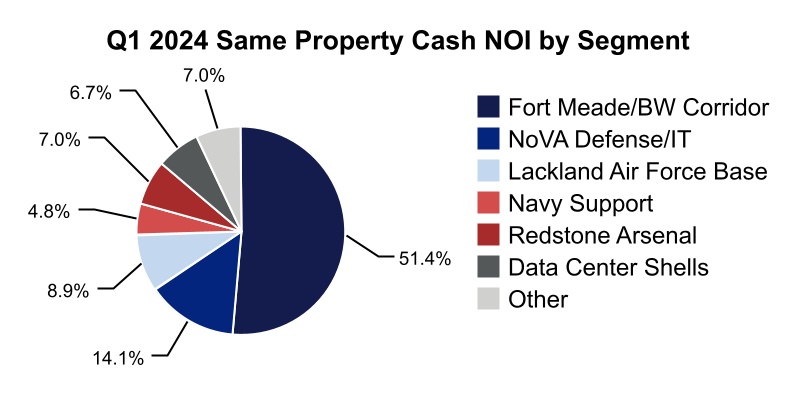

Same Property Cash NOI by Segment

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | | | |

| Same Property cash NOI from real estate operations (“cash NOI”) | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 47,052 | | | $ | 46,267 | | | $ | 45,513 | | | $ | 45,727 | | | $ | 43,662 | | | | | |

| NoVA Defense/IT | 12,933 | | | 12,882 | | | 12,764 | | | 12,642 | | | 11,423 | | | | | |

| Lackland Air Force Base | 8,186 | | | 8,114 | | | 7,913 | | | 7,919 | | | 7,915 | | | | | |

| Navy Support | 4,429 | | | 4,932 | | | 4,545 | | | 4,825 | | | 4,940 | | | | | |

| Redstone Arsenal | 6,412 | | | 4,966 | | | 4,953 | | | 3,771 | | | 5,015 | | | | | |

| Data Center Shells: | | | | | | | | | | | | | |

| Consolidated properties | 4,984 | | | 4,960 | | | 4,865 | | | 4,918 | | | 5,101 | | | | | |

| COPT Defense’s share of unconsolidated real estate JVs | 1,183 | | | 1,108 | | | 1,106 | | | 1,095 | | | 1,092 | | | | | |

| Total Defense/IT Portfolio | 85,179 | | | 83,229 | | | 81,659 | | | 80,897 | | | 79,148 | | | | | |

| Other | 6,440 | | | 6,264 | | | 7,134 | | | 7,092 | | | 7,243 | | | | | |

| Same Property cash NOI (1) | $ | 91,619 | | | $ | 89,493 | | | $ | 88,793 | | | $ | 87,989 | | | $ | 86,391 | | | | | |

| Percentage change in total Same Property cash NOI (1)(2) | 6.1% | | | | | | | | | | | | |

| Percentage change in Defense/IT Portfolio Same Property cash NOI (2) | 7.6% | | | | | | | | | | | | |

(1)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(2)Represents the change between the current period and the same period in the prior year.

COPT Defense Properties

Leasing (1)(2)

Three Months Ended 3/31/24

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Defense/IT Portfolio | | | | | | | | |

| | Ft Meade/BW Corridor | | NoVA Defense/IT | | | | Navy Support | | Redstone Arsenal | | | | Total Defense/IT Portfolio | | | | Other | | Total | | | | |

| Renewed Space | | | | | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | 227 | | | 116 | | | | | 80 | | | 85 | | | | | 509 | | | | | 42 | | | 551 | | | | | |

| Expiring Square Feet | 272 | | | 127 | | | | | 125 | | | 89 | | | | | 613 | | | | | 93 | | | 706 | | | | | |

| Vacating Square Feet | 45 | | | 11 | | | | | 45 | | | 4 | | | | | 105 | | | | | 51 | | | 155 | | | | | |

| Retention Rate (% based upon square feet) | 83.5 | % | | 91.5 | % | | | | 64.1 | % | | 95.3 | % | | | | 82.9 | % | | | | 45.6 | % | | 78.0 | % | | | | |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | 2.89 | | | $ | 5.77 | | | | | $ | 0.63 | | | $ | 0.19 | | | | | $ | 2.75 | | | | | $ | 3.10 | | | $ | 2.77 | | | | | |

| Weighted Average Lease Term in Years | 4.2 | | | 4.8 | | | | | 3.1 | | | 2.0 | | | | | 3.8 | | | | | 7.9 | | | 4.1 | | | | | |

| Straight-line Rent Per Square Foot | | | | | | | | | | | | | | | | | | | | | | | |

| Renewal Straight-line Rent | $ | 32.58 | | | $ | 34.91 | | | | | $ | 28.89 | | | $ | 26.03 | | | | | $ | 31.44 | | | | | $ | 32.07 | | | $ | 31.49 | | | | | |

| Expiring Straight-line Rent | $ | 30.44 | | | $ | 37.87 | | | | | $ | 24.78 | | | $ | 25.11 | | | | | $ | 30.36 | | | | | $ | 30.35 | | | $ | 30.36 | | | | | |

| Change in Straight-line Rent | 7.0 | % | | (7.8 | %) | | | | 16.6 | % | | 3.6 | % | | | | 3.6 | % | | | | 5.7 | % | | 3.7 | % | | | | |

| Cash Rent Per Square Foot | | | | | | | | | | | | | | | | | | | | | | | |

| Renewal Cash Rent | $ | 32.20 | | | $ | 37.16 | | | | | $ | 28.71 | | | $ | 25.82 | | | | | $ | 31.72 | | | | | $ | 30.83 | | | $ | 31.65 | | | | | |

| Expiring Cash Rent | $ | 32.62 | | | $ | 39.79 | | | | | $ | 27.97 | | | $ | 25.45 | | | | | $ | 32.34 | | | | | $ | 33.93 | | | $ | 32.46 | | | | | |

| Change in Cash Rent | (1.3 | %) | | (6.6 | %) | | | | 2.6 | % | | 1.4 | % | | | | (1.9 | %) | | | | (9.2 | %) | | (2.5 | %) | | | | |

| Compound Annual Growth Rate | 2.4 | % | | 1.4 | % | | | | 2.5 | % | | 1.7 | % | | | | 2.1 | % | | | | 2.2 | % | | 2.1 | % | | | | |

| Average Escalations Per Year | 2.7 | % | | 2.5 | % | | | | 2.6 | % | | 2.5 | % | | | | 2.6 | % | | | | 1.1 | % | | 2.4 | % | | | | |

| New Leases | | | | | | | | | | | | | | | | | | | | | | | |

| Development and Redevelopment Space | | | | | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | — | | | — | | | | | — | | | 10 | | | | | 10 | | | | | — | | | 10 | | | | | |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | 3.14 | | | | | $ | 3.14 | | | | | $ | — | | | $ | 3.14 | | | | | |

| Weighted Average Lease Term in Years | — | | | — | | | | | — | | | 5.3 | | | | | 5.3 | | | | | — | | | 5.3 | | | | | |

| Straight-line Rent Per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | 23.81 | | | | | $ | 23.81 | | | | | $ | — | | | $ | 23.81 | | | | | |

| Cash Rent Per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | 23.50 | | | | | $ | 23.50 | | | | | $ | — | | | $ | 23.50 | | | | | |

| Vacant Space | | | | | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | 80 | | | 20 | | | | | 13 | | | — | | | | | 113 | | | | | 47 | | | 160 | | | | | |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | 9.23 | | | $ | 9.12 | | | | | $ | 4.64 | | | $ | — | | | | | $ | 8.68 | | | | | $ | 6.14 | | | $ | 7.93 | | | | | |

| Weighted Average Lease Term in Years | 8.8 | | | 9.5 | | | | | 5.1 | | | — | | | | | 8.5 | | | | | 7.4 | | | 8.2 | | | | | |

| Straight-line Rent Per Square Foot | $ | 32.09 | | | $ | 33.17 | | | | | $ | 25.29 | | | $ | — | | | | | $ | 31.50 | | | | | $ | 28.03 | | | $ | 30.48 | | | | | |

| Cash Rent Per Square Foot | $ | 30.77 | | | $ | 34.40 | | | | | $ | 25.96 | | | $ | — | | | | | $ | 30.85 | | | | | $ | 28.15 | | | $ | 30.05 | | | | | |

| Total Square Feet Leased | 307 | | | 136 | | | | | 93 | | | 95 | | | | | 632 | | | | | 89 | | | 721 | | | | | |

| Average Escalations Per Year | 2.6 | % | | 2.6 | % | | | | 2.6 | % | | 2.6 | % | | | | 2.6 | % | | | | 1.9 | % | | 2.5 | % | | | | |

| Average Escalations Excl. Data Center Shells | | | | | | | | | | | | | | | | | | | 2.5 | % | | | | |

(1)Activity excludes owner occupied space, leases with less than a one-year term and expirations associated with space removed from service. Weighted average lease term is based on the term defined in the lease assuming no exercise of early termination rights. Committed costs for leasing are reported above in the period of lease execution. Actual capital expenditures for leasing are reported on page 10 in the period such costs are incurred.

(2)Refer to the section entitled “Definitions” for definitions of certain terms on this schedule.

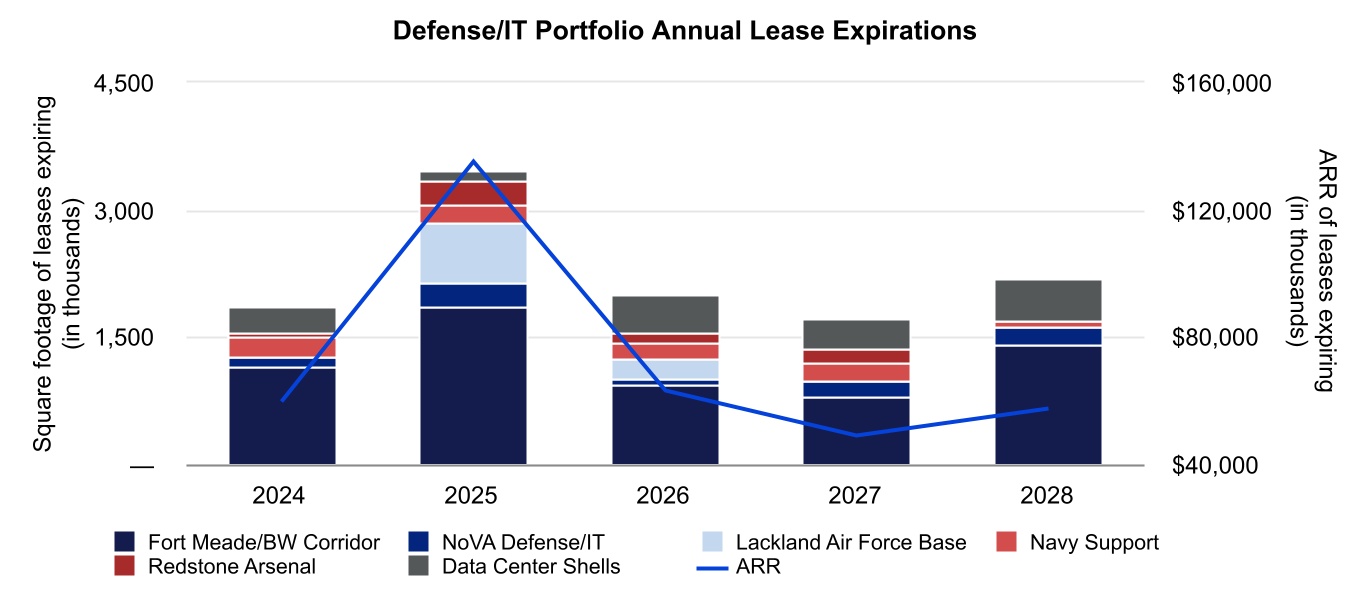

COPT Defense Properties

Lease Expiration Analysis as of 3/31/24 (1)

(dollars and square feet in thousands, except per square foot amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment of Lease and Year of Expiration (2) | | Square Footage of Leases Expiring | | Annualized Rental

Revenue of Expiring Leases (3) | | % of Defense/IT

Annualized

Rental

Revenue

Expiring (3) | | Annualized Rental

Revenue of

Expiring Leases per Occupied Sq. Foot (3) | | | | | | | | | | | |

| Defense/IT Portfolio | | | | | | | | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 1,145 | | | $ | 47,852 | | | 8.1 | % | | $ | 41.75 | | | | | | | | | | | | |

| NoVA Defense/IT | | 130 | | | 3,987 | | | 0.7 | % | | 30.71 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Navy Support | | 234 | | | 6,275 | | | 1.1 | % | | 26.79 | | | | | | | | | | | | |

| Redstone Arsenal | | 49 | | | 1,019 | | | 0.2 | % | | 20.81 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 310 | | | 444 | | | 0.1 | % | | 14.31 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2024 | | 1,868 | | | 59,577 | | | 10.1 | % | | 37.47 | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 1,870 | | | 71,284 | | | 12.1 | % | | 38.06 | | | | | | | | | | | | |

| NoVA Defense/IT | | 281 | | | 11,849 | | | 2.0 | % | | 42.21 | | | | | | | | | | | | |

| Lackland Air Force Base | | 703 | | | 39,803 | | | 6.8 | % | | 56.64 | | | | | | | | | | | | |

| Navy Support | | 212 | | | 4,968 | | | 0.8 | % | | 23.41 | | | | | | | | | | | | |

| Redstone Arsenal | | 288 | | | 6,860 | | | 1.2 | % | | 23.82 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 121 | | | 175 | | | — | % | | 14.48 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2025 | | 3,475 | | | 134,939 | | | 22.9 | % | | 40.06 | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 938 | | | 37,545 | | | 6.4 | % | | 40.02 | | | | | | | | | | | | |

| NoVA Defense/IT | | 66 | | | 2,250 | | | 0.4 | % | | 33.84 | | | | | | | | | | | | |

| Lackland Air Force Base | | 250 | | | 12,793 | | | 2.2 | % | | 51.17 | | | | | | | | | | | | |

| Navy Support | | 193 | | | 6,722 | | | 1.1 | % | | 34.77 | | | | | | | | | | | | |

| Redstone Arsenal | | 105 | | | 3,021 | | | 0.5 | % | | 28.71 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 446 | | | 814 | | | 0.1 | % | | 18.26 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2026 | | 1,998 | | | 63,146 | | | 10.7 | % | | 39.52 | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 793 | | | 29,477 | | | 5.0 | % | | 37.18 | | | | | | | | | | | | |

| NoVA Defense/IT | | 190 | | | 6,443 | | | 1.1 | % | | 33.86 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Navy Support | | 212 | | | 8,231 | | | 1.4 | % | | 38.80 | | | | | | | | | | | | |

| Redstone Arsenal | | 163 | | | 4,394 | | | 0.7 | % | | 26.94 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 364 | | | 518 | | | 0.1 | % | | 14.23 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2027 | | 1,722 | | | 49,063 | | | 8.3 | % | | 35.18 | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 1,421 | | | 48,015 | | | 8.1 | % | | 33.76 | | | | | | | | | | | | |

| NoVA Defense/IT | | 211 | | | 7,170 | | | 1.2 | % | | 33.93 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Navy Support | | 54 | | | 1,462 | | | 0.2 | % | | 27.31 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 515 | | | 867 | | | 0.1 | % | | 16.82 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2028 | | 2,201 | | | 57,515 | | | 9.8 | % | | 33.08 | | | | | | | | | | | | |

| Thereafter | | | | | | | | | | | | | | | | | | | |

| Consolidated Properties | | 7,227 | | | 220,697 | | | 37.5 | % | | 29.81 | | | | | | | | | | | | |

| Unconsolidated JV Properties | | 2,539 | | | 4,363 | | | 0.7 | % | | 17.18 | | | | | | | | | | | | |

| Total Defense/IT Portfolio | | 21,030 | | | $ | 589,300 | | | 100.0 | % | | $ | 34.01 | | | | | | | | | | | | |

COPT Defense Properties

Lease Expiration Analysis as of 3/31/24 (1) (continued)

(dollars and square feet in thousands, except per square foot amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment of Lease and Year of Expiration (2) | | Square Footage of Leases Expiring | | Annualized Rental

Revenue of Expiring Leases (3) | | % of Total

Annualized

Rental

Revenue

Expiring (3) | | Annualized Rental

Revenue of

Expiring Leases per Occupied Sq. Foot (3) |

| Total Defense/IT Portfolio | | 21,030 | | | $ | 589,300 | | | 90.0 | % | | $ | 34.01 | |

| Other | | | | | | | | |

| 2024 | | 44 | | | 1,547 | | | 0.2 | % | | 34.05 | |

| 2025 | | 173 | | | 11,027 | | | 1.7 | % | | 29.40 | |

| 2026 | | 164 | | | 5,995 | | | 0.9 | % | | 36.47 | |

| 2027 | | 124 | | | 4,622 | | | 0.7 | % | | 36.93 | |

| 2028 | | 243 | | | 8,951 | | | 1.4 | % | | 36.73 | |

| Thereafter | | 806 | | | 33,480 | | | 5.1 | % | | 41.33 | |

| Total Other | | 1,554 | | | 65,622 | | | 10.0 | % | | 38.21 | |

| Total Portfolio | | 22,584 | | | $ | 654,922 | | | 100.0 | % | | $ | 34.36 | |

| Consolidated Portfolio | | 18,289 | | | $ | 647,741 | | | | | |

| Unconsolidated JV Properties | | 4,295 | | | $ | 7,181 | | | | | |

Note: As of 3/31/24, the weighted average lease term was 5.2 years for both the Defense/IT and total portfolio and 5.1 years for the consolidated portfolio.

(1)This expiration analysis reflects consolidated and unconsolidated properties and includes the effect of early renewals completed on existing leases but excludes the effect of new tenant leases on square feet yet to commence as of 3/31/24. With regard to properties owned through unconsolidated real estate joint ventures, the amounts reported above reflect 100% of the properties’ square footage but only reflect the portion of Annualized Rental Revenue that was allocable to COPT Defense’s ownership interest.

(2)The year of lease expiration is based on the lease term determined in accordance with GAAP.

(3)Refer to the section entitled “Definitions” for a definition of annualized rental revenue.

COPT Defense Properties

2024 Defense/IT Portfolio Quarterly Lease Expiration Analysis as of 3/31/24 (1)

(dollars and square feet in thousands, except per square foot amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment of Lease and Quarter of Expiration (2) | | Square Footage of Leases Expiring | | Annualized Rental

Revenue of Expiring Leases (3) | | % of Defense/IT

Annualized

Rental

Revenue Expiring (3) | | Annualized Rental Revenue of Expiring Leases per Occupied Sq. Foot (3) | | | | | | | | | | | | | |

| Defense IT Portfolio | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 663 | | | $ | 27,421 | | | 4.7 | % | | $ | 41.38 | | | | | | | | | | | | | | |

| NoVA Defense/IT | | 89 | | | 3,006 | | | 0.5 | % | | 33.77 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Navy Support | | 21 | | | 630 | | | 0.1 | % | | 29.64 | | | | | | | | | | | | | | |

| Redstone Arsenal | | 31 | | | 550 | | | 0.1 | % | | 17.72 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 | | 804 | | | 31,607 | | | 5.4 | % | | 39.32 | | | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 240 | | | 8,605 | | | 1.5 | % | | 35.73 | | | | | | | | | | | | | | |

| NoVA Defense/IT | | 30 | | | 630 | | | 0.1 | % | | 20.72 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Navy Support | | 97 | | | 2,233 | | | 0.4 | % | | 23.07 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 310 | | | 444 | | | 0.1 | % | | 14.31 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Q3 2024 | | 677 | | | 11,912 | | | 2.1 | % | | 29.84 | | | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 243 | | | 11,826 | | | 2.0 | % | | 48.73 | | | | | | | | | | | | | | |

| NoVA Defense/IT | | 10 | | | 351 | | | 0.1 | % | | 33.78 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Navy Support | | 116 | | | 3,412 | | | 0.6 | % | | 29.37 | | | | | | | | | | | | | | |

| Redstone Arsenal | | 18 | | | 469 | | | 0.1 | % | | 26.15 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Q4 2024 | | 387 | | | 16,058 | | | 2.8 | % | | 41.47 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | 1,868 | | | $ | 59,577 | | | 10.1 | % | | $ | 37.47 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

(1)This expiration analysis reflects consolidated and unconsolidated properties and includes the effect of early renewals completed on existing leases but excludes the effect of new tenant leases on square feet yet to commence as of 3/31/24.

(2)The period of lease expiration is based on the lease term determined in accordance with GAAP.

(3)Refer to the section entitled “Definitions” for a definition of annualized rental revenue.

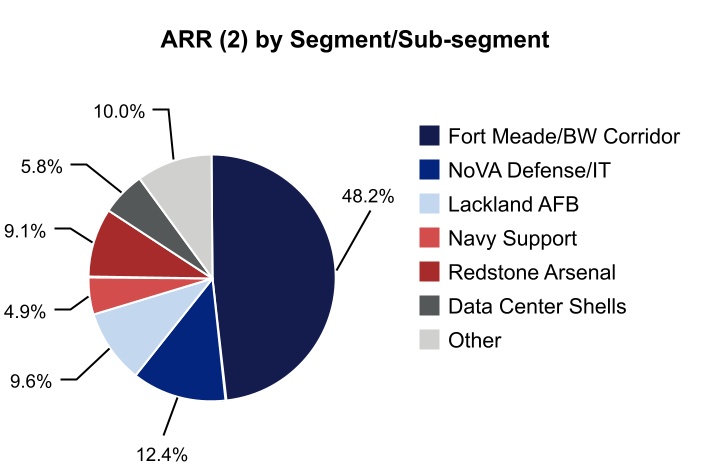

COPT Defense Properties

Top 20 Tenants as of 3/31/24 (1)

(dollars and square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tenant | | | | Total

Annualized

Rental Revenue (2) | | %

of Total

Annualized

Rental Revenue (2) | | Occupied Square Feet | | Weighted Average Remaining Lease Term (3) |

| United States Government | (4) | | | $ | 232,891 | | | 35.6 | % | | 5,529 | | | 3.5 | |

| Fortune 100 Company | | | | 57,542 | | | 8.8 | % | | 6,182 | | | 7.9 | |

| General Dynamics Corporation | | | | 32,844 | | | 5.0 | % | | 703 | | | 3.6 | |

| Northrop Grumman Corporation | | | | 15,048 | | | 2.3 | % | | 519 | | | 5.5 | |

| The Boeing Company | | | | 14,701 | | | 2.2 | % | | 443 | | | 2.7 | |

| CACI International Inc | | | | 13,166 | | | 2.0 | % | | 327 | | | 4.2 | |

| Peraton Corp. | | | | 12,858 | | | 2.0 | % | | 330 | | | 4.5 | |

| Booz Allen Hamilton, Inc. | | | | 12,103 | | | 1.8 | % | | 297 | | | 1.9 | |

| Fortune 100 Company | | | | 11,752 | | | 1.8 | % | | 183 | | | 10.5 | |

| Morrison & Foerster, LLP | | | | 9,631 | | | 1.5 | % | | 102 | | | 13.0 | |

| CareFirst, Inc. | | | | 9,067 | | | 1.4 | % | | 264 | | | 10.4 | |

| KBR, Inc. | | | | 7,843 | | | 1.2 | % | | 309 | | | 9.1 | |

| Yulista Holding, LLC | | | | 7,088 | | | 1.1 | % | | 368 | | | 5.7 | |

| AT&T Corporation | | | | 6,774 | | | 1.0 | % | | 321 | | | 5.5 | |

| Mantech International Corp. | | | | 6,584 | | | 1.0 | % | | 200 | | | 1.5 | |

| Jacobs Solutions Inc. | | | | 6,474 | | | 1.0 | % | | 185 | | | 5.2 | |

| Wells Fargo & Company | | | | 6,270 | | | 1.0 | % | | 145 | | | 4.4 | |

| The University System of Maryland | | | | 6,054 | | | 0.9 | % | | 172 | | | 5.8 | |

| Lockheed Martin Corporation | | | | 5,712 | | | 0.9 | % | | 194 | | | 6.0 | |

| The Mitre Corporation | | | | 5,406 | | | 0.8 | % | | 152 | | | 2.2 | |

| Subtotal Top 20 Tenants | | | | 479,808 | | | 73.3 | % | | 16,925 | | | 5.6 | |

| All remaining tenants | | | | 175,114 | | | 26.7 | % | | 5,659 | | | 4.1 | |

| Total / Weighted Average | | | | $ | 654,922 | | | 100.0 | % | | 22,584 | | | 5.2 | |

(1)For properties owned through unconsolidated real estate JVs, includes COPT Defense’s share of those properties’ ARR of $7.2 million (see page 33 for additional information).

(2)Refer to the section entitled “Definitions” for a definition of annualized rental revenue.

(3)Weighted average remaining lease term is based on the lease term determined in accordance with GAAP. The weighting of the lease term was computed based on occupied square feet (excluding leases not associated with square feet, such as ground leases).

(4)Substantially all of our government leases are subject to early termination provisions which are customary in government leases. As of 3/31/24, $5.8 million of our ARR was through the General Services Administration (GSA), representing 2.5% of our ARR from the United States Government and 0.9% of our total ARR.

COPT Defense Properties

Operating Property Acquisition

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property | | Property Segment/Sub-Segment | | Location | | # of Properties | | | | Operational Square Feet | | Transaction

Date | | % Occupied on Transaction Date | | Transaction

Value

(in millions) |

| 6841 Benjamin Franklin Drive | | Fort Meade/BW Corridor | | Columbia, Maryland | | 1 | | | | 202 | | 3/15/24 | | 55.6% | | $ | 15 | |

|

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

COPT Defense Properties

Summary of Development Projects as of 3/31/24 (1)

(dollars and square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Rentable Square Feet | % Leased as of 3/31/24 | as of 3/31/24 (2) | Actual or Anticipated Shell Completion Date | Anticipated Operational Date (3) |

| Anticipated Total Cost | Cost to Date | Cost to Date Placed in Service |

|

| Property and Segment/Sub-Segment | Location |

| Defense/IT Portfolio: | | | | | | | | | |

| Fort Meade/BW Corridor: | | | | | | | | | |

| 400 National Business Parkway | Annapolis Junction, Maryland | | 138 | | 0% | $ | 65,100 | | $ | 12,776 | | $ | — | | 1Q 25 | 1Q 26 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Redstone Arsenal: | | | | | | | |

| 8100 Rideout Road (4) | Huntsville, Alabama | | 128 | | 42% | 45,991 | | 33,085 | | 11,723 | | 3Q 23 | 3Q 24 |

| 9700 Advanced Gateway | Huntsville, Alabama | | 50 | | 20% | 11,000 | | 161 | | — | | 1Q 25 | 1Q 26 |

| Subtotal / Average | | | 178 | | 35% | 56,991 | | 33,246 | | 11,723 | | | |

| | | | | | | | | |

| Data Center Shells: | | | | | | | | | |

| Southpoint Phase 2 Bldg A | Northern Virginia | | 225 | | 100% | 82,500 | | 27,222 | | — | | 3Q 24 | 3Q 24 |

| Southpoint Phase 2 Bldg B | Northern Virginia | | 193 | | 100% | 65,000 | | 5,410 | | — | | 3Q 25 | 3Q 25 |

| MP 3 | Northern Virginia | | 225 | | 100% | 111,800 | | 10,402 | | — | | 4Q 25 | 4Q 25 |

| Data Center Shells Subtotal / Average | | 643 | | 100% | 259,300 | | 43,034 | | — | | | |

| | | | | | | | | |

| Total Defense/IT Portfolio Under Development | | 959 | | 74% | $ | 381,391 | | $ | 89,056 | | $ | 11,723 | | | |

(1)Includes properties under, or contractually committed for, development as of 3/31/24.

(2)Cost includes land, development, leasing costs and allocated portion of structured parking and other shared infrastructure, if applicable.

(3)Anticipated operational date is the earlier of the estimated date when leases have commenced on 100% of a property’s space or one year from the cessation of major construction activities.

(4)Although classified as under development, 27,000 square feet were operational as of 3/31/24.

COPT Defense Properties

Development Placed in Service as of 3/31/24

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Square Feet Placed in Service | Total Space Placed in Service % Leased as of 3/31/24 |

| | Total Property | | |

| Property Segment/Sub-Segment | % Leased as of 3/31/24 | Rentable Square Feet | | | 2024 | |

| Property and Location | 1st Quarter | | | | |

5300 Redstone Gateway Huntsville, Alabama | Redstone Arsenal | 100% | 46 | | | | 46 | | | | | | | 100% |

8100 Rideout Road Huntsville, Alabama | Redstone Arsenal | 42% | 128 | | | | 27 | | | | | | | 100% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Development Placed in Service | 57% | 174 | | | | 73 | | | | | | | 100% |

% Leased as of 3/31/24 | | | | | | 100% | | | | | | |

COPT Defense Properties

Summary of Land Owned/Controlled as of 3/31/24 (1)

(dollars and square feet in thousands)

| | | | | | | | | | | | | | | | | |

| Location | Acres | | Estimated Developable Square Feet | | Carrying Amount |

| Defense/IT Portfolio land owned/controlled for future development: | | | | | |

| Fort Meade/BW Corridor: | | | | | |

| National Business Park | 144 | | 1,483 | | |

| Howard County | 19 | | 290 | | |

| Other | 126 | | 1,338 | | |

| Total Fort Meade/BW Corridor | 289 | | 3,111 | | |

| NoVA Defense/IT | 29 | | 1,171 | | |

| | | | | |

| Navy Support | 38 | | 64 | | |

| Redstone Arsenal (2) | 295 | | 3,350 | | |

| | | | | |

| Total Defense/IT Portfolio land owned/controlled for future development | 651 | | 7,696 | | $ | 158,839 | |

| | | | | |

| | | | | |

| Other land owned/controlled | 53 | | 1,538 | | 9,656 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Land held, net | 704 | | 9,234 | | $ | 168,495 | |

| | | | | |

(1)This land inventory schedule includes properties under ground lease to us and excludes all properties listed as development as detailed on page 25. The costs associated with the land included on this summary are reported on our consolidated balance sheet in the line entitled “land held.”

(2)This land is controlled under a long-term master lease agreement to LW Redstone Company, LLC, a consolidated JV (see page 32). As this land is developed in the future, the JV will execute site-specific leases under the master lease agreement. Lease payments will commence under the site-specific leases as cash rents under tenant leases commence at the respective properties.

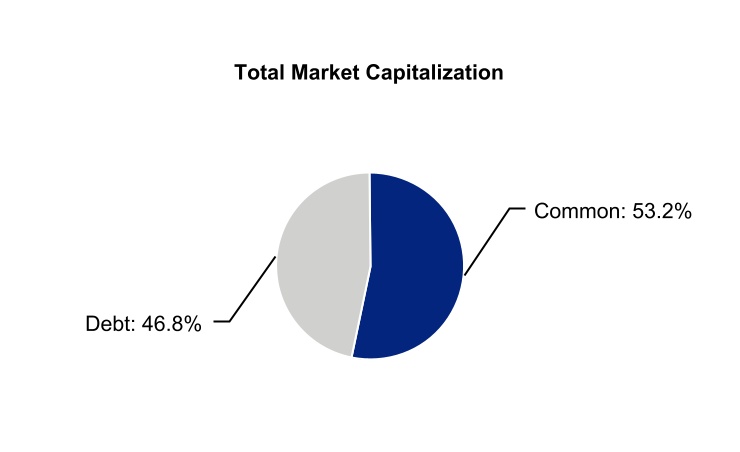

COPT Defense Properties

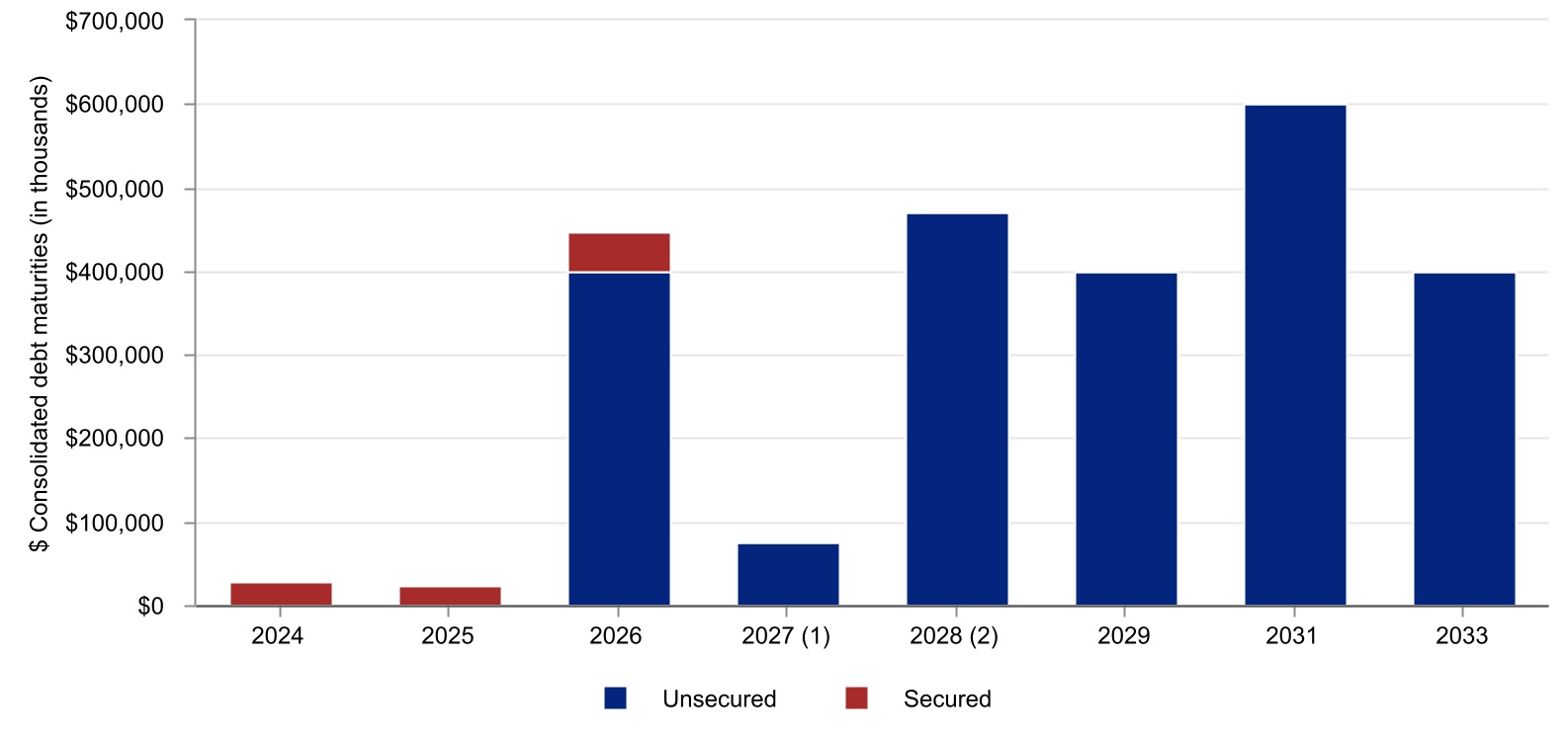

Capitalization Overview

(dollars, shares and units in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Wtd. Avg. Maturity (Years) (1) | | Stated Rate | | Effective Rate

(2)(3) | | Amount Outstanding at 3/31/24 |

| | | | |

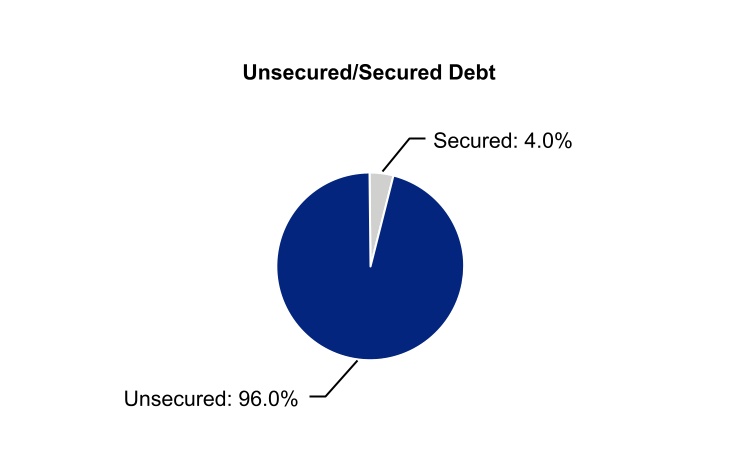

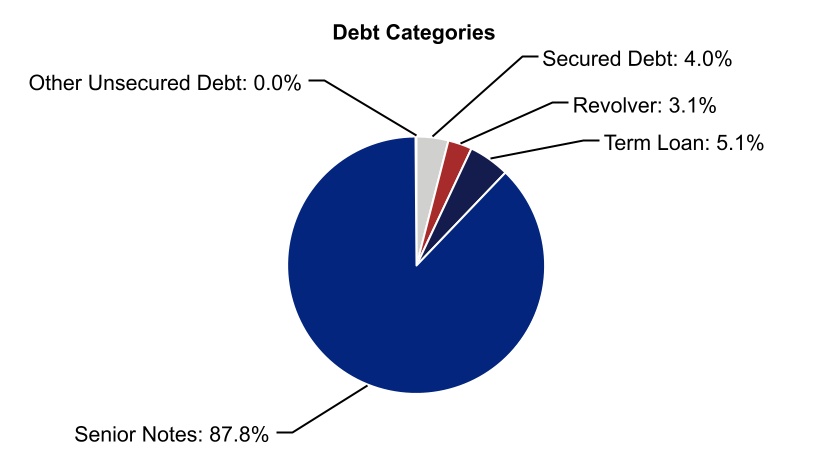

| Debt | | | | | | |

| Secured debt | | 1.4 | | 5.04 | % | | 3.54 | % | | $ | 98,820 | |

| Unsecured debt | | 5.6 | | 3.26 | % | | 3.34 | % | | 2,345,411 | |

| Total Consolidated Debt | 5.4 | | 3.33 | % | | 3.34 | % | | $ | 2,444,231 | |

| | | | | | | | |

| Fixed-rate debt (3) | | 5.6 | | 2.98 | % | | 3.34 | % | | $ | 2,444,231 | |

| Variable-rate debt (3) | | 3.4 | | 6.67 | % | | N/A | | — | |

| Total Consolidated Debt | | | | | | | | $ | 2,444,231 | |

| | | | | | | | |

| | | | | | | | |

| Common Equity | | | | | | | | |

| Common Shares | | | | | | | | 112,641 | |

| Common Units (4) | | | | | | | | 2,148 | |

| Total Common Shares and Units | | | | | | 114,789 | |

| | | | | | | | |

Closing Common Share Price on 3/28/24 | | | | $ | 24.17 | |

| Equity Market Capitalization (5) | | | | $ | 2,774,450 | |

| | | | |

| Total Market Capitalization (5) | | | | $ | 5,218,681 | |

| | | | |

| | | | |

(1)Calculated assuming exercise of extension options on our Revolving Credit Facility and term loan.

(2)Excludes the effect of deferred financing cost amortization.

(3)Includes the effect of interest rate swaps with notional amounts totaling $233.0 million that hedge the risk of changes in interest rates on variable-rate debt. We had swaps in place for all of our variable-rate debt balances as of 3/31/24.

(4)Includes certain unvested share-based compensation awards in the form of profit interest units.

(5)Refer to the section entitled “Definitions” for a definition of this measure.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Investment Grade Ratings & Outlook | | Latest Report |

| Fitch | | BBB- | Stable | | 11/22/23 |

| Moody’s | | Baa3 | Stable | | 1/22/24 |